The Amazon Price Wars Playbook

An effective pricing strategy is a fundamental component of any business operating on Amazon’s marketplace — over three-quarters of consumers go to the platform to check prices prior to making a purchase. With this in mind, sellers are constantly competing for the most optimal price point to win conversions, which can often result in what is known as “price wars.”

In this playbook, we break down what exactly price wars are, why they happen, and how you can navigate them with Amazon‑expert strategies and AI‑driven technology.

1. Introduction

Price Wars in 2020

82% of Amazon consumers consider price to be a very important factor when selecting a product, demonstrating that price drives consumer purchase decisions.1

While price carries tremendous weight for consumers, it is also the cornerstone of brands’ and retailers’ online businesses. Without a competitive, sophisticated pricing strategy, you run the risk of losing out on profits, experiencing price erosion, and worse — entering a “race to the bottom” price war with competitors on the Amazon marketplace.

How do you get tangled up in Amazon price wars to begin with? What exactly causes them to happen? What steps can you take, as a brand or retailer on Amazon, to prevent them from occurring and effectively manage them if they do occur?

Our Amazon experts answer all of these questions and more in this comprehensive playbook. By tracking nearly 10 million Amazon products over a 10-month period, we identified more than 60,000 price wars per day, which we used to inform the insights included here.

Discover strategies you can implement to avoid compromising your profit margins, maintain brand equity, and understand price wars and the impact they can have on your business.

2. Definition of Price Wars

What Are Price Wars?

A price war is defined as “a competitive exchange among rival companies who lower the price points on their products in a strategic attempt to undercut one another and capture greater market share.”2

Essentially, a price war takes place when competitors, such as two Amazon third-party (3P) sellers, repeatedly reduce their prices so they can offer the least-expensive deal to the customer. Price wars often begin on the marketplace because sellers believe that cutting their prices will allow them to win the Buy Box and, therefore, capture additional sales.

Your optimal price point is a number that is strategically chosen to appeal to your target audience and entice shoppers to engage and ultimately convert. When you abandon this notion and explicitly slash your prices, you will likely sacrifice profit margins for the potential short-term business you may win, which is never a guarantee.

Price wars can be detrimental to your business and, therefore, should be entered cautiously — a 1% price drop can end up slashing your profits by more than 10%.2

Historically, merchants have resorted to lowering their prices in order to draw business away from their competitors. This notion, compounded by the speed of dynamic, online marketplaces such as Amazon, has enabled price wars to take place tens of thousands of times a day, within minutes, given that sellers can change their prices with the click of a mouse or by using automated price optimization technology. In that short span of time, price wars have the capacity to fuel dramatic price reductions.

3. Examples of Price Wars

Examples of Price Wars

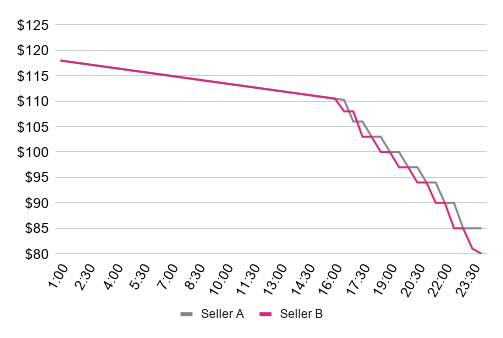

One-Day Price War, High Impact

In this example, two sellers began by gradually dropping their prices and accelerated to a more rapid pace. By the end of a 24-hour period, the prices dropped by 24%.

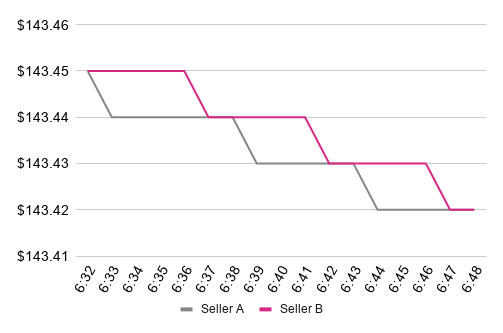

Short Price War, Low Impact

In this example, you can see that Seller A dropped the price and Seller B followed suit, inciting the price war. This particular price war only lasted for 17 minutes and the price ultimately dropped 0.02%.

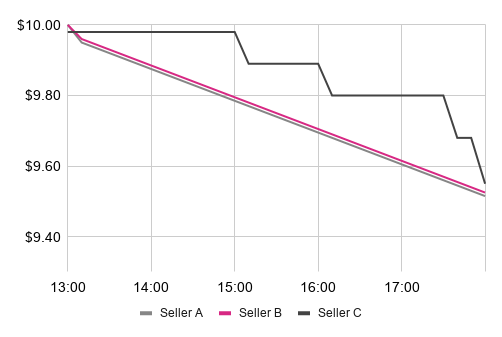

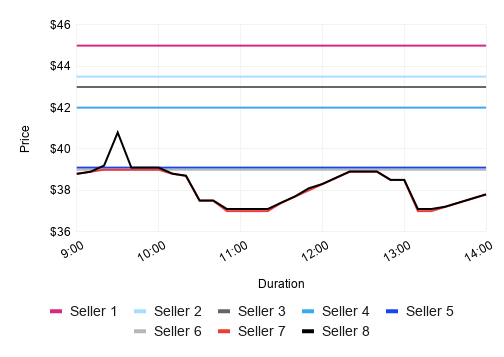

Multiple Competitors, Multiple Methods

Here, you can see three competitors who were vying for the same ASIN. Sellers A and B closely followed each other, while Seller C continued to set prices above the two competitors while observing the price drops. Though Seller C was certainly involved in the price war, his strategy was quite different than that of his two rivals.

4. Breaking Down Price Wars

Amazon Price War Statistics

Feedvisor’s extensive study on price wars dynamics revealed several important facts about price wars, which are outlined below.

1. Price Wars Are Brief

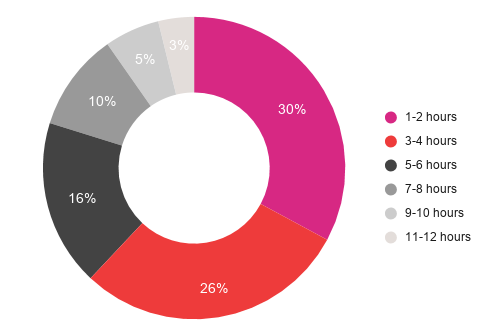

Most price wars occur over a very short period of time. In fact, the majority of the price wars we observed lasted no more than six hours.

2. Price Wars Can Occur at Any Time

Variables such as day, hour, or seasonality had no effect on when price wars took place.

3. Price Wars Typically Involve Two Competitors

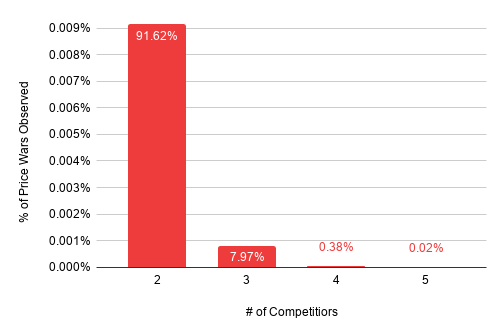

More often than not, price wars are waged between two competing sellers or brands. Occasionally, though, three sellers participate. Price wars with more than three competitors are rather rare.

4. Price Wars Are Not Exclusive to Sellers Competing for the Buy Box

While a significant number of price wars take place between competitors in a race to win the Buy Box for the same listing, they can in fact occur among private label sellers. Although these price wars would be much slower and take place between two different listings, they are possible.

For sellers competing for the Buy Box, it is critical to remember that the highly lucrative position is not won by price alone. While it is an important factor, the Buy Box exists to give the customer the best value for their money and considers both low price and high seller performance metrics, among other variables.

5. Lowest Price Point Manipulations Will Not Always Ensure You Win the Buy Box

This theory claims that a seller who undercuts the lowest competition by a certain percentage and then takes off an extra penny will always win the Buy Box. After testing this theory with multiple products, at multiple price points, and in multiple categories, it is evident that this is not a fixed rule. Continuously lowering the price creates price wars, driving down margins for both parties.

6. Price Wars Can Have Significant Impact

Although price wars were identified in only about 2% of products, their impact on market gross merchandise volume (GMV) is significantly higher. When prices get lower and lower and a “race to the bottom” ensues, this can lead to minimal, if any, profits all around.

5. Why Price Wars Happen

What Causes Price Wars on Amazon?

Amazon price wars are usually triggered by predefined repricing rules.

Since a significant amount of price changes on Amazon involve automation, products are repriced according to the rules set for the repricer. In other words, price wars can occur if two sellers have repricers that are programmed to always set the price below that of their competitors’ until they hit rock bottom.

This also helps explain why there is no seasonality to price wars. They can occur at any time, and on any day of the year, because they are being waged by automatic pricing rules. It is also possible that there is a large percentage of FBA products engaged in price wars because sellers sometimes liquidate inventory in order to avoid Amazon’s long-term storage fees. To quickly move through slow-moving inventory, sellers may cut prices, which, in turn, can prompt a competitor’s repricer to take the same action.

In order to manage price wars on Amazon’s ever-evolving marketplace, merchants today must rely on automatic repricers. Given that the selling environment is saturated with competition, it would be next to impossible to manually monitor and reprice a product catalog — particularly one with hundreds or even thousands of SKUs — around the clock.

Advanced repricers, backed by AI-powered technology, make decisions based on data, not instinct, and can therefore help you find the optimal way to manage a price war and avoid unjustified ones.

Rule-Based Repricing vs. Algorithmic Repricing

It is evident that manually repricing can lead to both error and human bias, so sellers looking to automate their pricing efforts typically choose between rule-based or algorithmic repricing technology.

Rule-Based Repricing:

Rule-based repricing looks at competitors’ prices for each product and adjusts the seller’s price based on a predefined set of rules. For example, rules can be set to match the lowest price on the market, beat the lowest price by a certain dollar amount, or be in the lowest 20% of all prices.

Although rule-based repricing is quicker and easier than manually repricing, the rules need to be constantly monitored and managed to ensure they deliver the best possible performance in various marketplace situations, which involves a lot of manual oversight. Moreover, rule-based repricers are unable to continuously search for the price point that maximizes profit, which may frequently change over time.

Algorithmic Repricing:

This method of repricing utilizes machine-learning algorithms to determine the most optimal price based on all known market conditions. Unlike rule-based repricing, algorithmic repricing monitors variables used to determine who wins the Buy Box — for competitive sellers — and sets a price that gives the optimal balance of Buy Box share and profit margin for each individual product.

For brands and private label sellers, this technology identifies your competitors in search and optimizes prices in real time according to your business objectives, such as revenue or profit.

Get in touch with us to discover how you can implement a dynamic pricing strategy on Amazon.

6. Navigating Price Wars

How to Avoid Price Wars and Maintain Market Share

1. Understand Your Competitive Arena

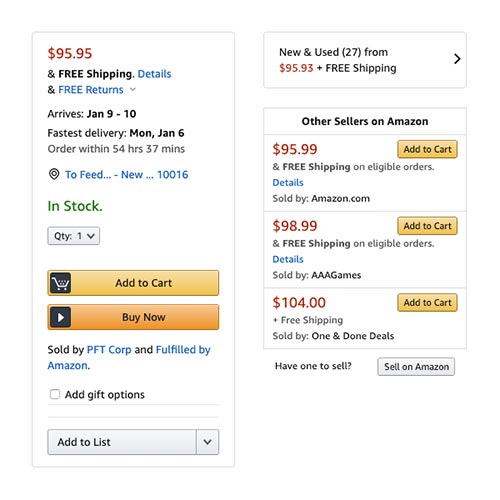

The first step is to understand that you are not competing against all sellers in a price war; frequently, it is just one. In the diagram below, for example, seven merchants are selling the same product, yet only two are actually competing against each other in a price war. In all likelihood, these sellers are vying for and winning the Buy Box.

2. Know Your Competitors

Determining who your competitors are — both in a price war and in general on the marketplace — can help you figure out the realistic share of the Buy Box that you can obtain as well as who may be taking demand from you.

The increasingly saturated Amazon marketplace indicates that more sellers are changing prices more frequently.

As a result, you should know your competitors’ pricing strategies to avoid price wars and maintain market share in your respective product categories and subcategories. By knowing how your competitors set their prices, you will be able to optimize your behavior accordingly.

It is important to note that your pricing strategy will vary depending on your selling model, such as if you are competing for the Buy Box or you are a brand or private label.

You should also analyze the estimated floor price of your competitors. Knowing how low they can go will indicate if you can price your products slightly lower in order to capture the Buy Box.

Lastly, you will want to understand what your competitive differentiators are versus the key competitors and how much higher you can price the product and still receive the desired result, such as increased Buy Box share or profit maximization.

3. Lead Instead of Follow

Some sellers initiate “reverse price wars” where they increase their prices and watch their competitors follow their lead. To minimize risk in these scenarios, you should only employ this tactic in non-peak hours.

4. Understand the Customer Impact

If you drive down your product prices in a price war, you may begin setting an unrealistic expectation for your customers, altering shopper perception of a certain product line or your brand altogether.

They may come to expect those low prices from you all the time and, if you do not constantly provide them, they will likely go convert their sale with a competitor. Over time, they may also begin to associate lower prices with lower-quality products, when in actuality your products are of high quality.

5. Gain Buy Box Share in Other Ways

There are other measures you can implement to increase your chances of winning the Buy Box, such as shipping your products quickly and on time, gaining positive feedback and reviews, responding to customer inquiries in a timely fashion, maintaining a healthy inventory position so you do not stock out, and so on.

Instead of solely isolating price, focus on providing competitive prices while maintaining healthy seller performance metrics.

Interestingly, of the Amazon sellers utilizing repricing technology, 94% find their account health score to be above average compared to their competitors.1

An AI-driven repricer, for example, can help sellers drive incremental sales and adhere to bespoke Amazon requirements such as on-time delivery. As a result of this satisfactory customer experience, they can generate repeat purchases and shopper loyalty, which usually go hand-in-hand with positive ratings and reviews, impacting not only your Buy Box share but your overall performance.

6. Leverage Minimum Advertised Price (MAP) Policies

Price wars originate with the simple concept that low price is a deciding factor for who wins the Buy Box. One seller decides that if his price is just a fraction below the current Buy Box winner, he will be able to secure the Buy Box. A second seller then responds with the same thinking, leading to a race to the bottom.

With MAP policies, the prices advertised by the sellers (whether in the Buy Box or on the offer listing page) cannot be less than a certain amount. Therefore, with MAP policies, price wars happen less frequently and brands and retailers can more effectively police their reseller footprint and protect their per-item profitability.

7. Implement AI-Driven Repricing Technology

Utilizing sophisticated price optimization technology can help you find the optimal price point between demand and price. Feedvisor’s platform, for example, takes into account other factors, such as if competing products are exact matches or just similar, as well as marketing expenses.

Instead of focusing solely on pricing your product the lowest to outbid competitors, Feedvisor’s technology experiments with raising the prices and monitors how the market — including consumers and other sellers — adjusts.

7. Conclusion

No One Wins in the 'Race to the Bottom'

In order to capture the maximum number of sales on Amazon, you need to be vigilant about your pricing strategy.

To avoid participating in the “race to the bottom” and face shrinking profit margins as a result, do not assume that lowering your prices and engaging in price wars will help you outpace the competition or recoup any sales or organic ranking placements.

Engaging in price wars typically ends up being a zero sum game, so it is more important to have a clear understanding of your SKU-specific pricing strategy, who your key competitors are, and what their pricing methods look like.

Leverage the data-driven insights included in this playbook to protect your brand value and margins, avoid price erosion, and ensure that your overall pricing strategy on Amazon is dynamic — automatically adjusting based on variables such as current market behaviors and competitors.

Get Access

Get full access to all chapters of the playbook. Please note that the form will not appear if you are using ad blockers.