Categories

Latest Posts

Tags

Advertising Amazon Amazon Advertising Amazon Experts Amazon Listing Optimization Amazon Marketplace Amazon News Amazon Prime Amazon Professional Sellers Summit Amazon Seller amazon sellers Amazon Seller Tips Amazon Seller Tools ASIN Brand Management Brands Buy Box Campaign Manager Conference COVID-19 downloadable Dynamic Pricing Ecommerce FBA FBM Holiday Season industry news Multi-Channel Fulfillment Optimize pay-per-click Pricing Algorithm Pricing Software Private Label Profits Repricing Repricing Software Revenue Sales Seller Seller-Fulfilled Prime Seller Performance Metrics SEO SKU Sponsored Products Ads Strategy

Get the latest insights right in your inbox

Resource | Blog

No More Price Matching: Target’s Pivot Away from the Discount Wars

SUMMARY

Target ends price matching to focus on dynamic pricing and value-driven strategies amid rising costs and shifting retail dynamics. Discover what this means for the future of e-commerce.

Rachel Horner

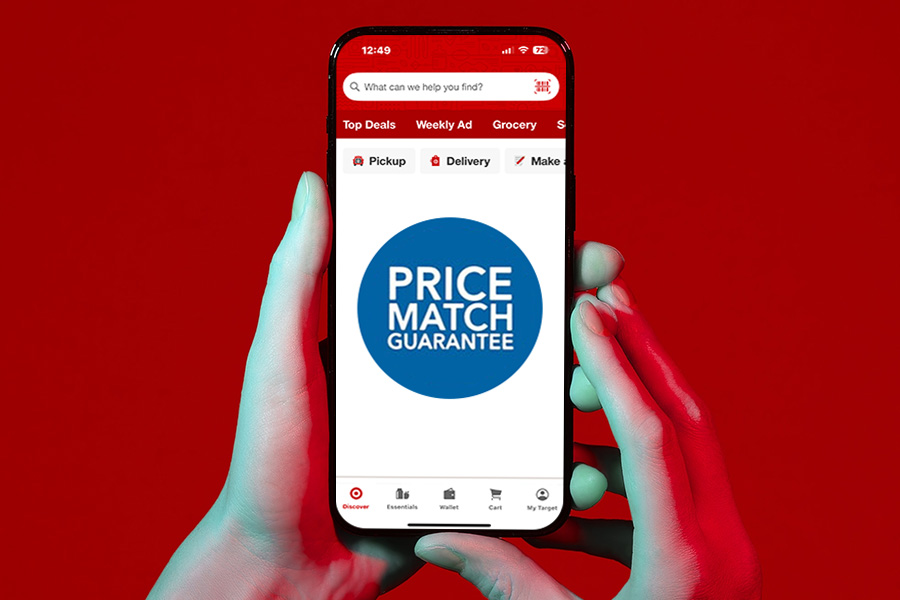

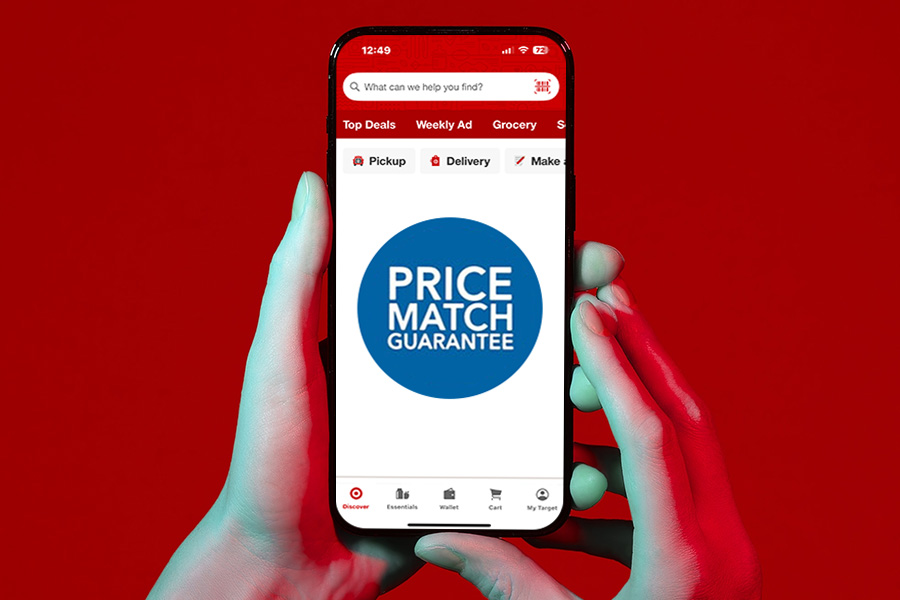

Beginning July 28, Target will no longer match prices on identical products sold by Amazon or Walmart within 14 days of purchase.

It’s a notable reversal for a retailer that once leaned on price match guarantees to stay competitive with e-commerce giants. But in today’s volatile retail climate, price matching is losing its appeal, fast. Walmart scrapped its price match policy back in 2019. Amazon, for its part, never truly engaged in the practice at scale.

So why is Target pulling the plug now, and what does it signal about the broader state of e-commerce in 2025?

The answer lies in survival. Target is in the middle of a strategic reset after facing several tough quarters marked by declining sales, lower foot traffic, and ongoing consumer pushback on everything from politics to pricing. Factor in an unpredictable tariff landscape and inflation-weary shoppers, and it’s clear: the old playbook isn’t cutting it anymore.

What Target’s Price Match Exit Says About Competing in Today’s Market

The Case for Margin Recovery

While many retailers continue to promise price consistency in the face of rising tariffs and inflation, Target’s decision to abandon price matching is a signal that those promises have limits. The retailer has already made headlines this year for revisiting its pricing strategies, often citing economic pressures linked to President Trump’s proposed trade policy changes.

But the move goes deeper than tariffs. This is about reclaiming margin in a consumer environment that’s forcing every retailer to reassess what’s sustainable. As promotions intensify and competition sharpens, the cost of chasing price parity, especially with Amazon, can quickly spiral into a margin-draining trap.

Price matching might win short-term loyalty, but in today’s market, it also invites a race to the bottom. For Target, walking away from it is a way to:

- Slow the erosion of already-thin margins

- Reset expectations with shoppers

- Rebuild pricing power during key seasonal windows

With peak shopping periods ahead, removing this policy gives Target more breathing room to execute sharper, SKU-specific pricing strategies without being boxed in by Amazon’s algorithmic undercutting.

Appealing to Value, Not Just Price

With Target’s stock down roughly 28% year-to-date, the retailer is under pressure to reassert its identity, and price matching doesn’t fit the new narrative.

The data backs that decision. According to our latest consumer behavior report, Target is the top choice for shoppers making mid-range purchases. A full 59% of its customers spend between $51 and $200 per visit—more than any other major retail platform. This sweet spot reflects Target’s new pricing strategy: not discount-deep, but value-forward.

In doing so, Target is redefining how value is communicated. Think curated private labels, premium partnerships, and exclusive drops that resonate with higher-income shoppers who care about more than just savings. It’s a bet that shoppers will pay more when they believe they’re getting more in return.

Dynamic Pricing Is the New Norm

Price matching made sense in a pre-digital world, when retailers couldn’t track every competitor’s price in real time. It was a customer-friendly promise rooted in trust: “If you find it cheaper, we’ll match it.” However, in today’s AI-powered retail environment, that policy has aged out.

Shoppers now compare prices mid-purchase. Loyalty is transactional. And every retailer, Target included, has full visibility into competitive pricing at all times. Holding on to price matching in this climate means locking yourself into Amazon’s low-margin strategy while operating with higher costs.

Dynamic pricing, powered by real-time data and AI, has replaced price guarantees. It gives retailers the flexibility to adjust based on demand, inventory, competitor moves, and customer behavior, without being anchored to a competitor’s lowest price.

Target’s decision to walk away from price matching is a clear acknowledgment that the rules of retail have changed. In today’s market, flexibility wins. Outdated pricing strategies simply can’t keep up.

Unlock Smarter Pricing With Feedvisor

Shift from price wars to value wins. Discover how dynamic pricing drives success.

Final Thoughts

Target is done chasing the cheapest shelf, and that’s a bold market signal.

For brands, this shift opens the door to rethink how they approach the retailer. There’s new room for premium positioning and business strategies that don’t hinge on matching Amazon’s floor. It’s also a wake-up call for other retailers: are you ready to play offense on value, or are you still stuck playing defense on price?

It’s Time to Embrace Dynamic Pricing

Target’s decision also highlights a broader industry truth: dynamic pricing, not price matching, is now essential for survival. The lowest price is no longer a guarantee for a sale. Winning businesses will focus on value, agility, and smart pricing strategies that flex with market shifts and consumer expectations.

Those who want to stay ahead can’t rely on outdated pricing models or one-size-fits-all discounts. As Target signals a shift away from reactive pricing, the real opportunity lies in smarter, AI-driven strategies that dynamically respond to demand, competition, and margin goals in real time.

Feedvisor is the leader in AI-first dynamic pricing, trusted by top brands to optimize every SKU, every day. Ready to move beyond price matching and take control of your margins? Start your 14-day free trial of Feedvisor today and see what intelligent pricing can do for your business.