Categories

Latest Posts

Tags

Advertising Amazon Amazon Advertising Amazon Experts Amazon Listing Optimization Amazon Marketplace Amazon News Amazon Prime Amazon Professional Sellers Summit Amazon Seller amazon sellers Amazon Seller Tips Amazon Seller Tools ASIN Brand Management Brands Buy Box Campaign Manager Conference COVID-19 downloadable Dynamic Pricing Ecommerce FBA FBM Holiday Season industry news Multi-Channel Fulfillment Optimize pay-per-click Pricing Algorithm Pricing Software Private Label Profits Repricing Repricing Software Revenue Sales Seller Seller-Fulfilled Prime Seller Performance Metrics SEO SKU Sponsored Products Ads Strategy

Get the latest insights right in your inbox

Resource | Blog

Walmart Just Walked Into ChatGPT. Amazon Just Locked the Door.

SUMMARY

Walmart has become the second major retailer (after Etsy) to integrate directly with ChatGPT, allowing users to browse and buy products through OpenAI’s new Instant Checkout feature—no website visit required. This move positions Walmart on the “open rail” of AI-driven commerce, where discovery and checkout happen through conversational agents. Meanwhile, Amazon is taking the opposite path—blocking AI crawlers from platforms like ChatGPT and Google, and reinforcing its own “closed rail” ecosystem through its in-house assistant, Rufus, and AI-powered product summaries.

These opposing strategies mark the start of an “AI Storefront War,” where commerce splits between open conversational platforms and closed retail ecosystems. While Walmart bets on accessibility and cross-platform reach, Amazon still dominates product discovery—80% of shoppers start there. To stay competitive, brands must optimize for both rails: structuring data and content for open-agent discovery while feeding Amazon’s AI clean, consistent signals to maintain visibility within its walls.

FAQ

Q: How does Walmart ChatGPT integration work for online shopping?

A: Shoppers can browse and buy Walmart products directly in ChatGPT using Instant Checkout, with multi-item carts and Sam’s Club integration coming soon.

Q: Why is Amazon blocking AI crawlers from its website?

A: Amazon blocks AI crawlers to protect product data, control search and advertising, and ensure shoppers stay within its Rufus-powered ecosystem.

Q: What are the open and closed rails of AI commerce?

A: Open rail includes platforms like ChatGPT, Walmart, and Etsy where AI agents guide discovery and checkout. Closed rail is Amazon and Rufus, where the retailer controls the entire shopping experience.

Q: Which platform leads in online product discovery?

A: Amazon leads with 80% of shoppers starting product searches there, ahead of Walmart, Google, and social media channels.

Q: How can brands optimize for AI shopping assistants on Walmart and ChatGPT?

A: Brands should structure titles, bullets, and bundles for AI understanding, include clear metadata, and provide “best for” statements to improve recommendation accuracy.

Q: How can brands optimize for Amazon Rufus and AI-powered search?

A: Use high-quality reviews, detailed product pages, consistent pricing, and seed FAQs to help Rufus surface your products correctly.

Q: What’s the future of AI-powered eCommerce and conversational shopping?

A: Expect multi-agent carts, conversational ads, and new KPIs like “Prompt-to-Purchase Rate” as AI chat increasingly replaces traditional search.

Marissa Incitti

Walmart just became the second major retailer (after Etsy) to integrate directly with ChatGPT. Through OpenAI’s new Instant Checkout feature, shoppers can now browse and buy Walmart products without ever leaving ChatGPT. Sam’s Club integration is coming next, and multi-item carts are on the roadmap.

At the same time, Amazon is moving in the opposite direction. The company recently blocked AI crawlers from ChatGPT, Google, and others, tightening its walls while doubling down on its in-house assistant, Rufus, and new AI-powered summaries on product pages.

The divide is stark:

- Walmart is leaning into openness — meeting shoppers where they already ask questions.

- Amazon is doubling down on control — keeping discovery, ads, and attribution in its own ecosystem.

Together, they mark the beginning of a new retail era: The AI Storefront War.

In this post, I’ll walk you through:

- What’s new (and why it changes “where you win”)

- The split rails of AI-enabled commerce

- How to win on both rails

- What’s likely to come next

The Future of Retail Is Here

Learn how AI guides your brand to smarter decisions and bigger wins.

What’s New (and Why it Changes Where You Win)

Walmart + OpenAI: chat → buy in one flow

Walmart has officially partnered with OpenAI to enable direct shopping through ChatGPT, allowing users to browse Walmart’s catalog and complete purchases using Instant Checkout without ever leaving the chat interface. The official go-live date has yet to be announced, but Bloomberg mentioned “fall”. Walmart describes this evolution as a move “beyond the search bar,” creating a multimedia, personalized, and contextual shopping experience that adapts to individual preferences rather than static search results.

The partnership builds on Walmart’s broader integration of AI across its operations. The retailer already uses generative and predictive AI to shorten fashion production cycles, optimize customer service responses, and improve supply chain forecasting, all part of its strategy to make shopping more intuitive and efficient.

Yet for all its innovation, Walmart is still playing catch-up to Amazon’s gravitational pull over product discovery. Even as Walmart moves commerce into the open-chat ecosystem, Amazon remains the primary search engine for shopping, shaping how consumers begin, and often end, their purchase journeys.

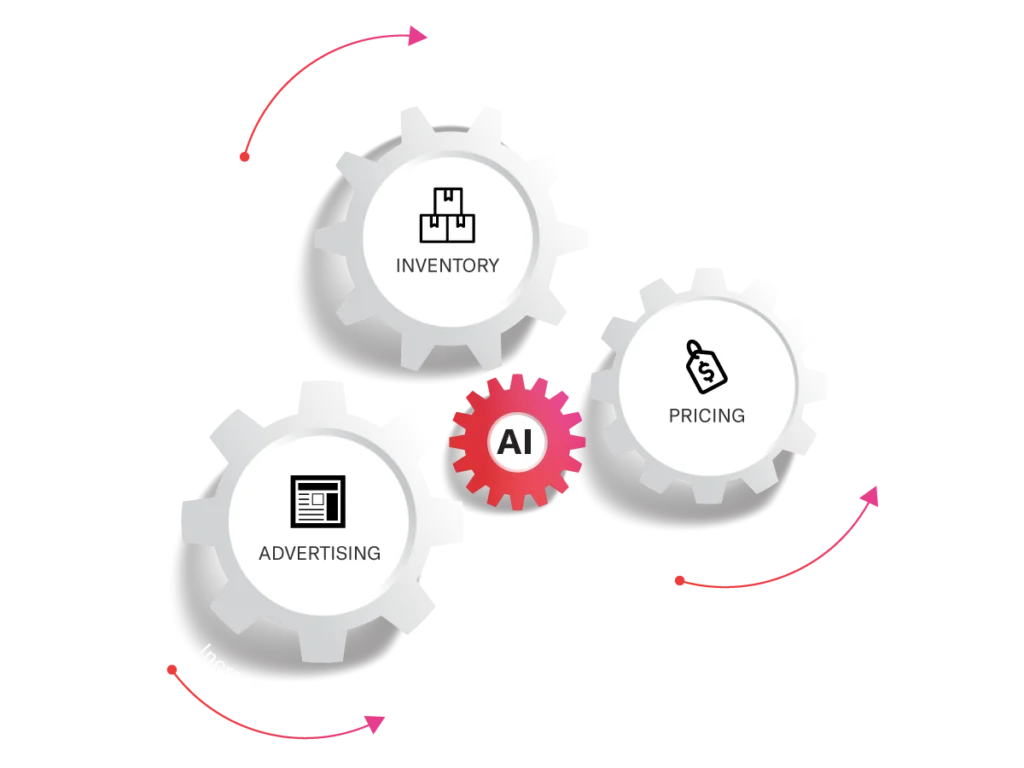

Amazon’s Counter: Protect, Internalize, and Own Discovery

While Walmart opens its catalog to conversational AI, Amazon is reinforcing its own walls. The company has updated its robots.txt files and underlying site code to block major AI crawlers, including those from Google, Meta, Anthropic, and Perplexity, effectively preventing external AI tools from indexing or retrieving its product data. Instead, Amazon is doubling down on Rufus, its proprietary AI shopping assistant, and embedding generative tools such as AI-powered summaries, comparison guides, and personalized recommendations directly within its platform.

By doing so, Amazon ensures that shoppers stay inside its own ecosystem where data, discovery, and ad monetization remain fully under its control. It’s a contrasting strategy to Walmart’s open integration: one that prizes walled-garden dominance over cross-platform reach.

If AI Can’t Find You, Neither Will Shoppers

Brands that don’t optimize for every assistant risk invisibility. Download Feedvior’s guide to learn the levers these assistants prioritize and ensure AI recommends your products first.

Two Rails of Agentic Commerce

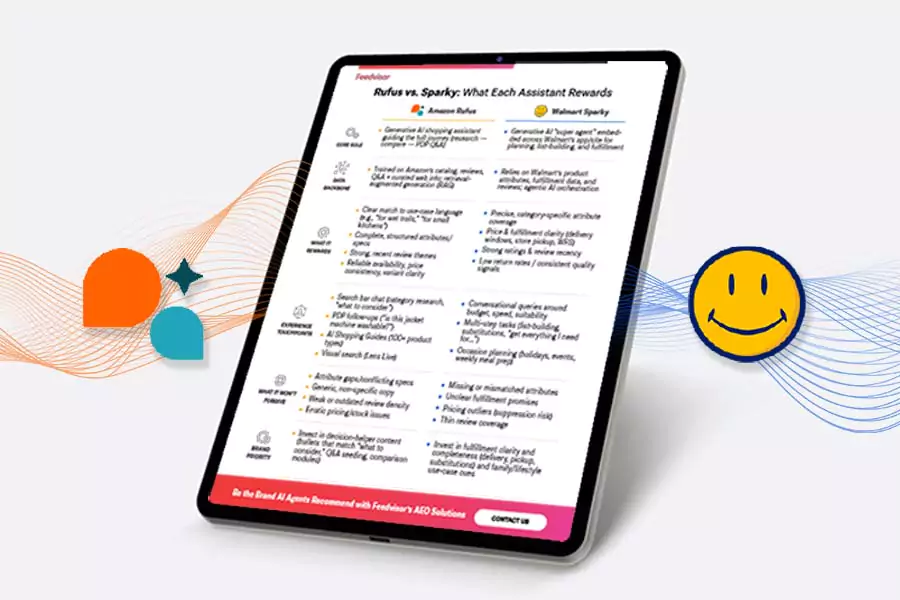

I see the emerging battle as a two-rail split:

Rail | Players | Discovery | Check out Route | Data Control | What brands must do |

Open Rail | ChatGPT + Walmart/Etsy/Shopify etc. | Agent surfaces via conversation prompts | Instant Checkout (or multi-item cart later) | Shared / mediated by the assistant | Optimize content for agent access, in addition to SEO and humans, enable bundling, stitch identity, capture downstream LTV |

Closed Rail | Amazon / Rufus / Proprietary Assistants | Discovery inside a retailer’s AI layer | Checkout inside Amazon / via its system | Full control of signals, ranking, ads, attribution | Feed agent-friendly product data, seed Q&A, manage adversarial prompts, measure agent conversions internally |

So rather than “which side do I pick?”, brands must optimize for both rails simultaneously. The risk is a lopsided bet: gain traction in ChatGPT but lose in Amazon’s own closed loop or vice versa.

The Reality Check: Amazon Still Owns Discovery

For all the headlines about “open” commerce and agentic shopping, the data tells a harder truth: Amazon still owns the discovery moment and that dominance is actually growing.

According to Feedvisor’s 2025 Consumer Behavior Report, 80% of shoppers now begin their product search on Amazon, up from 60% the year prior. This signals more than incremental growth, it’s an acceleration of habit. Consumers trust Amazon’s reviews, delivery reliability, and frictionless path to purchase.

“A standard search bar is no longer the fastest path to purchase; rather, we must use technology to adapt to customers’ individual preferences and needs.”

— Suresh Kumar, Global CTO & Chief Development Officer, Walmart Inc.

Even with Walmart’s ChatGPT integration, that search gap remains wide. Walmart follows at 50%, while Google sits at 42%. Social channels—Facebook, Instagram, and TikTok—collectively influence 48% of product discovery. This fragmentation underscores a key truth: AI assistants and conversational commerce aren’t replacing search yet, but they’re augmenting it.

And when shoppers do turn to AI assistants, Amazon is still part of the conversation. Among consumers who have used an AI assistant for product searches:

- 26% used ChatGPT

- 18% used Google’s Gemini

- 13% used Amazon Rufus

- 7% used Microsoft Copilot

- 4% used Anthropic’s Claude

A striking 93% found them helpful, suggesting that while the volume of users remains modest, satisfaction and trust are high, especially for Amazon’s Rufus, which has evolved from early criticism (“unhelpful,” “just plain wrong”) into a functional, intuitive shopping guide that can interpret prompts like “help me find a gift for Mom.”

What it means for brands

AI discovery may be fragmenting, but Amazon still sets the baseline expectations for speed, accuracy, and relevance. Walmart and ChatGPT are building an open alternative, but the reality is, most consumer journeys still begin and end on Amazon.

That makes the “two rails” approach even more urgent:

- The closed rail (Amazon) isn’t just walled, it’s winning.

- The open rail (Walmart + ChatGPT) is the emerging counterbalance, creating optionality and future-proofing for brands.

Optimizing for both is more risk mitigation than redundancy, but if you had to choose between one or the other, Amazon is still your best bet.

How to Win on Both Rails

Rail A: Open (ChatGPT: Walmart, Etsy, Shopify)

- Structure for agents, not search engines

- Write titles, bullets, and specs that disambiguate variants, sizes, and compatibilities.

- Include “best for” statements (“best for travel,” “under $50,” “vegan-safe”) so AI assistants can surface your products confidently.

- Write titles, bullets, and specs that disambiguate variants, sizes, and compatibilities.

- Prepare for agent-assembled carts

- Design pre-bundled kits and complementary products so ChatGPT can assemble multi-item baskets that make sense.

- Include metadata like “compatible with X” and “pair with Y” to improve bundle accuracy.

- Design pre-bundled kits and complementary products so ChatGPT can assemble multi-item baskets that make sense.

- Fix the attribution gap

- ChatGPT checkout flows often default to “guest” mode (like Etsy’s current integration).

- Add deep-link tracking, claim-your-order emails, and post-purchase account stitching to reclaim first-party data and LTV.

- ChatGPT checkout flows often default to “guest” mode (like Etsy’s current integration).

- Build a “Prompt Map”

- Identify your top 100 natural-language queries (e.g., “eco-friendly cleaning products under $20,” “beginner guitar kit for teens”).

- Map each to a curated bundle or PDP collection page.

- Identify your top 100 natural-language queries (e.g., “eco-friendly cleaning products under $20,” “beginner guitar kit for teens”).

- Plan for transparency and fallback

- Provide short, factual “why this product” explanations.

- Add clear return and guarantee policies the assistant can quote when users ask follow-up questions.

- Provide short, factual “why this product” explanations.

Rail B: Closed (Amazon: Rufus)

- Feed Rufus the right signals

- Optimize PDPs for readability: comparisons, benefits, proof points, and certifications.

- Use high-quality reviews, full attribute coverage, and consistent pricing to ensure Rufus and AI summaries surface your brand correctly.

- Optimize PDPs for readability: comparisons, benefits, proof points, and certifications.

- Seed conversational Q&A

- Add FAQ content that matches real shopper phrasing: “Which is better for oily skin?”, “Can I use this for hiking?”

- This helps Rufus learn context from real questions, not just keywords.

- Reduce volatility

- Frequent price or stock changes can lower confidence in AI recommendations.

- Use stable signals during campaigns or promotions.

- Frequent price or stock changes can lower confidence in AI recommendations.

What Comes Next

Walmart and OpenAI may have opened the first conversational checkout lane, but Amazon still owns the highway.

That won’t last forever, but it will define how quickly AI commerce scales.

Over the next year, expect:

- Assistant interoperability: shared catalog APIs and multi-agent shopping carts

- Retail media redefinition: ads embedded within AI chats and agent recommendations

- Agentic KPIs: “Prompt-to-Purchase Rate” replacing CTR

- Voice, visual, and multimodal discovery expanding into everyday search

For brands, the takeaway is clear:

The search bar is dissolving. The conversation is the new conversion.

Those who optimize for both rails, closed and open, will not only capture today’s demand but future-proof their discoverability across every emerging AI interface.