Categories

Latest Posts

Tags

Advertising Amazon Amazon Advertising Amazon Experts Amazon Listing Optimization Amazon Marketplace Amazon News Amazon Prime Amazon Professional Sellers Summit Amazon Seller amazon sellers Amazon Seller Tips Amazon Seller Tools ASIN Brand Management Brands Buy Box Campaign Manager Conference COVID-19 downloadable Dynamic Pricing Ecommerce FBA FBM Holiday Season industry news Multi-Channel Fulfillment Optimize pay-per-click Pricing Algorithm Pricing Software Private Label Profits Repricing Repricing Software Revenue Sales Seller Seller-Fulfilled Prime Seller Performance Metrics SEO SKU Sponsored Products Ads Strategy

Get the latest insights right in your inbox

Resource | Blog

Amazon’s 2026 Fee Update: 3 Things to Know Before Q1

Even the smallest fee increase can tip your margins in 2026. Be the first to access The 2026 Amazon Fees Guide and protect your margins before they’re impacted. Join the waitlist now.

Marissa Incitti

SUMMARY

Amazon’s 2026 FBA and referral fee updates will impact brand profitability, especially after high-volume events like Prime Big Deal Days and Q4. Rising ad costs, supply chain pressures, and material inflation make operational precision and dynamic pricing essential for protecting margins.

Top brands are taking an offensive approach: simulating SKU-level profit impacts, reallocating ad spend to high-margin products, and using AI to spot inefficiencies early. Tools like Feedvisor’s AI Advisor and the upcoming 2026 Amazon Fee Survival Guide provide actionable insights to safeguard profitability and drive growth in the changing marketplace.

Fresh off the heels of Prime Big Deal Days, brands are racing to finish Q4 strong amid increasingly cautious shoppers and tougher conversions. Discounts are steeper, ad costs are higher, and every margin point matters.

Now, Amazon has added another layer of pressure with its newly announced 2026 referral and fulfillment-by-Amazon (FBA) fee updates. The changes may appear modest at first glance, but for brands already balancing tight profitability across multiple SKUs, they underscore a difficult reality: 2026 will demand even tighter operational and pricing precision to stay profitable.

Here’s a quick breakdown of what’s changing, what it means for your margins, and how to prepare before the new fees take effect.

Multichannel Pricing Solution

Power Your Brand with Future-Ready Technology for Amazon and Beyond.

The Latest Amazon Fee Changes

Amazon’s 2026 updates, effective January 15, 2026, include:

- A slight increase in FBA fees. On average about $0.08 per unit sold, which Amazon says is “less than 0.5% of an average item’s selling price.”

- Amazon’s shift toward more granularity in fee structure: lower fees where their cost of service is lower, and higher fees where they provide enhanced services or value. For instance, to maintain the fast delivery speeds that drive sales while offsetting rising operational and labor costs, Amazon will adjust standard-size and low-inventory-level fees.

- Additional external signals brands should note: for instance, Amazon is ending all in-house prep and labeling services for U.S. FBA shipments starting January 1, 2026.

Even small per-unit cost increases matter when scaled across hundreds or thousands of SKUs and as brands face pressure on sourcing, logistics, and advertising.

Why It Matters More in 2026

Unlike prior years when brands could absorb fee hikes as a cost of doing business, 2026 will be different. Here’s where the challenges, and opportunities, lie:

- Brands are already contending with increased landed costs, global supply chain disruption, and inflationary pressure on materials and freight.

- Advertising and visibility costs on Amazon continue to climb, meaning brands must squeeze more margin from each unit to maintain profitability.

- A shift in Amazon’s structure means brands that manage pricing, inventory, and ads more intelligently will be better placed to offset fee pressure.

- Coming off high-volume events like Prime Big Deal Days and the Q4 holiday rush, brands are shifting into 2026 planning mode. It’s the perfect moment to evaluate performance, adapt to recent updates, and position for stronger growth.

In short, 2026 will be less about absorbing fees and more about offsetting them strategically.

How Top Brands Are Preparing

The brands best positioned for 2026 are playing offense instead of defense. They’re anticipating margin pressures, making smarter investments, and leveraging AI to turn insight into action before inefficiencies erode profitability, specifically:

- Simulating profit impact by SKU and adjusting pricing dynamically.

- Reallocating ad spend toward products with the highest margin resilience.

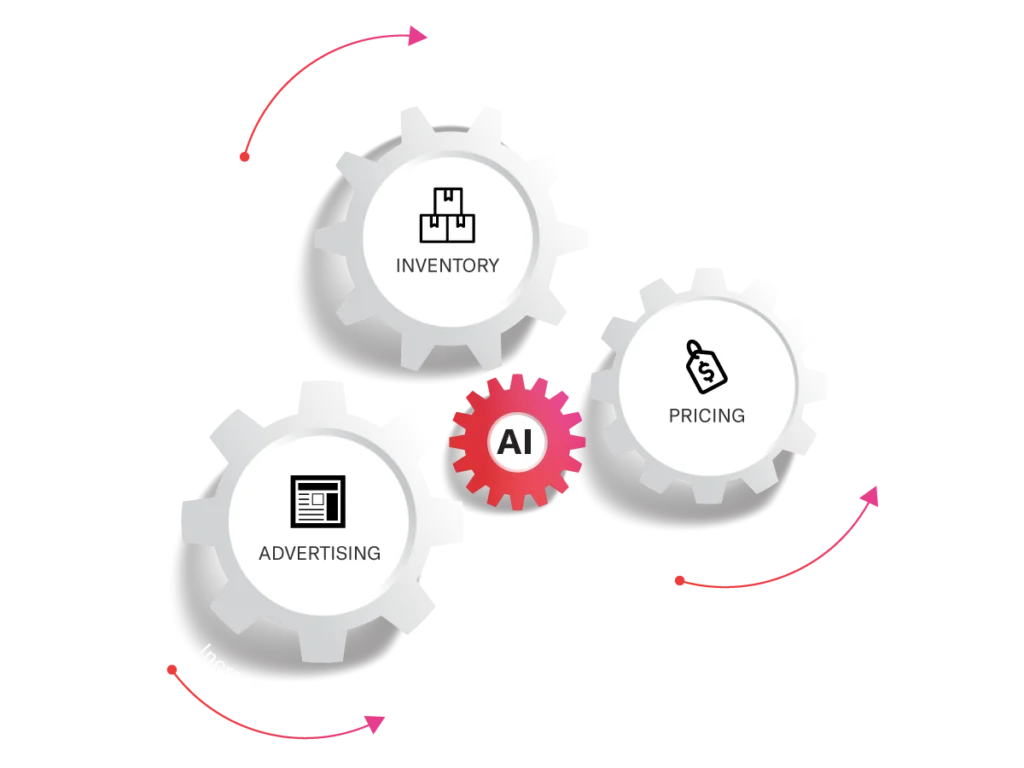

- Syncing advertising, pricing, and inventory data through AI to reveal margin-draining inefficiencies early.

Spotting margin-draining inefficiencies before they escalate is key to sustaining profitability. Tools like Feedvisor’s AI Advisor make it possible to connect pricing, inventory, and advertising data in real time—so when fees increase, you’re adjusting proactively rather than playing catch-up in Q1.

Harness AI-Powered Pricing Optimization to Protect Inventory and Avoid Fees

Feedvisor’s pricing optimization technology uses real-time inventory data to keep your stock healthy. Start your free 14-day trial and see it in action.

What Comes Next

Feedvisor’s full 2026 Amazon Fee Survival Guide is coming soon.

We’ll break down every new fee, the expected margin impact by category, and the actions brands can take to protect profit and visibility.

Sign up to be the first to get the guide.

FAQ

Q: When do the 2026 Amazon FBA and referral fee updates take effect?

A: The new fees go into effect on January 15, 2026 for FBA and referral fees.

Q: How will Amazon’s fee changes impact my brand’s profits?

A: Even small per-unit increases can affect margins across multiple SKUs, especially with rising advertising, supply chain, and material costs.

Q: What strategies can brands use to offset fee increases?

A: Top strategies include SKU-level profit simulations, reallocating ad spend to high-margin products, and integrating pricing, inventory, and advertising data using AI-driven tools to identify margin inefficiencies early.

Q: How can AI help brands prepare for Amazon’s 2026 fee changes?

A: AI tools, like Feedvisor’s AI Advisor, help brands optimize pricing, advertising, and inventory in real time, ensuring proactive margin protection and better visibility in a changing marketplace.