Categories

Latest Posts

Tags

Advertising Amazon Amazon Advertising Amazon Experts Amazon Listing Optimization Amazon Marketplace Amazon News Amazon Prime Amazon Professional Sellers Summit Amazon Seller amazon sellers Amazon Seller Tips Amazon Seller Tools ASIN Brand Management Brands Buy Box Campaign Manager Conference COVID-19 downloadable Dynamic Pricing Ecommerce FBA FBM Holiday Season industry news Multi-Channel Fulfillment Optimize pay-per-click Pricing Algorithm Pricing Software Private Label Profits Repricing Repricing Software Revenue Sales Seller Seller-Fulfilled Prime Seller Performance Metrics SEO SKU Sponsored Products Ads Strategy

Get the latest insights right in your inbox

Resource | Blog

Answering Seller Questions: When the Floor Price Feels Like Your Only Option

Get Smarter Ways to Clear Inventory Without Killing Margins

SUMMARY

With decades of experience in the Amazon industry, we’re here to share our expert insights and address your most pressing questions. Below, we answer a common question from seller forums.

Rachel Horner

It Feels Like My Only Option To Win the Buy Box Is Dropping to the Floor Price. What Should I Do?

When storage limits are maxed out and fees are looming, the floor price may be your only option to move excess inventory fast.

That said, it’s important to approach floor pricing strategically, rather than out of panic. Dropping prices without a plan can erode margins more than necessary and train customers to expect rock-bottom prices on your products.

When Is Dropping to the Floor Price Your Best Move?

First, determine if it’s absolutely necessary to drop to the floor price. You may need to if:

- You’re facing imminent long-term storage fees that will significantly cut into your profits; in this case, quick liquidation, even at the floor price, may save you money overall.

- Inventory age is causing slow turnover that could trigger additional Amazon fees or removal charges; it’s often better to sell at a loss than continue holding costly stock.

If you do need to use your floor price, keep a close eye on timing. Timing can make the difference between minimizing losses and eroding margins unnecessarily. If long-term storage fees or removal charges are weeks away, you may have time to test smaller adjustments before resorting to the floor price. If the deadline is imminent, you may need to act more aggressively.

Either way, don’t hold inventory beyond the fee deadline, as the added costs can outweigh any potential sales.

Take Back Control of Your Margins

Inventory fluctuations are inevitable. Stay ahead of overstocking and costly fees with the only inventory-aware AI pricing solution.

When You Can Avoid the Floor Price

There are also situations where you can clear inventory without dropping all the way to the floor. Many sellers think pricing is binary: either hold firm and risk paying storage fees, or slash prices to rock-bottom and accept razor-thin margins. But there’s a smarter approach.

Dynamic pricing takes the guesswork out of this process. It uses real-time data—demand trends, competitor pricing, sell-through rates, and time until storage fees hit—to identify that threshold. Instead of blindly slashing prices, you can make precise, incremental adjustments that move inventory efficiently without eroding your margins.

Think of it as precision discounting instead of panic discounting. For example:

- A product might only need a 5–7% price drop to see a 20% boost in sell-through, instead of an unnecessary 25% slash to hit the floor.

Ultimately, it gives you control in what feels like a no-win situation. Rather than reacting emotionally to upcoming fees or competition, you’re making informed pricing decisions backed by data.

Final Thoughts

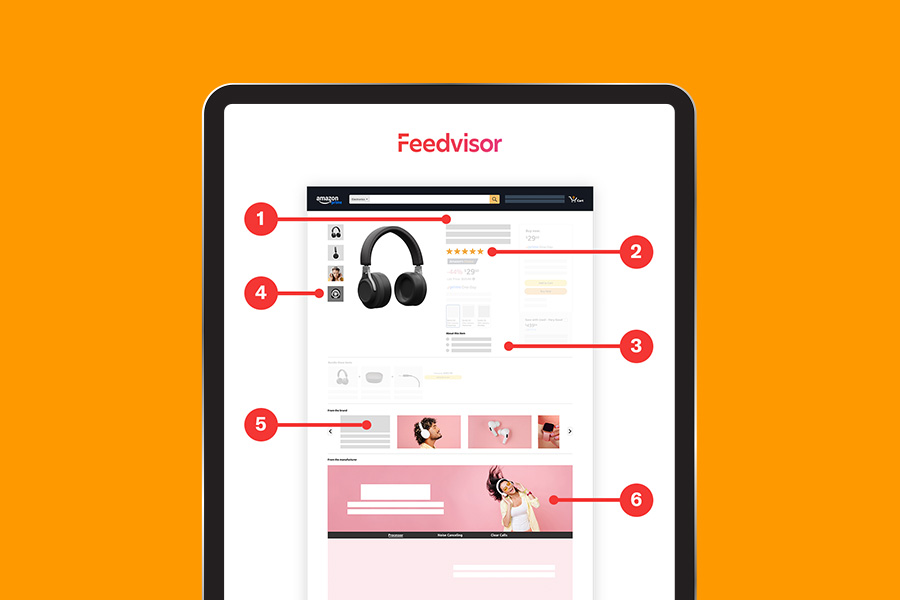

The key isn’t just reacting to the problem, though. It’s preventing it. Predictive insights and real-time pricing optimization can help you avoid overstocking in the first place. Feedvisor’s AI-powered technology continuously analyzes your inventory levels, storage limits, and sell-through rates to recommend the best pricing strategy before fees force your hand.

And if you’re already up against the clock, the platform can help you strike the right balance between liquidation and profitability.

The bottom line: While it might feel like the floor price is your only option, there are more strategic ways to move excess inventory without undermining your margins. Get a free, 14-day trial of Feedvisor’s advanced pricing technology to see how it can protect your profitability, even under pressure.