Resources - Blog

Cyber 5 2023 Analysis: A Deep Dive into Record-Breaking Sales and Shopping Trends

This year’s holiday shopping results shocked everyone, in the best way possible. As initial predictions from research firms cautioned slow growth for the holidays this year (Deloitte predicted a 3.3% to 4.6% increase in sales and Customer Growth Partners predicted a meager 2.1% increase in holiday spending), it was a great surprise and relief to see record-breaking sales numbers and growth – proving the consumer is primed to still spend despite the economic hardships.

Below, we will unpack the five-day shopping period, providing our insights using aggregated data across Feedvisor’s clients.

Among the most popular purchases over the weekend were toys, sneakers, activity trackers, smartwatches, and TVs.

Historic Sales and Number of Shoppers Mark 2023 Holiday Shopping

While holiday shopping officially kicked off with Prime Big Deal Days in October, shoppers showed up – both physically and online – for attractive Cyber Week deals.

The five-day holiday weekend from Thanksgiving Day through Cyber Monday saw a record-setting 200.4 million shoppers, surpassing last year’s record of 196.7 million. Of those, 134.2 million US consumers logged on to take advantage of digital deals, up from 130.2 million last year.

The sales results speak for themselves:

Overall, Adobe Analytics reported a 7.8% increase in Cyber Week 2023 total sales compared to 2022. It’s safe to say the double-digit growth enjoyed during the pandemic is long past; however, this year’s holiday shopping period is higher than pre-pandemic levels showing promise for a new growth pattern to emerge.

Cyber 5 2023 Sales Results: Feedvisor

Feedvisor clients enjoyed a 12% year-over-year sales increase when compared to 2022.

Each day of Cyber Week showed growth versus last year, with Black Friday coming in with the highest increase at 16%. Cyber Monday saw an 11% increase year-over-year, and Thanksgiving increased just under 2%. Interestingly enough, Small Business Saturday showed a 13% increase in sales year-over-year, which may have been due to Black Friday deals bleeding into the following days. This seems especially probable as the average ordered units were up 58% compared to 2022.

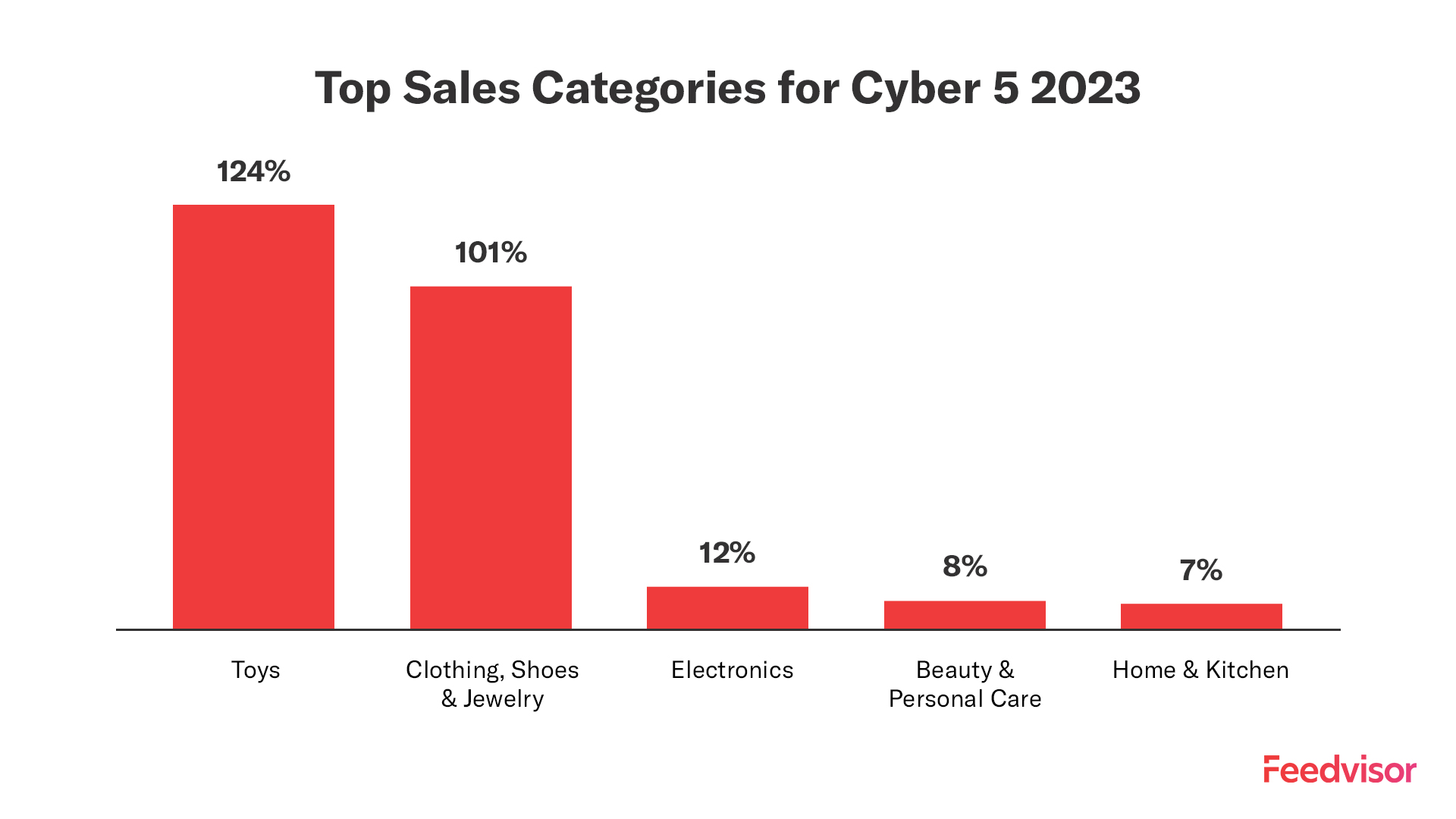

Top categories reported by Digital Commerce 360 were apparel (154% growth), appliances (129%), toys (122%), jewelry (113%), personal care products (90%), and furniture (84%) also recorded significant sales compared to a typical day.

Our data shows similar results, with Toys being the standout category showing the highest sales this year, experiencing an incredible 124% increase y-o-y. Following close behind are Apparel (101% increase) and Electronics (12% increase).

The Great Discount Year: Record-Breaking Deals Entice Inflation-Weary Shoppers

While inflation may have driven up retail sales numbers in recent months, consumer demand was the driving force behind this year’s Cyber Five record sales, egged on by the deep discounts offered this year.

The average discount was 29% off the retail price, according to Salesforce. General apparel had the highest discounts, averaging 38% off, followed by health and beauty at 35% off, and activewear (26% off).

With such deep discounts, the average order value (AOV) across Feedvisor clients increased slightly by 2.7% compared to year-over-year. Adobe Analytics reflects this change as well, showing the AOV rising 3.2% during Cyber Weekend (Nov. 25 and Nov. 26).

Ads Performed Well Thanks to Cyber 11

Retailers have continued to respond to earlier holiday demand with sales and promotions throughout the season, spending ad dollars for a longer period of time. Luckily, the extended promotion period paid off, with ad spend decreasing 15% when compared to 2022. Thanks to Amazon announcing Cyber 11 deals, retailers and brands were able to hone in on the most impactful days for ad spend, cutting out excess.

2023 Cyber Five Ad Sales and Performance

Ad sales across our clients for the top 5 categories showed a modest increase at 12% this year compared to last, but showed a 15% increase in RoAS, likely due to targeted deal promotions. Ad cost of sale (ACoS) dropped 5% during the holiday weekend, a trend attributed to strategic adjustments in targeting and ad spend optimization.

Average ordered units across our diverse client base are up 67% compared to 2022, signaling a heightened consumer demand, despite conversions witnessing a modest 1% increase year-over-year. Business owners were able to maintain their ability to convert potential customers into actual buyers despite a meager improvement in conversions.

Another bright spot is that CPCs decreased by 4% for two of the top three categories compared to 2022. This is a welcome reprieve for sellers, with Thanksgiving showing the lowest CPC. The highest CPC day was Cyber Monday at an average CPC of $1.25 versus the lowest of $0.95 on Thanksgiving.

CPM was relatively flat compared to 2022, with a 1% average increase across categories. The Toys category saw the greatest increase, with 6%.

Notable Cyber Five Trends in 2023

During this year’s Cyber Five, we studied not only the apparent metrics but also the top three consumer trends and behaviors affecting sales, purchasing habits, and strategies.

1. Couch Commerce Dominates, Especially on Thanksgiving

Mobile and social were critical acquisition channels this Cyber Week, with a historical 79% of e-commerce traffic coming from mobile phones, up from 76% in 2022.

As a key driver for digital sales, the increase in couch or mobile commerce shows that many consumers now find the experience on par with desktop shopping. Plus, it’s easier to surf and shop from your phone while visiting family.

Especially on Thanksgiving. Last year, we predicted mobile commerce would make up 60% of Thanksgiving sales. This year, sales on Thanksgiving 2023 came in at 59% of online sales compared to 55% in 2022.

Mobile usage remained high across Cyber Week, with smartphones driving 51.8% of online sales (up from 49.9% in 2022).

2. Buy With Prime Expands During Cyber 5

Amazon announced that Buy With Prime unit purchases increased 300% during Cyber Week versus the daily average for the month of October 2023.

Consumers are enjoying the convenience of staying within the platform of choice and not having to enter their payment information to yet another site. The free shipping from being a Prime Member is also a plus.

3. Cyber Week Deals Will Continue to Linger

Just as the sales bell curve is flattening out, holiday deals will no longer be confined to 5 days a week. This year, Amazon announced their “11 days of deals” and “new deals dropping every day through December 24”. We’ll continue to see deals creep earlier and later surrounding the holiday season.

Final Thoughts

In the face of widespread challenges, marked by factors such as layoffs, global conflicts, inflationary pressures, and rising fees, the year has demanded resilience and adaptability.

Despite these adversities, a silver lining emerges through the lens of innovation.

Opportunities for gaining profound insights into consumer behavior, streamlining data collection processes, and uncovering the next wave of e-commerce advancements persist.

For Amazon sellers, navigating this landscape can be daunting, but it’s crucial to recognize that, with the right strategies, there’s a unique advantage to be leveraged. Take charge of your future—try our services with a risk-free trial for 14 days or engage in a personalized consultation to chart a path forward.