Categories

Latest Posts

Tags

Advertising Amazon Amazon Advertising Amazon Experts Amazon Listing Optimization Amazon Marketplace Amazon News Amazon Prime Amazon Professional Sellers Summit Amazon Seller amazon sellers Amazon Seller Tips Amazon Seller Tools ASIN Brand Management Brands Buy Box Campaign Manager Conference COVID-19 downloadable Dynamic Pricing Ecommerce FBA FBM Holiday Season industry news Multi-Channel Fulfillment Optimize pay-per-click Pricing Algorithm Pricing Software Private Label Profits Repricing Repricing Software Revenue Sales Seller Seller-Fulfilled Prime Seller Performance Metrics SEO SKU Sponsored Products Ads Strategy

Get the latest insights right in your inbox

Resource | Blog

Prime Day 2025 Results

SUMMARY

With Feedvisor’s analysis, explore the highs and lows of Prime Day 2025, from record-breaking sales and consumer trends to the challenges faced by sellers and advertisers.

Marissa Incitti

It’s the week after Prime Day 2025, and the usual post-event buzz feels oddly quiet. In past years, social media feeds would be flooded with brands and Amazon touting “record-breaking sales” and “millions of SKUs flying off the shelves”. But this year, there’s a noticeable absence of those celebratory anecdotes.

Yet despite the silence, Amazon has declared the event its biggest Prime Day ever. At the same time, Adobe reported total U.S. online retail sales reached $24.1 billion over the same four-day event (July 8–11), a 30.3% increase year-over-year. However, that figure reflects the combined sales across the top 100 US retailers, not just Amazon. While it underscores strong consumer demand across the broader e-commerce landscape, it’s worth noting that this total is nearly double the size of a typical Black Friday, signaling the importance of this event, even beyond Amazon.

That said, topline e‑commerce growth doesn’t always reflect what’s happening within the Amazon marketplace itself. Behind the headline-grabbing numbers, however, the reality from consumers and merchants tells a more complex story. Below, we’ll examine key data points and highlight trends by examining the results from Feedvisor’s customer sales data across Amazon’s U.S. marketplace during Prime Day events from 2025.

Integrated Solution

Prime Performance Not What You Wanted?

Prep for H2 with a free trial of our AI-Powered Advertising and Pricing Platform

A Record-Breaking Prime Day… But At What Cost?

While the extended format helped drive the headline total, it also revealed some soft spots. If Prime Day had remained a two-day event, it’s likely the year-over-year growth would have looked far less dramatic, but Amazon spread demand over four days instead of trying to capture it in two – a move that they started during Cyber 5”, extending the format to “Cyber 12” by promoting deals the days leading up to and after Black Friday. Amazon has still never officially released the dates they calculate for Cyber 12.

At Feedvisor, our clients experienced a 5.48% lift in sales performance compared to Prime 2024 and the two days immediately following. This is in line with industry averages and exceeded our pre-event predictions of 3 – 4% growth.

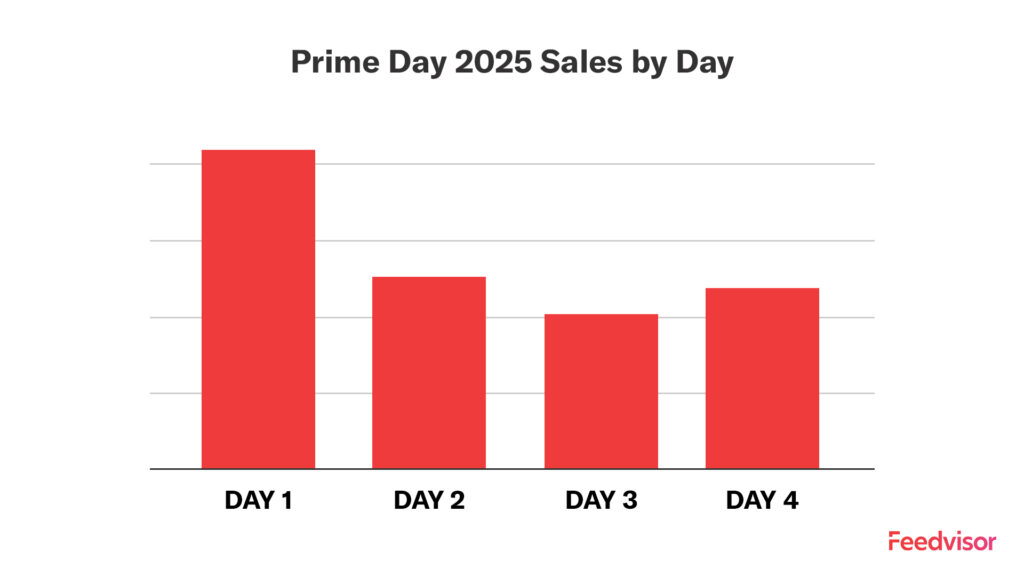

We saw sales peak on Day 1, with a cascade effect throughout the rest of the event. Day 3 was the lowest sales day and a small rush on Day 4 to grab last minute deals. This mirrors industry data as Adobe reported Day 1 at the highest sales – $7.9 billion. While not released, the following days would need to be around $5.4 billion each or a mix to hit the total $24.1 billion.

The electronics category had the only deviation in the pattern, with days 1 and 4 being the highest in sales.

Consumer and Merchant Sentiment: Cautious Optimism

While Amazon touted its record-breaking numbers, many consumers reported mixed feelings about this year’s deals. Comments like “The discounts weren’t as deep as last year” and “I was glad other retailers had events too—I stocked up on paper towels and pantry staples at prices I normally see for a week’s worth of groceries” surfaced repeatedly across Reddit threads and social media.

Back-to-school shoppers were a bright spot. “My kids’ school sent supply lists early this year, so we focused on notebooks, backpacks, and pens,” one parent noted. This seasonal focus contributed to notable surges in school-related categories, especially kids apparel, dorm essentials, and school supplies.

Merchants, on the other hand, had to adapt to a different shopping rhythm. The extended four-day format spread out purchases and diluted the sense of urgency that typically drives early Prime Day spikes. Many sellers also reported that deal comparison shopping was more pronounced this year as consumers toggled between Amazon, Walmart, Target, and Best Buy—each of which ran parallel “summer cyber week” events. In fact, over half of shoppers compared prices prior to placing their orders.

The Categories That Won Prime Day

Despite softer consumer enthusiasm, several categories experienced impressive growth, according to Adobe:

- Kids’ apparel surged by 250%, a clear sign that families leaned into Prime Day for back-to-school shopping.

- Home security products jumped 185%, as did school supplies (+175%) and refrigerators and freezers (+160%).

- Other strong performers included games, headphones and speakers, car seats, luggage, vacuum cleaners, power tools, and computers—all posting gains between 120%–160%.

- Even categories like dorm essentials and exercise equipment saw meaningful growth, at 84% and 80%, respectively.

Feedvisor clients saw similar momentum, particularly in high-demand categories like kids’ apparel, home goods, and electronics. By dynamically optimizing advertising bids and pricing in real time, and with our expert team actively managing performance throughout the event, they were able to capitalize on surging demand and maximize results.

Take Back Control of Your Margins

Use the learnings from Prime Day to help inform your Q4 strategy and get a leg up on the competition with the award-winning optimization platform for Amazon and Walmart brands.

Discounts, Tariffs, and Changing Shopper Behavior

Two macro forces shaped this year’s results: discount dynamics and tariff-related inventory constraints.

U.S. retailers leaned heavily on competitive discounts to drive growth, with price-sensitive consumers responding strongly. Apparel discounts peaked at 24% off listed prices (vs. 20% in 2024), while categories like electronics and appliances saw markdowns of 23% and 17%, respectively.

At the same time, some brands struggled to secure enough product ahead of Prime Day. Amazon’s FBA storage limits, implemented earlier this year, forced sellers to be highly selective about which SKUs they sent in. Others faced challenges replenishing inventory quickly enough to meet demand, partly due to ongoing tariff volatility disrupting supply chains. Still others decided not to participate in the Prime promotions due to bad timing.

In past year’s discounts of 30% were often enough to meet Amazon deal filter thresholds, but this year we saw a shift – 40% off appeared to be the new floor of visibility in key placements. This pushed many brands and retailers to lean heavily on loss leaders, compressing margin and making it harder to scale profitably during the event.

The Rise of AI, Influencers, and Retail Competition

Prime Day 2025 didn’t happen in a vacuum. As Amazon extended its event to four days, other major retailers like Walmart, Target, Best Buy, and Kohl’s launched competing summer “deal days” of their own, creating a crowded and highly competitive shopping landscape. For consumers, this meant more opportunities to compare prices across platforms, which likely contributed to a slower, more deliberate pace of purchasing during Prime Day.

Within this environment, two powerful forces shaped shopper behavior: generative AI and influencer commerce.

Adobe reported that generative AI traffic to U.S. retail sites surged by 3,300% year-over-year, as shoppers increasingly turned to AI-powered chat services and browsers for help finding deals or product recommendations. While AI-driven traffic is still modest compared to channels like paid search and email, its exponential growth signals a transformative shift in how consumers discover products online.

Influencers proved increasingly powerful, driving a 15% year-over-year lift in revenue contribution and converting shoppers 10x more effectively than organic social content, yet forums like Reddit are showing influencer discontent as earnings were not where they were expected to be. It’s been reported that Amazon even doubled influencer commissions on Prime Day.

The Takeaway: Prime Day Is Weakening

Prime Day 2025 set new records, but the context around those numbers reveals how much the retail landscape has shifted. The event’s extended timeline allowed consumers to browse more intentionally, compare prices across retailers, and wait for the deepest discounts rather than urgently buy.

For merchants, these changes underscore the need for smarter, more adaptive strategies. Success now depends on the ability to think long-term, adjust strategies in real-time, and meet shoppers where they are.