Resources - Blog

3 Recent Freight Trends – and How They Could Impact Cyber 5 in 2023

As Amazon sellers learned all too well from the pandemic, global supply chain problems can have ripple effects: a delay at a port in China can drive up shipping prices, cause congestion around the world, jam up warehouses thousands of miles away, and leave customers empty-handed and unhappy.

Luckily, we have largely recovered from the worst of the global shipping disruptions of the past few years. But things are not quite back to normal in the world of freight – or in the highly related world of consumer spending.

At Freightos, we keep a close eye on global supply chains, including retail trends, and how they affect businesses worldwide.

So what’s been happening over the past few months in freight, and how might that impact Cyber 5 and the upcoming holiday season?

Let’s get into three trends and what they could mean for your business in the coming months.

Ocean freight peak season was shorter than usual – but still came

In a typical year – that is, one that follows the consistent seasonal trends we used to see before 2020 – ocean peak season runs roughly from August through mid-October.

That’s when retailers stock their stores and warehouses for the holiday season, starting with back-to-school supplies all the way through Christmas sales.

Since COVID-19, peak season has been all over the map, with 2020-2021 seeing unprecedented highs in freight rates throughout the year, and 2022 seeing prices actually drop during normal peak season as spending started to shift back to services. This year, experts weren’t sure if peak season would happen at all.

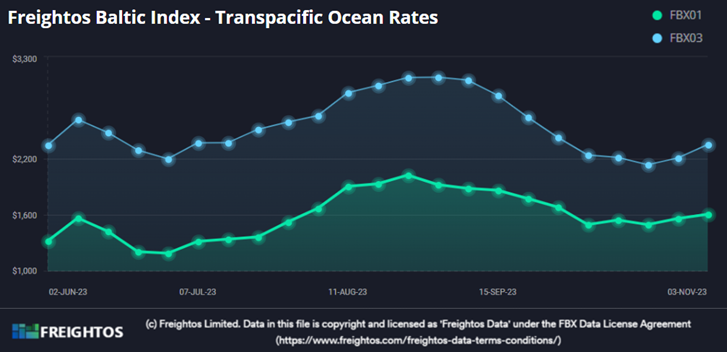

In the end, transpacific ocean freight prices to the West Coast climbed from mid-July to early September by 54% and to the East Coast by 29% before declining through early October. Peak season came, but it was shorter than usual.

The pattern in freight pricing also mirrored the volume of imports to the US. The latest National Retail Federation US ocean import report estimates that August was the peak for container volumes this year, with imports falling 1% in September, and estimates that volumes will ease through the end of the year.

We’re not quite back to regular seasonality. But some of the more extreme jumps are evening out.

Inventories are still high – which could mean that lower freight demand won’t impact sales this year

One reason for this year’s short, early peak season is that many retailers still had stock on their shelves and, therefore, less to order for the holiday season.

Think back to the beginning of the pandemic. Consumer spending plummeted, and inventories were left untouched.

Then, people started ordering – a lot. But the supply chain had been thrown into crisis, resulting in massive delays and huge price jumps. Companies couldn’t keep up with the demand.

So they got creative to keep supply up – only to have demand drop again in the second half of 2022, leaving companies big and small, including two-thirds of Freightos.com small and medium importers and exporters, with excess inventory.

A year later, many companies are still working with oversupply, although reports by many major retailers indicate that inventories are now under control. This is a positive sign that demand may go up after the holidays to restock so long as buyers buy according to their normal patterns. And it means that even with lower freight demand now, retailers are still preparing for a strong season.

Retail spending increased in September – but a slowdown could be approaching

September consumer data shows retail spending increased .07% compared to August. That’s good news for the holiday season, right?

Well, maybe. Much of the increase is coming from more expensive items bought by wealthier consumers, and along with it, we are seeing multiple signs that a slowdown could be coming, including some spending pull-back among lower-income consumers, a falling personal saving rate, and an increase in late payments on loans, credit cards, and other debts.

However, for the time being, people are still spending. And retailers are hoping that they will continue – and that we begin to truly emerge from the disruption of the pandemic and return to more normal spending and ordering patterns.