Resources - Blog

Future Foretold: Grading Our 2023 Predictions

As we stride into a new year, it’s only fitting to take a retrospective look at the predictions that shaped our expectations for 2023. From the dominance of mobile and social commerce to the evolution of the creator economy, we explore how trends played out in the face of economic pressures, changing consumer behaviors, and technological advancements.

Below, we revisit the 10 trends and predictions we shared at the onset of 2022 and analyze the accuracy of our predictions against the unfolding realities of the past year.

M-Commerce and Social Commerce Will Dominate

2022 witnessed a surge in mobile commerce, dubbed as m-commerce. Our foresight led us to predict that m-commerce and its companion, social commerce, would ascend to new heights in 2023.

This prediction proved to be quite accurate. Mobile commerce experienced a notable surge in 2023, particularly during the holiday season. Our Cyber Five analysis, as reported by Salesforce, showed that an unprecedented 79% of Black Friday shopping activity occured on mobile handsets.

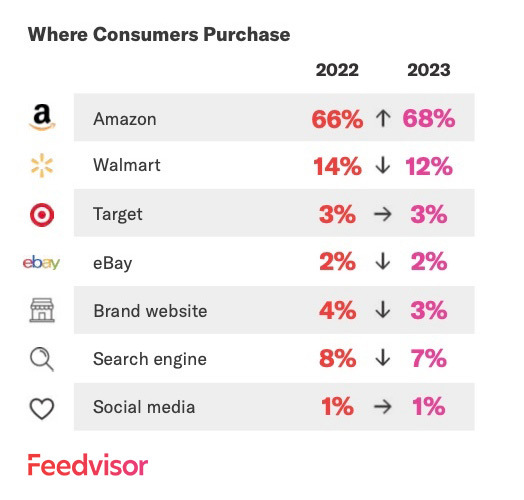

While mobile commerce thrived in retail spending, social commerce struggled to surpass e-commerce giants like Amazon, Walmart, and Target. Our 2023 Consumer Survey found that just 1% of shoppers made purchases through social media. During the holidays, one-third expected only a small portion of shopping on social media, in contrast to 74% predominantly using Amazon.

Creator Economy Evolves

We anticipated a shift in the industry’s preference from macro influencers to micro-influencers, specifically those with a follower count ranging from 5,000 to 10,000. As economic pressures increased, influencers portraying unattainable, lavish lifestyles lost favor with shoppers seeking more relatable content.

Our prediction proved true as micro-influencers dominated in 2023, partnering with major brands, political candidates, and more. Aspire IQ’s report indicates that 64% of today’s marketers work with nano- and micro-influencers. Shoppers now gravitate towards relatable influencers, evident in trends like de influencing, where consumers discourage each other from buying merely trendy products that lack substantial value.

Brands and Retailers Break Through the Noise with Shoppable Videos

Shoppable video presents significant potential, meeting the growing demand for video content, transforming the shopping experience, and streamlining the sales funnel. Our 2023 prediction foresaw the rise of shoppable videos as a novel way to engage consumers.

While our prediction was on track, shoppable videos have a long way to go. According to eMarketer, 57% of retail media ad agency professionals see shoppable video content as the next big trend in retail media.

This channel is still in its early stages. Walmart is currently testing shoppable CTV ads through its Roku partnership, and YouTube only recently introduced shopping features ahead of the holiday season. Despite its promising future, shoppable video will likely to undergo further trials before becoming mainstream.

OTT Ad Strategies Become a Lifeline

Anticipating the challenges posed by inflation and increasing budget constraints, we foresaw a strategic move by brands towards leveraging Over-the-Top (OTT) platforms.

Our prediction proved true as 2023 witnessed a noteworthy transformation in the OTT landscape. Media behemoths such as Netflix, Disney+, and Amazon Prime Video embraced the adoption of ad-supported video, departing from conventional subscription-only models. This shift not only catered to changing market dynamics but also unlocked fresh opportunities for advertisers to tap into the extensive and diverse audience that streaming platforms command.

DTC Business Will Rely on Marketplaces

The Direct-to-Consumer (DTC) model, known for its independent selling approach, gained prominence in recent years. However, our foresight in 2023 revealed that economic pressures would compel DTC brands to relinquish some control.

Our prediction held true as high-profile DTC brands like Glossier and Allbirds adapted their selling strategies to include marketplaces. Why? The previously stable economic landscape, allowing for riskier behavior, is no more. Financial pressure has also led consumers to prioritize brands offering perks like rewards programs and free shipping. Instead of exclusively buying from individual brands, customers prefer spending on marketplaces to access these sought-after rewards. Amazon’s “Buy with Prime” gained popularity, with a 300% increase in unit purchases during Cyber Week.

Strategies Will Adapt to New Consumer Realities

In the face of recessionary threats and diminishing savings, 2023 emerged as the year of the price-conscious consumer.

Our prediction proved remarkably accurate. The success of this prediction was best demonstrated by the surge in deals and discounts during the holiday season. While inflation may have influenced retail sales numbers, consumer demand fueled this year’s record-breaking Cyber Five sales. The proliferation of deep discounts played a significant role, with the average discount reaching 29% off the retail price, as reported by Salesforce.

Subscriptions and Memberships Drive Loyalty

Amid concerns about inflation and the imminent end of the third-party data era with Google phasing out cookies, we predicted that subscriptions and memberships would become more appealing to both consumers and retailers.

While our prediction held true to some extent, there was a caveat. E-commerce subscriptions experienced slower growth in 2023, accounting for approximately 3% of total e-commerce sales, as per eMarketer. On the flip side, paid memberships witnessed a surge. Deloitte reported that 53% of consumers now pay for a loyalty program, a significant increase from 32% in 2022. The model, popularized by giants like Costco and Amazon, is now taking hold among large retailers such as Restoration Hardware and Best Buy, and smaller brands.

Retail Media Networks Scale and Standardize

In 2023, retail media networks emerged as a dominant force, with Amazon, Walmart, and Target leading the way.

Our forecast swiftly materialized in what was dubbed the “retail media arms race.” Retailers from Walmart and The Home Depot to Cars.com actively participated in the retail media boom. This strategic move not only presents an opportunity to attract more ad dollars but also introduces access invaluable to first-party data. MediaRadar analysis shows that retail media ad spending grew by 22% YoY through November 2023, reaching $5.09 billion.

Measuring ROAS Becomes Paramount

With budgets tightening, brands can’t afford to squander ad dollars. Our forecast emphasized the shift from big brand plays at the top of the funnel to a focus on attributing dollars and overall Return on Ad Spend (ROAS).

Our forecast has proven mostly accurate, with ROAS gaining significance in the past year. Simultaneously, there’s a heightened emphasis on measurement overall. Advertisers are advocating for more standardized and accurate measurement, with organizations like the IAB and ISBA playing a commendable role in steering industry discussions and providing thought leadership. Simultaneously, various vendors, including Nielsen, VideoAmp, and iSpot, are contending for status as the go-to video currency option.

AI is Infused Throughout E-commerce

The surge in generative AI technology, exemplified by innovations like ChatGPT, has made AI a focal point in recent years.

Our prediction that AI would play an increasingly significant role in e-commerce this year was on the mark. According to Bloomreach’s State of AI x Commerce Report, 64% of commerce leaders acknowledge that AI can enhance customer experiences and provide a distinct competitive edge. Larger retailers, like Amazon, translated this sentiment into reality with the introduction of Amazon Q, a new generative AI assistant set to launch across the entire AWS ecosystem.

Notably, smaller brands are also tapping into AI’s potential. Adopting dynamic and AI-based pricing, particularly in repricing, works well as sellers are driven by the need to adapt to rapid fluctuations in market conditions and changes in consumer behavior.

Final Thoughts

It’s clear that predicting the future isn’t just a game of chance—it’s a dance with dynamic forces shaping commerce, technology, and consumer behavior. From the bull’s-eye hits on mobile commerce and the rise of micro-influencers to the unfolding saga of shoppable videos and the strategic moves in the DTC landscape, our predictions faced the litmus test of reality.

The story doesn’t end here. We’re gearing up for another round of foresight with our upcoming Trends and Predictions eBook for 2024. Stay tuned for the next wave of e-commerce insights, where we navigate the uncharted waters of what’s to come this year.