Resources - Blog

Know Your Competition: How to Increase Sales on Amazon [Webinar Recap]

Stay on top of the latest e-commerce and marketplace trends.

Competition on Amazon is at an all-time high and the role of third-party (3P) sellers is rapidly changing.

An increasing amount of data reveals that 3P sellers are becoming a shrinking segment on the platform. In 2019, less than 24% of the top 3P sellers are resellers versus 31% in 2016, according to Marketplace Pulse, demonstrating that hardships around category saturation and competition are pushing 3P sellers off the platform.

As the original categories of many top 3P sellers become increasingly saturated, sellers are seeking opportunity elsewhere, expanding to new categories or sub-categories, often with private labels. On top of that, brands are increasingly shifting to the 3P marketplace, which is only adding to the competition for 3P sellers.

What can you do to stay ahead of the competition and ensure a long-term future for sustainable growth?

In this webinar, Feedvisor’s Amazon expert and solutions engineer Ken Veseli unpacks every layer of competition that exists on Amazon’s marketplace, as well as the tools and data that are available for you to price against your competition for every SKU in your catalog, including branded, private label, and single-seller SKUs. In addition, Veseli shares his strategies to rank highly on Amazon’s search results page, win back demand from your competitors, and increase your sales.

Private Label Competition Is on the Rise

More than half (62%) of Amazon sellers in 2019 have private label products in their catalogs, according to Feedvisor data. Of those sellers, over a quarter have Amazon catalogs that are 100% private label and over one-third say that private label items make up 60% or more of their catalog — and that number is poised to increase.

Nearly one-third (32%) of Amazon sellers plan to launch a new private label brand this year. As private labels continue to flood the marketplace, it has become increasingly challenging for brands and sellers to pinpoint their competition and determine effective price strategies for their items.

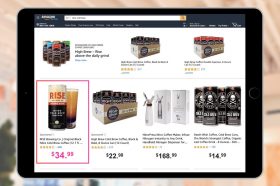

What data can you gather on pricing? Do you have competitive insights into how other sellers or brands price similar ASINs?

Amazon is a dynamic marketplace in which market conditions change constantly. From stockouts to Lighting Deals to sales and more, there are constant variables that impact the demand and effective price points for your items. Yet, many sellers only change the prices of their private label items once per month or once per quarter. Those who are slow to adjust their product prices are consequently slow to adapt to changes in market conditions and risk losing out on increased profit potential.

Complementary and substitute products within the CompetitiveSphere™ on Amazon are going to directly impact the demand for your items.

Inside the CompetitiveSphere™ on Amazon

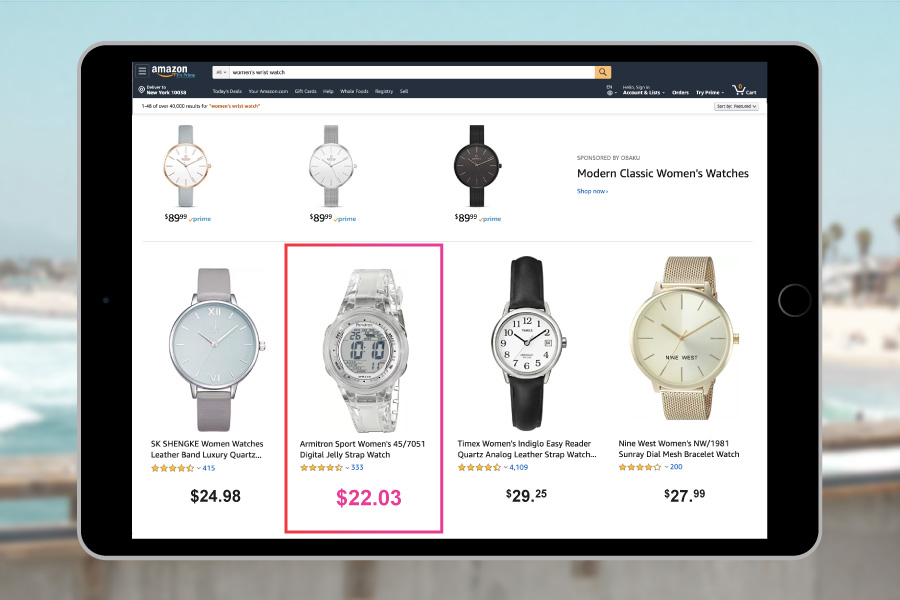

The prices of your items not only impact your sales but also affect your search position, discoverability, conversion rate, and more. To optimally price your private label products, sellers must have a complete understanding of all the layers within your CompetitiveSphere™ on Amazon, as well as insight into how these variables impact the demand and price points of their items. There are several product types that must be taken into consideration:

- Competing: Certainly the most obvious, competing products are those that satisfy the same consumer need as your product, but factors such as their price or brand name dictate a customer’s preference, ultimately impacting your demand (i.e. Nike versus Adidas).

- Complementary: These products are not the same, but are often associated or paired with another product in which the demand for one impacts the demand for the other (i.e. a lamp versus a lightbulb).

- Substitute: While these items are not necessarily the same, they could be used for the same purpose and are identical, similar, or comparable to another product in the eyes of the consumer (i.e. peanut butter versus almond butter).

For each of these product types, sellers must understand the correlation between that product and their own product to determine their price points. For instance, while the cost of a lamp certainly will not directly compete with the cost of the complementary light bulb, the demand for that lamp most definitely will have an impact on the effective price for your light bulb. If there is a sudden surplus of that particular lamp available on the marketplace, that will cause a rise in demand for your specific light bulb. This creates an opportunity to raise the price of your light bulb and increase your profits without negatively impacting your demand.

Leverage Automation to Tap Into Missed Profit Potential

To manually monitor these ever-changing marketing conditions and correlating products for every SKU in your catalog is nearly impossible, as these conditions change on a daily basis and there are hundreds — if not thousands — of correlating products that can have an impact on a single product.

Historically, AI-based pricing technology could only be utilized by resellers competing for the Buy Box on Amazon, and there has never been a dynamic pricing solution available for branded and private label ASINs due to complexities with these particular items. To satisfy this solution gap in the marketplace, Feedvisor recently launched its ProductSphere™ pricing technology — the first and only AI-based dynamic pricing technology that enables brands and private labels to win against every layer of competition on Amazon.

Through machine-learning algorithms, ProductSphere™ maps the competition, identifying up to 1,000 competing, complementary, and substitute products that correlate to an item’s demand, on a SKU-by-SKU basis. The technology pinpoints who you are competing against, effectively prices your products against those other items in real time, and tracks the influence of those price changes on demand.

Pricing strategies for each individual SKU can be set based on a seller’s business objectives, such as revenue optimization, profit, or liquidation. From there, the explore-exploit algorithms continuously search for the optimal price point and make real-time price adjustments based on the demand curve — ensuring that you never miss an opportunity to increase your sales and profits while maintaining your product’s demand.

Final Thoughts

The rising competition on Amazon’s 3P marketplace has made it challenging for brands and private labels to determine the most effective price points for their products, often resulting in a pricing strategy that is based on emotion rather than real-time, hard data. With ProductSphere™ pricing technology, brands and private labels for the first time can win against their competitors on Amazon and achieve their business goals.

Learn what Feedvisor can do for your business.

When you partner with Feedvisor, you automatically receive access to our true, AI-driven technology and hands-on team of e-commerce experts. Contact one of our team members today to learn more about our end-to-end solution for brands and large sellers on Amazon, Walmart, and e-marketplaces.