Resources - Blog

Amazon Competitor Analysis: How to Track Your Amazon Competitors

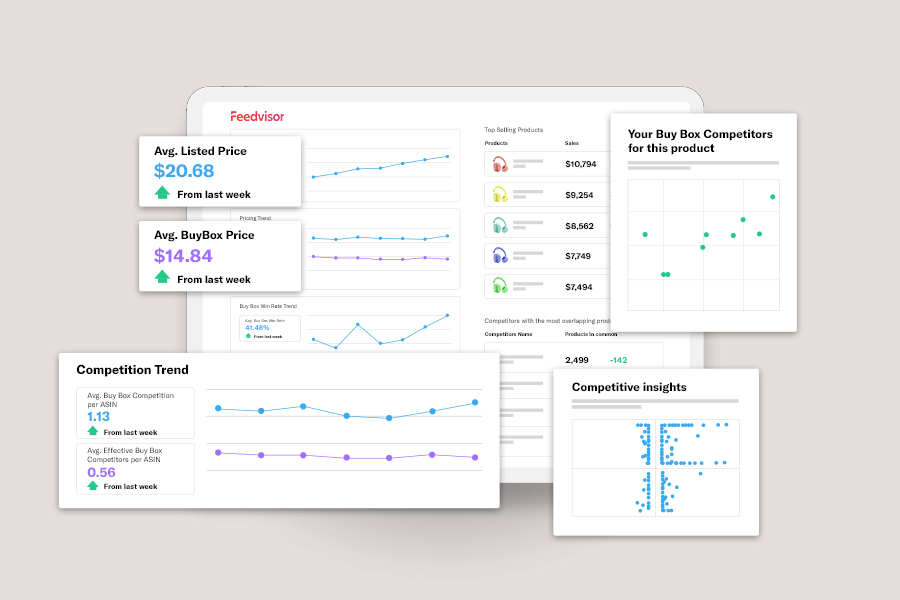

Stay ahead with an in-depth competitor analysis

This blog was originally published on June 20, 2018, and has been updated to include new and updated information.

Retailers selling on Amazon.com are feeling the effect of increased competition on the online marketplace.

It is more important than ever for sellers to analyze their Amazon competition to stand out and outperform the other merchants. Since each product typically has hundreds of different sellers, an in-depth competitor analysis is one of the most effective ways to stay ahead.

What You Can Gain from Tracking Your Amazon Competitors

By performing an Amazon competitor analysis, there are major benefits that sellers stand to gain.

Sellers can make more precise scouting and sourcing decisions for their portfolio, make sure that their pricing strategy is robust and competitive, optimize their advertising campaigns and get a better handle on ad spend, and more effectively track performance and profitability.

With the right tools and strategies, you can track specific metrics and beat your Amazon competition.

Competitor Metrics to Track

When sellers are researching their Amazon competitors, five key factors should be taken into consideration.

1. Reviews

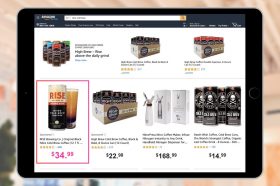

When researching product ideas, a great place to start is by looking at the first five products that show up in the search results. Doing so will allow you to see what main keywords a potential customer may type in to search for a specific product.

If all of the top five results have 300+ reviews, it might be best to steer clear of that item for catalog expansion — the competition will be difficult to beat. However, if a seller sees that at least a couple of the top five products have less than 300 reviews, they may be able to add that item as a viable option for their assortment.

An important distinction is that the reviews are not what’s giving the top products the high ranking. Reviews are an indication of the number of sales, so sellers need to be able to sell more units which will usually bring in an increased number of reviews.

Additionally, finding products with a combination of these factors should be targeted: Amazon’s Best Seller Rank, a low number of reviews, that fill a product gap or need, and that would have buyer demand.

2. Pricing Strategy

When performing competitor research, sellers can leverage Amazon seller software to receive data-driven insights and actionable recommendations about how to navigate and ultimately outpace the competition.

The increasingly saturated Amazon marketplace indicates that more sellers are changing prices more frequently — and sellers should understand their competitor’s pricing strategies in order to avoid price wars and maintain their Buy Box share.

It is, in fact, possible to beat Amazon to the Buy Box, and it can be accomplished by aiming to perfect at least one of these areas: better availability, faster shipping time, and a better/lower price.

It is also common that Buy Box winners win the space with higher prices than their competitors – they simply maintain better performance metrics when it comes to availability or shipping. Sometimes, however, sellers choose to avoid adding a specific item to their portfolio if Amazon is on the listing because they know that, more often than not, Amazon dominates the listing.

Sellers can research their competitors’ Amazon repricing methods and how low they can go with their estimated floor price.

Sellers should strive to differentiate themselves from the competition by engaging with their customers and getting involved in their buying process to make it the most enjoyable experience. This will foster their trust and recurring engagement which will eventually become customer loyalty.

3. Keywords

Before customers can buy a seller’s goods, they need to be able to easily find the items. It’s important to input as many relevant search terms as possible to optimize their product listings for visibility, relevance, and conversions.

The quality of a product listing, including keyword use and descriptions, is something that can always be improved, giving sellers an edge over competitors.

The title of the product listing is what will catch the attention of a prospective buyer once they touch down on a product page. Per Amazon’s guidelines, it’s important to keep the title short and sweet at 50 characters maximum.

It’s also crucial that the title contains information such as brand, product line, color, size, material or key feature, and packaging or quantity and order them in a fashion that places the most relevant keywords first. Not only does this help the customer easily understand what is being sold, but Amazon’s algorithm gives higher relevance to keywords that appear earlier in the title, a win-win.

If sellers aren’t leveraging keyword optimization, they are giving the competition an advantage to utilize those keywords and rank for them. With optimized keywords, sellers will receive more clicks and traffic than sellers who don’t take this extra step.

4. Sales Data

If retailers are beginning to sell an item, having a solid gauge of demand for the product is a great place to start. Knowing the daily, monthly, quarterly, and even annual demand will be extremely beneficial when deciding if an item makes sense to move forward with.

Looking at competitive sales data (i.e., like ASINs, similar product types and brands, similar dimensions and look/feel, etc.) will not only help gauge if an item makes sense to add to a seller’s mix but will also indicate how frequently it will convert. Monitoring competitor catalogs and ASINs will help sellers decide what to sell next, build stronger product bundles, and improve the sellers’ handle on the market landscape as a whole.

Additionally, relevant sales data that should be monitored are seasonality and sales trends. Analyzing what trend lines show by the time of year and understanding product dips and declines over time will be critical for sellers of all sizes. Special promotions like Prime Day, Black Friday, and Cyber Monday should also be taken into consideration.

5. PPC Strategy

Amazon sellers can take advantage of the current PPC landscape to not only lower their CPC (cost per click) but leverage the untapped keyword potential within Sponsored Products to buy more traffic for their products at a low cost.

To outperform the competition, it will be important to structure campaigns consistently, either by product category, brand, or top sellers. Sellers should be consistent with the organizational method or risk running repeat ads (such as when one is created by the brand and one by category).

Understanding how to create different ad groups for keywords with different levels of generality will also be helpful for sellers when optimizing keywords for PPC ads. The larger the seller’s catalog is, the larger the number of keywords with varying levels of specificity will be. For example, if a seller has a selection of shirts, for all shirts the keyword ‘shirt’ is relevant.

For some of the shirts, the keyword ‘men’s shirts’ is relevant, and for some men’s shirts, the keyword ‘men’s tank’ is relevant. Sellers should regularly monitor their PPC campaigns, learn to optimize their keyword CPC, and have a strategy in place to implement untapped long-tail keywords on Amazon.

Final Thoughts

The only way to create an effective strategy on Amazon is to understand who you are competing against. Discover your true competitors for your Top 20 Products and learn from their mistakes to win the Buy Box and, ultimately, the sale.

Get started with a free trial of Essentials, and understand the trends and strategies your competitors are using so you can win the Buy Box every time.