Resources - Blog

Last-Minute Tips to Win Over Today’s Digital Holiday Shoppers

Despite economic uncertainty, holiday shoppers have turned out in record-breaking numbers, creating a promising scenario for engagement and sales.

According to the NRF, 200.4 million shoppers participated during this year’s five-day holiday, surpassing the previous year’s record of 196.7 million. Of those, 134.2 million U.S. consumers actively sought digital deals, exceeding last year’s figures.

As we near the end of the holiday season, sellers, brands, and retailers alike have last-minute opportunities to maximize the potential of this record-breaking season. We’ll explore the dynamics behind this unexpected surge in holiday shopping and share last-minute tips for sellers to captivate and engage today’s holiday shoppers.

How Has Holiday Shopping Evolved?

Today’s holiday shopping is evolving, with several noteworthy trends emerging this season.

In light of inflation challenges and the post-pandemic aftermath in recent years, consumers have adapted by spending smarter, especially during the holiday season. According to Feedvisor’s Holiday Shopping Trends report, coupons and deals play a significant role in holiday shopping behaviors, influencing the decisions of 43% of consumers. This year’s busiest shopping week saw retailers fiercely competing to offer the best deals and discounts, aiming to win over increasingly price-conscious consumers:

- Days that typically see less shopping traffic saw a surprising spike in growth, such as Small Business Saturday. Feedvisor’s clients saw a 13% increase in sales YoY on the day, likely due to Black Friday deals bleeding into the weekend, while American Express’ 2023 Saturday Consumer Insights Survey found U.S. consumers spent an estimated $17 billion on Small Business Saturday.

- 66% of consumers (versus 49% in 2022) intended to purchase during the BFCM week.

- The average discount was 29% off the retail price, compared to 16.7% off in 2019 and 12.9% off in 2021.

Stores Become Complements for Online Sales

While many experts anticipated a resurgence of in-store shopping post-pandemic, what they didn’t foresee is that brick-and-mortar stores would become a complement to e-commerce facilities rather than their own standalone channels. In the wake of the pandemic, physical stores now act as mini fulfillment centers — a study by the AP-NORC Center for Public Affairs Research reveals that 33% of adults under 50 are likely to continue using curbside pickup post-pandemic. In other words, brick-and-mortar stores have taken a backseat to e-commerce, as today’s shoppers prefer the convenience of online platforms — especially for all their holiday needs. During Cyber Week, mobile and social platforms played pivotal roles as key channels for engagement, with a remarkable 79% of e-commerce traffic originating from mobile phones—an uptick from 76% in 2022.

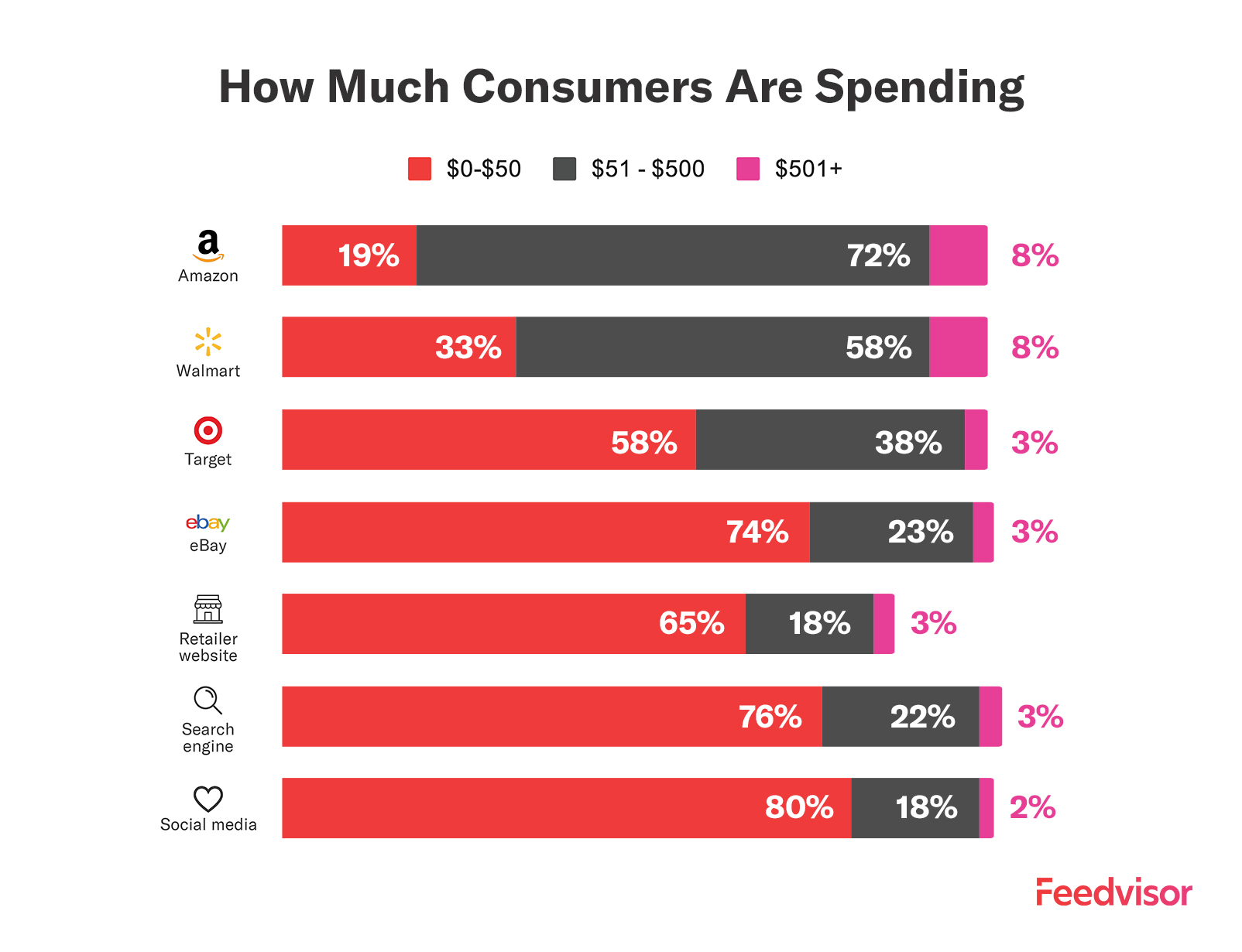

Amazon is still the number one e-commerce retailer, followed by Walmart and Target. New spending patterns indicate today’s consumers prefer to allocate a significant portion of their budget to online marketplaces while reserving a smaller share for social media and retailer websites.

This trend persisted through the holiday season, with 83% of consumers intending to buy holiday gifts on Amazon, surpassing 58% on Walmart. Amazon reported a remarkable surge of 300% in Buy With Prime unit purchases during Cyber Week compared to the daily average for October 2023.

Last-Minute Tips and Tricks

Keep a Close Eye on Your Inventory

Shipping and fulfillment are crucial elements of online shopping year-round but become even more critical during the holidays. When asked what factors are most important during holiday shopping, 73% of respondents found shipping extremely influential, and 70% agreed inventory availability is highly impactful.

As you gear up for those last-minute holiday purchases, be transparent about cut-off dates for shipping to manage consumer expectations accordingly. Keep a close eye on your inventory strategy, too. For those shopping closer to the holiday season, having items in stock is crucial to ensuring timely gift delivery. While inventory availability is less of a concern than last year, staying attentive still pays off.

Fine-Tune Your Product Detail Pages

Today’s consumers are savvier than ever, observing everything from superior deals elsewhere to unfavorable reviews and beyond. Surprisingly, over a third of consumers now stress the significance of conducting thorough research before making a purchase, with e-commerce sites emerging as the primary platforms for their investigative efforts.

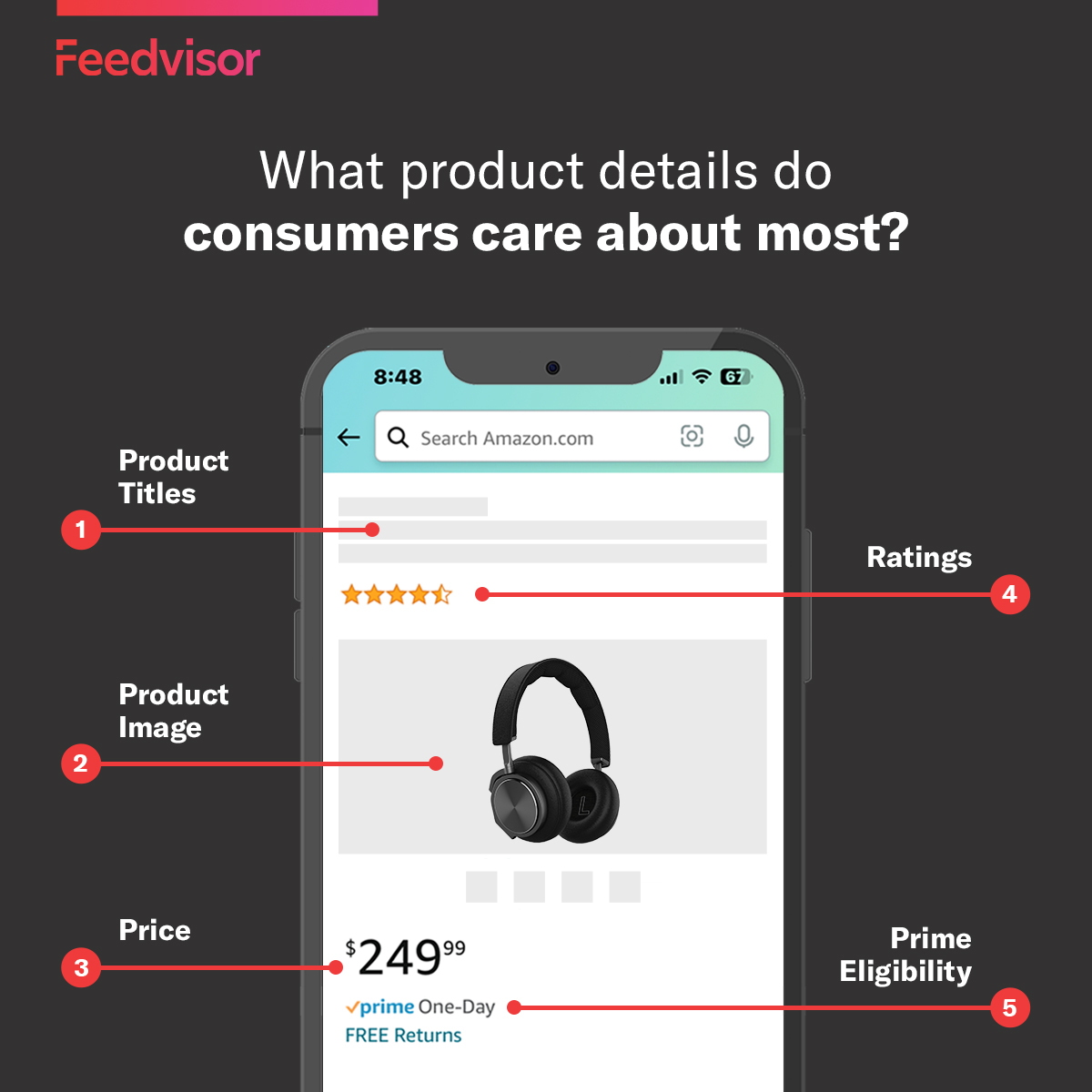

Even in the tail-end of the holiday season, it’s possible to ensure your product detail page is up to par to win over today’s savvy consumers. Double-check crucial details, such as pricing and images – these are especially important to shoppers according to our Anatomy of a High-Performing Product Detail Page infographic. Make sure they’re optimized to enhance the shopping experience and win favor during the holiday season.

Keep Your Advertising Momentum Going

This holiday season brought good news for advertisers. We observed a 12% increase in Ad sales year-over-year across our top 5 categories. Additionally, there was a 15% surge in Return on Ad Spend (RoAS), likely driven by targeted deal promotions. The Ad Cost of Sale (ACoS) decreased by 5% during the holiday weekend thanks to strategic adjustments in targeting and optimizing ad spend. And similar results were found elsewhere. According to one VP of Social Media in an interview with AdWeek, November conversion rates for their eCommerce clients saw a 22% jump YoY while ROAS increased 36% YoY.

The moral of the story: advertisers can, and should, carry this momentum into Q1 by continuing their campaigns — even in the final weeks of the holiday season. Amazon’s DSP is designed to learn and optimize consistently based on data. In simpler terms, the more data Amazon’s technology can learn from, the more effectively your campaign will perform. As the holiday season winds down, sustaining your momentum can lay the groundwork for success in the upcoming year.

Final Thoughts

As we wrap up this season, seize the remaining opportunities and set the stage for a successful start to the upcoming year. The holiday season remains rich with last-minute opportunities that retailers can leverage using our expert tips. And if your Q4 results fell short of expectations, consider a boost with Feedvisor’s advertising platform — your key to unlocking advertising success in the ever-evolving world of e-commerce.