Resources - Blog

Prime Big Deal Days Recap and Analysis

Prime Big Deal Days, Amazon’s second holiday prelude event, which took place on October 10th and 11th, not only surpassed its initial holiday shopping event from last year – Prime Early Access Sale but also established itself as the largest October holiday kickoff sale in the history of the e-commerce giant.

Prime members collectively purchased hundreds of millions of items, with more than 150 million of these purchases coming from third-party sellers, which form the bulk of the Gross Merchandise Value (GMV) on Amazon’s expansive marketplace. This exceptional performance is all the more remarkable considering the prevailing harsh economic conditions.

Below we will examine the results from Feedvisor customer sales and advertising data across Amazon’s U.S. marketplace during Prime Big Deal Days with comparisons to last year’s Prime Early Access Sale, identifying key trends and KPIs that helped inform our insights and projections for the remainder of the year.

Read on to discover how top brands and retailers are leveraging data to shape their Prime event strategies for the holidays and future tentpole events based on changing consumer behavior.

Sales Outpaced Last Year’s Holiday Kick-Off Event

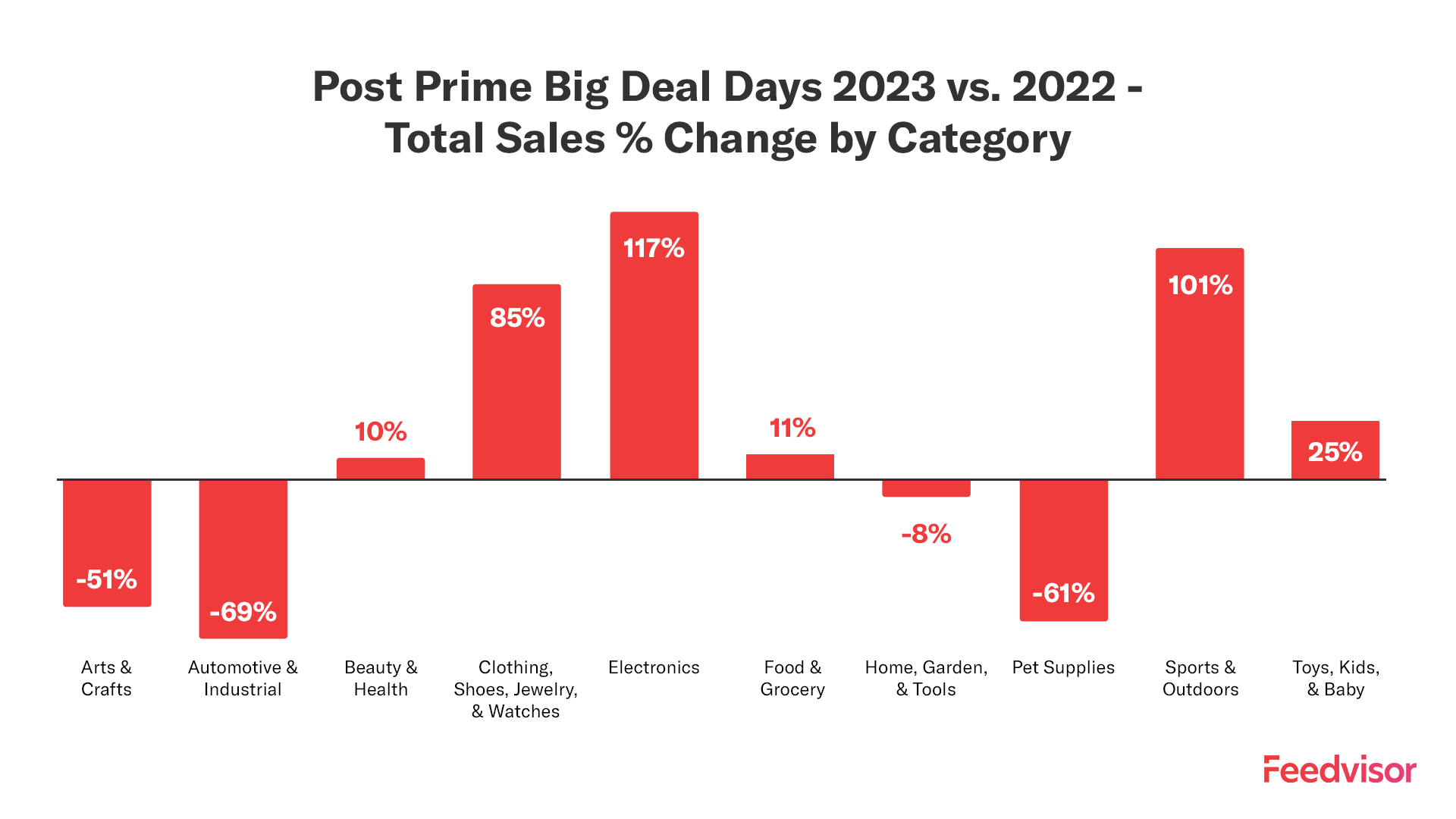

Feedvisors’ clients experienced an impressive 35% surge in sales during this year’s fall event compared to the previous year. The top-performing categories for our clients were notably consistent with Amazon’s trends, with Apparel, Home, and Beauty & Health standing out as the frontrunners. New this year was an impressive 101% increase for the Sports and Outdoors category, indicating that many people are increasingly prioritizing active lifestyles and outdoor pursuits as part of their holiday wish lists.

The average order size during this year’s event stood at a healthy $53.47, significantly higher than the Prime Early Access sales’ average of $45.90, but still lower than July’s $58.67. More than half (55%) of households placed two or more orders during Prime Big Deal Days, reflecting a greater willingness to engage with the sales event.

Average household spending also saw an uptick, reaching $124.09 compared to the previous year’s $117, and a 14% increase in units sold. This shift in spending patterns can be attributed to a combination of factors. The looming specter of creeping inflation might have incentivized consumers to seize discounted opportunities, while the obligation to repay student loans, now required for many, could have motivated a psychological factor, as more consumers looked to reward or treat themselves.

Deals Were Top of Mind

Deals took center stage for shoppers, as a significant 58% of Prime Big Deal Days shoppers expressed high satisfaction with the deals offered by Amazon, attesting to the appeal of the discounts and promotions available.

This behavior aligns perfectly with the sentiment among 44% of consumers, who have indicated that deals and discounts are their primary motivators for making purchases this year according to our latest research. As such, it’s clear that shoppers were on the hunt for the most enticing offers, and Amazon’s Prime Big Deal Days did not disappoint in delivering on these expectations.

Top deals according to Amazon were Apple AirPods Pro (2nd Generation), BISSELL Little Green Multi-Purpose Portable Carpet & Upholstery Cleaner, and Crest 3D Whitestrips.

Ad Spend and Ad Sales Were Up Compared to PEAS’22

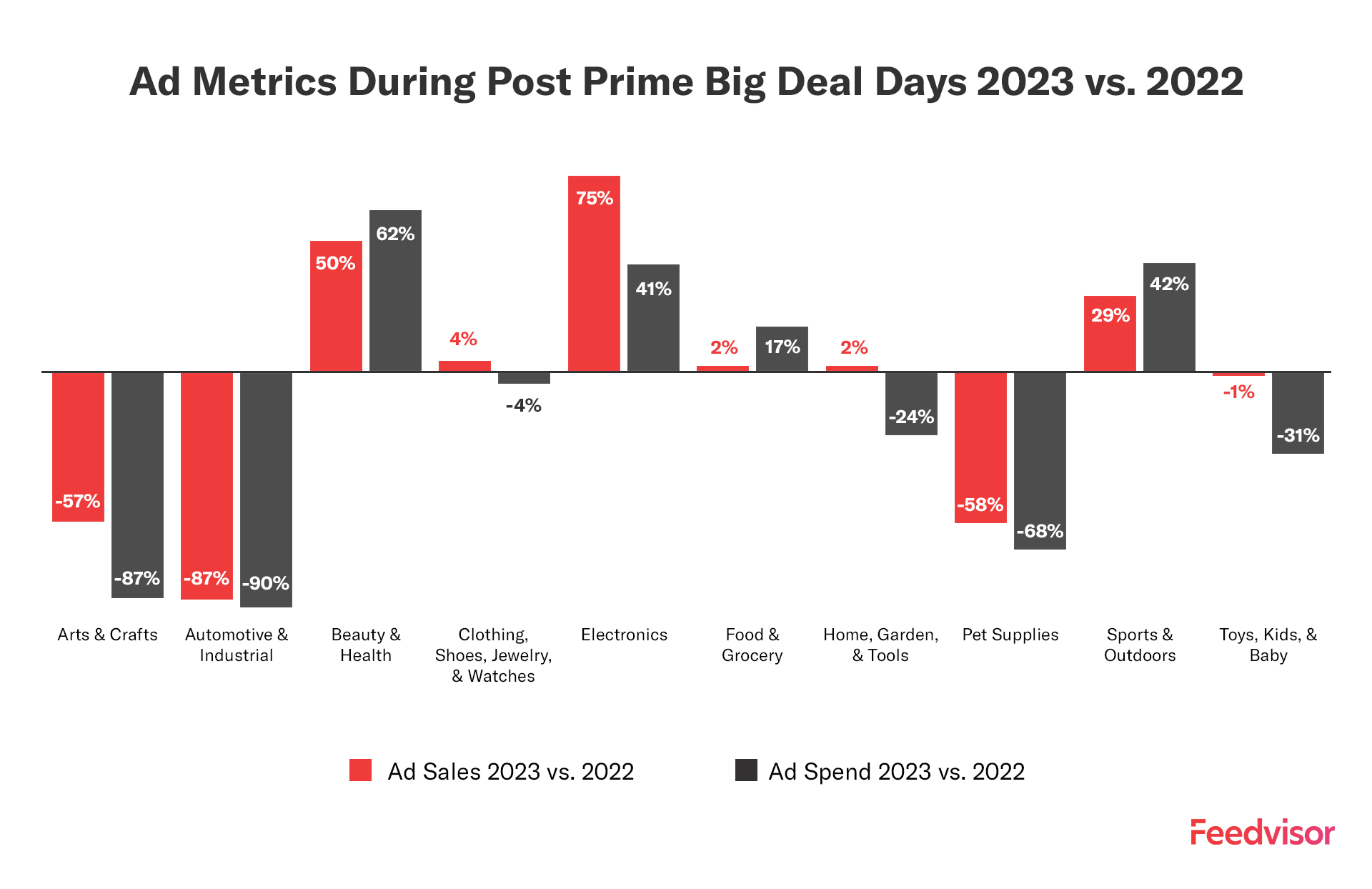

Ad spend for Prime Big Deal Day’s was much higher than PEAS’22, with sellers planning ahead now that the event was expected. Depending on the category, advertisers ranged from moderate to slightly high when it came to spending, though not as high as July’s Prime. Many chose to save their budgets for the bigger Cyber 5, now dubbed Cyber 11, time period.

Riding on the success of July’s Prime, ad spend increased by 37%, compared to PEAS, with a majority spent on the first day of Big Deal Days. On average, ad sales increased by 27% compared to PEAS, with ad sales on day 1 representing 55% of sales over the two days.

Of the top 5 categories, Electronics had the highest percentage of sales from ads, with a 75% increase compared to PEAS. Ad spend was up 41% in this category, while return on ad spend (RoAS) was also up 79%. This is a very competitive market with sought-after products for which consumers were on the hunt, such as Smart TV’s, noise-cancelling wireless headphones, smartwatches, and smartphones.

Across the top 5 categories, ACoS decreased 57% compared to PEAS, while RoAS increased 111%, thanks to unique strategies. The Home & Garden category saw the most significant increase in RoAS (33%), while Apparel saw an 8% bump.

CPC and CPM Were Below Average, Especially for Top 5 Categories

According to the Amazon 500 Index, our client’s average costs per click (CPC) across the top 5 categories was below average compared to the top 500 largest merchants on Amazon, coming in at $1.76 vs. $1.89. Likewise, our CPM across the to 5 categories averaged out to $4.17 vs. the reported $5.34.

The Beauty and Health category saw the highest increase in CPCs by 41% during this event, while the Food and Grocery category saw a 22% increase.

The Beauty and Health category also showed the highest CPM at $5.26 while the lowest CPM was in the Toys category, coming in at $0.64.

Impressions Rose for Big Deal Days

Impressions across all categories increased 43% compared to PEAS, attributed to the increased ad spend for this event.

Similar to PEAS, impressions were significantly higher on the first day of the Amazon Big Deal Days (October 10), with the Toys category showing a 25% increase in impressions from last year as well.

Final Thoughts

With Cyber 5 morphing to Cyber 11, an apples-to-apples comparison of last year’s holiday shopping results will be tricky, if not incredibly inaccurate. Anything will go this year as retailers face new challenges with inflation, rising shipping costs, and a consumer who’s more concerned about paying bills than ever before.

With a current prediction of holiday sales growth hovering between 3.5% and 4.6%, hitting $1.54 trillion (based on the period of Nov 1st to Jan 1st) the economic hardships are top of mind for retail experts.

In today’s market, consumers are increasingly driven by substantial discounts, making it even more critical to ensure that your products and deals stand out in the continually expanding competitive landscape. To achieve this, having cutting-edge technology and a team of experts at your disposal becomes essential. They can skillfully formulate a winning strategy by combining elements such as content, keywords, advertising, and repricing. This strategic approach is crucial in maximizing your product’s visibility, driving engagement, and ultimately boosting conversion rates.