Resources - Blog

Amazon’s Foray Into Health Care: What to Know and How You Can Prepare

Amazon’s gradual entry into the saturated health care market, much like their ingress into the grocery sector, has been defined by several key moments in time. The highly lucrative category is on the rise, with the growth in prices for health care goods and services on pace to increase to 2.2% in 2018, up from 1.4% in 2017. These statistics from the Centers for Medicare and Medicaid Services allude to faster projected prescription drug price growth. Given this acceleration, the following series of business decisions, acquisitions, and innovations position the company for success in the health care market.

Amazon’s Health Care Timeline

Amazon’s Health Care Timeline

A Joint Health Care Venture

At the end of January, Amazon announced a health care collaboration with Berkshire Hathaway and JPMorgan that will focus on driving down health care costs for the companies’ U.S. employees. In addition to reducing costs, the companies will attempt to improve employee satisfaction via technology solutions. Dr. Atul Gawande was announced as CEO of the non-profit health care venture and began his work in July.

Stay on top of the latest e-commerce and marketplace trends.

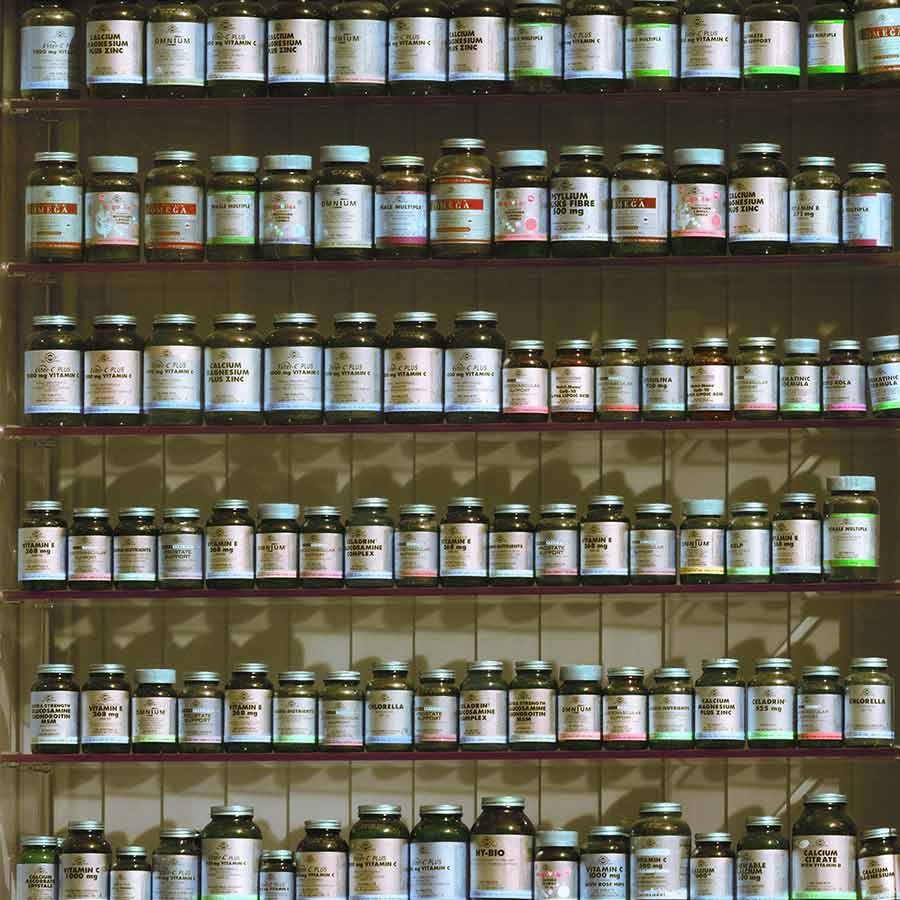

The Launch of Basic Care & Sale of Medical Supplies

Nearly a month after the health care venture announcement, Amazon quietly rolled out Basic Care — a line of more than 60 over-the-counter health care products across a variety of categories such as allergy and cough, digestive, hair regrowth, children’s, and feminine hygiene. Although Amazon does not own the brands included in the line — they are produced by a private label manufacturer, Perrigo — the move adds pressure to store-brand profit margins.

Today, Amazon sells a limited number of medical supply items on Amazon Business, its separate B2B marketplace. The company was hoping to expand this venture and become a dominant pharmaceutical distributor for large U.S. hospitals and outpatient clinics. However, it tabled this plan in April and will focus on optimizing its current offerings to smaller hospitals and clinics.

Acquisition of PillPack

The next milestone in Amazon’s health care foray is a direct-to-consumer play — the acquisition of online pharmacy startup PillPack for about $1 billion in June. PillPack manages prescriptions for customers by packaging, organizing, and delivering them directly to customers’ homes, thereby now giving Amazon that capability. Besides just delivering the medicine, PillPack compiles daily packets of the specific pills you need to take that day. PillPack doesn’t charge patients for shipping or for creating the pill packets and instead patients pay the same 30-day copay that they would pay elsewhere. With pharmacy licenses in all 50 U.S. states, Amazon has the ability to expand quickly and capitalize on PillPack’s existing customer base, which is 40,000 and growing.

For Amazon Sellers

In a recent survey of Amazon Prime users, Deutsche Bank found that 85% of users would be willing to buy medication on the site. This data suggests that the company’s gradual transition into the online and mail order pharmacy space has ground to stand on. Given that Prime subscribers are Amazon’s most loyal and frequent shoppers, this shift represents an opportunity for sellers and health care brands to capitalize on.

If you are already selling medical supplies on Amazon, whether via a 1P or 3P model, you should revisit your selections and optimize wherever possible, depending on sales velocity and trend data. Amazon can also simultaneously simplify the convoluted supply chain process which plagues the pharmaceutical industry by improving costs and overall experiences for patients and medical manufacturers. The company, which has demonstrated time and time again that it can deliver a vast array of products at an extremely fast rate, and their entrance into the health care industry will be no different.

Learn what Feedvisor can do for your business.

When you partner with Feedvisor, you automatically receive access to our true, AI-driven technology and hands-on team of e-commerce experts. Contact one of our team members today to learn more about our end-to-end solution for brands and large sellers on Amazon, Walmart, and e-marketplaces.