2020 Report

Brands and Amazon in the Age of E‑Commerce

Based on a Survey of 1,000+ U.S. Brands

Brands want to be where their customers are and, with 66% of consumers starting their search for new products on Amazon, brands know they need a presence on the vast, ever-evolving platform.

However, much is at stake. Not only do brands want to protect and preserve their margins, but they also want to maintain influence and safeguard their online presence, price value, and overall brand ethos.

In this groundbreaking analysis, we examine the dynamic relationships between more than 1,000 U.S. brands and Amazon to reveal key insights on the challenges, trends, and opportunities shaping the new normal for brands operating in today’s marketplace-driven retail ecosystem.

Stay current: grab the latest version of our e-commerce report for brands here.

1. Introduction

The State of the Industry

Modern marketplaces are shaping the future of e‑commerce, with Amazon as the driving force and Walmart steadily gaining ground.

Consumers are increasingly shifting their shopping behavior to marketplaces over brand and retailer websites, using these digital destinations for every phase of their purchase journey, from discovery to price comparison to conversion.

In 2018, consumers spent a staggering $1.66 trillion globally on the top 100 online marketplaces, generating 50% of global e‑commerce sales for that year.1 Then, for the first time in history, the U.S. e‑commerce market in 2019 surpassed 10% of total U.S. retail sales.2

The reach, sophistication, and convenience that online marketplaces offer have paved the way for a burgeoning “marketplace economy,” and Amazon is the epicenter. The company’s third-party marketplace accounts for nearly 60% of gross merchandise value (GMV) of marketplaces worldwide.3

While many brands have eagerly embraced the disruption of marketplaces within e‑commerce, others simply do not have the proper tools and guidance to help them succeed on platforms as dynamic as Amazon’s.

Yet, marketplaces are a key component of any e‑commerce strategy, and a robust advertising approach is imperative. As Amazon — with nearly 8% of the digital ad market — continues to compete with the Google-Facebook duopoly, brands will need a clear understanding of where to allocate their digital media spend across their channel mix to drive the highest ROI.4

With AI-powered technology, data-driven marketplace intelligence, and hands-on expertise, brands can bridge the gap between the “black box” of Amazon and their business, providing support and strategic solutions to help them navigate — and win — on and across Amazon, Walmart, and more.

Our second annual analysis, “Brands and Amazon in the Age of E‑Commerce,” documents more than 1,000 U.S. brands and their unique relationships with Amazon, including a deep dive into their media spend and advertising strategies; how the platform fits into their overall e‑commerce mix; annual revenue figures; and areas of tension and opportunity.

Whether you identify as a brand, retailer, private label seller, or other, this report sheds light on the strategies and opportunities you can leverage to navigate today’s disruptive, Amazon-driven retail ecosystem.

We hope you enjoy the insights of this report as much as we enjoyed mining them, and expect they will help you to reach new audiences, control your marketplace presence, and drive revenue and profits, all while maintaining your hard-earned equity and identity.

Findings at a Glance

- 73% of brands advertise on Amazon, up from 57% last year.

- 83% of brands see at least a 4x return with Amazon Advertising.

- 54% of brands selling on Amazon said e‑commerce marketplaces are their greatest source of opportunity.

- 62% of brands use Amazon to drive sales.

This survey was conducted by Zogby Analytics, a nationally and internationally respected opinion research firm, on behalf of Feedvisor. It was distributed online, from Nov. 15, 2019 to Dec. 6, 2019, among a national sample of 1,000+ retail business decision makers. Results from the full survey are based on a confidence interval of 95% and have a margin of error of plus or minus 3.1 percentage points. All numbers have been rounded to the nearest percent.

2. Marketplace Disruption

The Age of E‑Commerce

Brands Recognize Amazon’s Significance: 55% Are Selling on the Platform

Brands, now more than ever, are acutely aware of the profit-generating, brand-building opportunity that Amazon presents. The platform boasts more than 100 million Prime members in the U.S. alone and opens the door for brands to captivate these highly loyal consumers, increase market share and their digital shelf presence, and determine precisely how the platform fits into their overall e‑commerce strategy.5

However, several household brands — Nike, Ikea, and Birkenstock, among others — have chosen to end their direct business with Amazon. Although the moves signify pilot programs coming to a close, leaving the platform is not a turnkey solution.

Through Amazon’s third-party marketplace, these branded products will continue to be sold without intervention or oversight from the brands themselves — counterfeits, unauthorized sellers, price erosion, and competition with Amazon’s private labels will continue to persist.

In order to preserve and maintain price value, brand equity, and profit margins for the long term, brands need to holistically evaluate their e‑commerce channels and seller footprint to find the balance between risk and opportunity.

Consistent year over year, more than half of brands actively sell on Amazon, and those that are not on the platform recognize the risks associated with a lack of an Amazon presence.

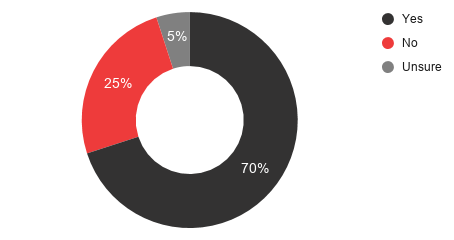

Brands Currently Selling on Amazon

Brands continue to recognize the importance of incorporating Amazon into their channel mix, given the transformative opportunities the platform presents. From access to the high-value Prime audience to gaining an additional inbound revenue stream to experimenting with new ways to optimize KPIs, brands are recalibrating their positions to utilize Amazon to their advantage.

For brands who are not currently selling on Amazon, more (48%) are inclined to start this year, up from 26% last year.

This change signals how more brands are recognizing Amazon’s importance to their e‑commerce strategy and are increasingly open to selling on the platform. Conversely, nearly one-third of brands (32%) are not sure if they want to start selling on Amazon and 16% would like to join the platform.

Finally, 35% of brands that are not selling on Amazon want to start doing so in the next three years, a number that increases to 43% within the next five years. These statistics indicate how brands view the channel as a long-term play and believe it will continue to be a dominant platform in the future.

Brands Leverage Amazon to Gain New Customers

Brands were asked to indicate how much they agree or disagree with certain statements about “the best part of selling on Amazon,” and the responses were diverse and varied by brand.

Those selling on Amazon agree that the most compelling benefits to selling on the platform are new customer acquisition (96%), increased sales volume (96%), Amazon’s credibility (95%), advertising and branding options (93%), and gaining market share (93%).

As Amazon becomes more ubiquitous than it already is, brands will continue to utilize the platform’s influence and vast audience to acquire new customers and increase sales volume.

Over three-fifths of brands strongly agree that driving sales volume and acquiring new customers are the most advantageous elements of selling on the platform, with 62% and 61% in agreement, respectively.

Brands not currently selling on Amazon agree that these two benefits are of the utmost importance, revealing that brands both with and without an Amazon presence are focused on establishing and expanding their customer base as well as generating revenue.

The Best Part of Selling on Amazon Is…

96% acquiring new customers

96% increased sales volume

95% Amazon’s credibility

93% access to customer insights

93% receiving customer feedback

93% advertising and branding options

93% gaining market share

92% reaching existing customers

92% generating brand awareness

89% the support Amazon gives me

*Respondents could cite “strongly agree,” “somewhat agree,” “somewhat disagree,” or “strongly disagree” for each option. These values represent an aggregate of “strongly agree” and “somewhat agree.”

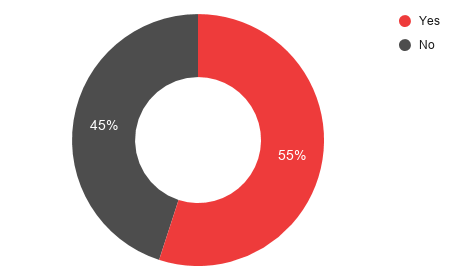

72% of 1P Brands Want to Expand to Amazon’s 3P Marketplace

In Amazon’s ever-evolving ecosystem, you need to remain agile and provide ongoing value to high-quality prospects and existing customers.

While both first-party (1P) and third-party (3P) selling models offer their own unique advantages, you should evaluate which makes the most sense for your business. Consider your size, the level of control and involvement you want, your existing fulfillment method(s), your annual budget, and any specific business objectives.

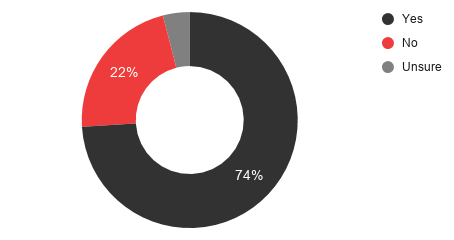

When asked if they are interested in branching out to the 3P selling model, nearly three-quarters of brands said “yes.”

Given the uncertainty about the future of Amazon’s relationships with vendors — and the occurrences of inconsistent purchase orders (POs) in 2019 — brands should take action now to get set up on the 3P marketplace so they can be protected and in control when changes are thrust upon them.

Whether brands begin by testing a specific subset of SKUs or decide to migrate their entire catalog, they need to be aware of the various ways to optimize their business on the marketplace.

Although Amazon’s policy changes are unpredictable, we anticipate the company to ask more vendors to transition to the 3P marketplace over time. By doing so, brands have the unique opportunity to create a distribution model that reaches Amazon’s expansive audience without having to solely rely on weekly PO replenishment.

When it comes to shifting from a 1P to 3P strategy on Amazon, there are several associated advantages and levers that brands can pull to help build a robust presence and simultaneously drive profits.

By migrating to 3P, brands can gain increased control over their pricing and inventory strategies, greater control of their listings with Amazon’s Brand Registry, an increase in promotional capabilities, more direct influence over their brand value proposition and reputation, and access to technology and Amazon experts to maximize 3P impact.

By aligning with a partner to guide them through any complexities, brands can receive the tools and expertise they need to enable increased sales, profits, brand equity, and discoverability on Amazon’s 3P marketplace.

Brands Want to Expand to 3P Selling

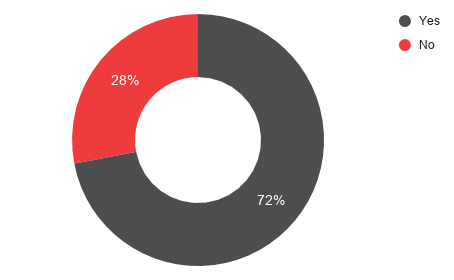

42% of Brands Generate at Least Half of E‑Commerce Sales From Amazon Alone

Marking 25 years since its genesis, 2019 was a historic year for Amazon. The company surpassed Walmart as the largest global retailer and also took the title as the world’s largest company, with a market capitalization of $797 billion.6

As the market leader, brands utilize the platform to maximize their exposure and drive incremental business — as both a source of e‑commerce-specific sales and a portion of total revenue.

For nearly half (42%) of brands surveyed that have an Amazon presence, the platform represents more than half of their e‑commerce sales. For nearly three-quarters of brands surveyed, Amazon represents between 26% and 75% of their total online sales.

Only 8% of brands selling on Amazon report that three-quarters or more of their e‑commerce sales come from the platform, which makes sense given the value brands place on having a diversified e‑commerce portfolio.

Percentage of Brands’ E‑Commerce Sales From Amazon

3. Advertising and Media Spend

Brands' Advertising and Media Spend Across Channels

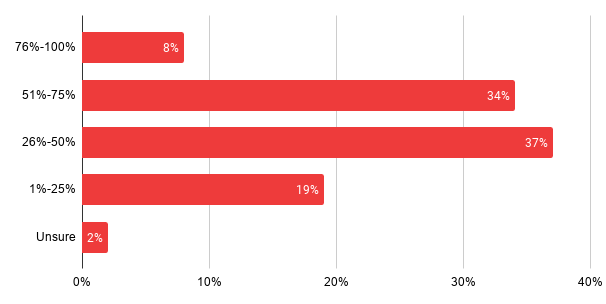

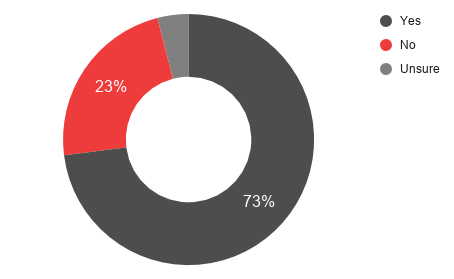

73% of Brands Advertise on Amazon, Up From 57% Last Year

In 2018, Amazon became the No. 3 digital ad seller in the U.S. In 2019, the platform generated nearly $10 billion in U.S. ad revenues, which represents almost 8% of the digital ad market.4

Throughout 2019, Amazon prioritized further building out its advertising offering, enticing brands and marketers to increase their ad spend on its platform. By adding enhanced targeting features, optimizing usability and function, improving metrics and attribution capabilities, and introducing new beta programs, Amazon is demonstrating its lasting commitment to the advertising and media space.

Nearly three-quarters of brands use Amazon’s advertising platform, up 26% from last year.

Interestingly, 23% of brands selling on Amazon have not yet begun advertising on the platform. As Amazon continues to develop its advertising portfolio and adoption rises, brands seeking additional ways to differentiate themselves from the increasing competition will continue to recognize the growing imperative for Amazon Advertising.

Finally, fewer 1P brands are advertising on Amazon than 3P brands — 67% of 1P brands advertise on the platform as compared to 73% of 3P brands.

Percentage of Brands Advertising on Amazon

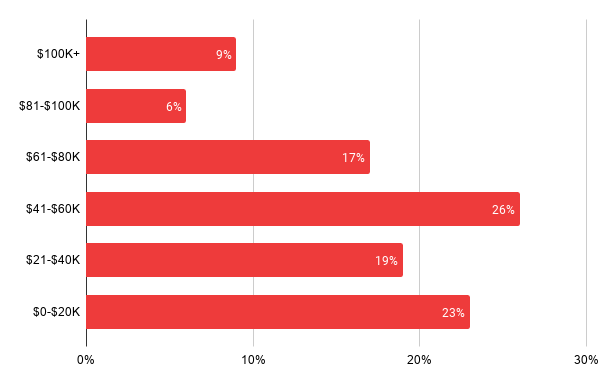

33% More Brands Spend at Least $40K/Month on Amazon Advertising vs. Last Year

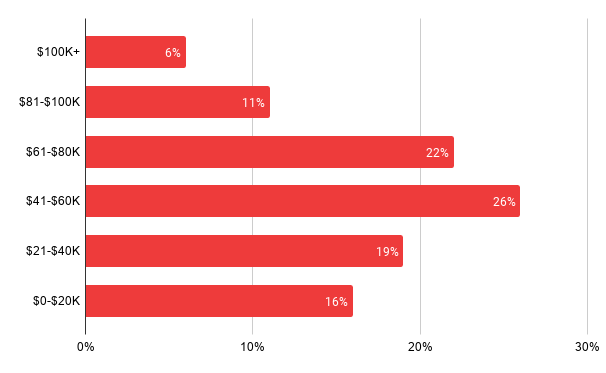

Brands are increasingly allocating ad spend to Amazon. More than three-fifths of brands selling on Amazon are spending over $40,000 per month on Amazon Advertising, a 33% increase from last year. In addition, more than one-third (38%) are spending over $60,000 monthly on Amazon Advertising.

Over a quarter (26%) of brands’ Amazon ad spend falls between $41,000-$60,000. Interestingly, 3P sellers are more likely to spend between $81,000-$100,000 each month on Amazon Advertising versus their 1P counterparts — only 7% of 1P brands spend that much as compared to 15% of 3P brands.

In Q4 2018, CNBC reported that some brands shifted 50%-60% of their Google search budget to Amazon.7 Moreover, WPP PLC, the world’s largest ad buyer, spent nearly $300 million on behalf of its clients on Amazon search ads in 2018 and about 75% of that spend came from Google search budgets.8

Whether brands shift budgets from other channels or apply new incremental spend to the platform, Amazon will continue to rapidly gain momentum in the advertising space.

The company’s frictionless end-to-end customer experience and access to customer purchase data and behavior sets it apart from the Google and Facebook duopoly, making it an obvious choice to advertisers who want to be on a platform where the end result is a conversion.

Amount Brands Spend on Amazon Advertising Monthly

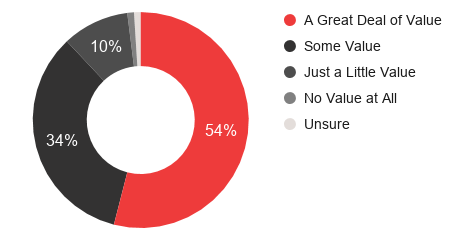

98% of Brands See Value in Amazon Advertising

Advertising on Amazon is a natural choice for brands seeking to reach high-value prospects and customers throughout their purchase journeys. In fact, only 2% of brands on Amazon do not see value in Amazon Advertising, revealing that brands truly do revere the platform for the exposure and return on ad spend (RoAS) it is capable of generating.

With a plethora of advertising options available to brands on Amazon — and more programs in beta – stakeholders are open to and optimistic about experimenting and A/B testing to figure out which ad types drive the highest RoAS for their business.

Over half (54%) of brands selling on Amazon believe there is a great deal of value in Amazon Advertising.

This is followed by 34% who believe there is some value and just 10% who believe there is only a little value. Moreover, of the brands not selling on Amazon, 75% believe they would see some value in advertising on the platform and 74% of the brands who say they do not want to join the platform see at least some value in doing so. This signifies that a majority of brands, regardless of their relationship with Amazon, acknowledge that the company’s advertising efforts can be immensely fruitful if navigated properly.

Brands can leverage third-party advertising optimization software, such as Feedvisor’s AI-driven campaign platform, to maximize their advertising potential on Amazon by launching campaigns and promotions according to specific business objectives and significantly impacting discovery and conversion.

Amount of Value Brands See From Amazon Advertising

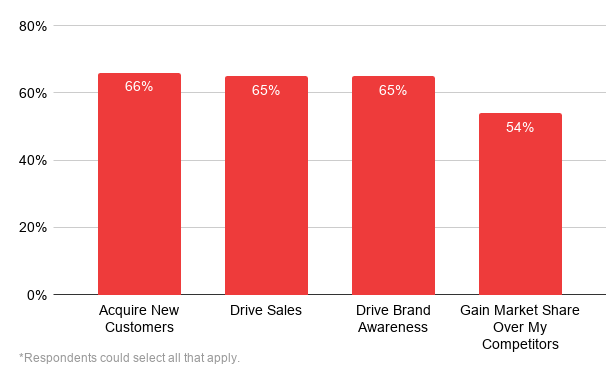

Amazon Is Emerging as a Full-Funnel Advertising Player

Over the last few years — and certainly into 2020 — Amazon has gradually grown and advanced its slate of advertising options, encouraging brands’ investment and adoption.

As a result, the company is becoming a serious contender for full-funnel advertising budgets. When asked about their goals for advertising on Amazon, the results speak to this notion, as 66% said they want to acquire new customers, 65% said they want to drive brand awareness, and 65% said they want to generate sales.

When analyzed by seller type, a majority (71%) of hybrid brands selling via both Vendor Central and Seller Central use Amazon Advertising to acquire new customers, followed by 66% of 1P brands and only about half (51%) of 3P brands who use the platform for that reason.

Brands’ Goals for Advertising on Amazon

For example, brands can bolster top-of-the-funnel efforts with new customer acquisition strategies or in-market targeting through Amazon DSP, which allows businesses to programmatically buy display and video ads at scale.

In a 2018 interview, Ryan Mayward, Global Agency Development Lead at Amazon, stated that in the next five years, Amazon will continue to “deliver top-tier DSP capabilities as well as innovate in areas that are unique to Amazon,” revealing that the company will remain focused on optimizing its top-of-the-funnel offering.9

During the middle-of-the-funnel consideration stage, brands can leverage similar product remarketing through DSP to target consumers that are browsing products similar to theirs. They can also integrate Sponsored Brands to drive sales and increase brand visibility, which may lead to more loyal, repeat buyers.

Lastly, brands can leverage tried-and-true Sponsored Products to appear in search results and on product detail pages, making them beneficial for conversion, as well as situations involving new offers, clearance items, and seasonal promotions.

Brands can also use Amazon’s Sponsored Display to diversify the reach of their ads to include off-Amazon websites and apps, targeting relevant audiences based on their Amazon shopping activities. These ads can help brands gain conversions, as well as upsell, cross-sell, or even tap into a network of out-of-category shoppers.

As evidenced, Amazon is intent on disrupting the advertising duopoly of Google and Facebook. New features and developments from 2019 along with its acquisition of the Sizmek ad server and Sizmek’s Dynamic Creative Optimization (DCO) platform will continue to enable Amazon to offer additional tools to scale, innovate, and improve beyond its owned channels.

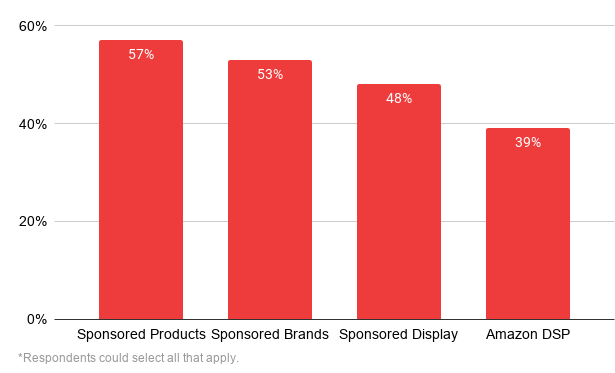

Brands Are Open to Experimenting With Amazon Ad Types

As Amazon’s advertising offering expands, brands are willing to test new ad types to deduce what format performs the best for their unique business.

A majority of brands advertising on Amazon (57%) leverage Sponsored Products ads, followed by 53% who utilize Sponsored Brands. Adoption of Sponsored Display came quickly, as nearly half (48%) of brands advertising on Amazon utilize the ad type, which was recently introduced in September 2019. Lastly, nearly two-fifths (39%) of respondents incorporate Amazon DSP into their advertising mix.

Interestingly, less than one-third (28%) of 1P brands use Amazon DSP as part of their advertising strategy compared to 35% of 3P brands who do so. This may indicate that 1P brands who utilize a traditional agency model are more reliant on the Google ecosystem and other DSPs, as their agencies lack the comprehensive understanding of Amazon’s depths of data and ability to drive to sale on Amazon.

With regard to Sponsored Products, over half of 1P brands (56%) incorporate them into their advertising mix versus half (50%) of 3P brands.

Amount of Brands Currently Using Amazon’s Ad Types

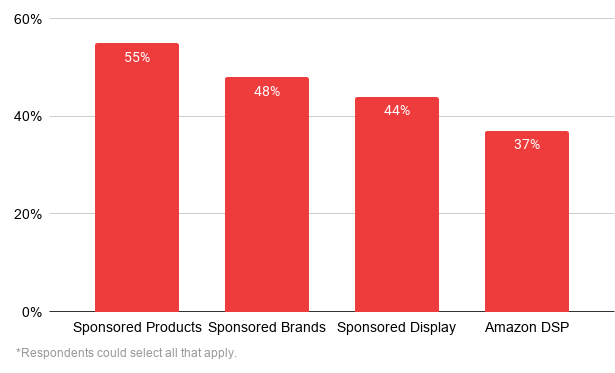

Sponsored Products Drive the Highest RoAS for Brands on Amazon

When it comes to RoAS from Amazon Advertising solutions, a majority (55%) of brands believe Sponsored Products are the most valuable, followed by Sponsored Brands (48%), Sponsored Display (44%) and Amazon DSP (37%).

When analyzed by seller type, Sponsored Products still remain at the forefront. A majority (61%) of hybrid brands believe Sponsored Products generate the most RoAS, as well as 54% of 1P brands and 45% of 3P brands.

Sponsored Products are a core element of Amazon’s advertising offering and a key driver of discoverability and incremental growth for brands and retailers operating on the platform.

The keyword or product attribute targeted, cost-per-click (CPC) ads are displayed to shoppers in search results and on product detail pages on both desktop and mobile. They can be used to achieve a variety of business goals such as driving exposure and visibility for new or low-exposure ASINs, generating incremental revenue, increasing product discoverability, and more.

These responses make sense given Amazon’s current advertising landscape — the company is still beefing up its offering in the top-of-the-funnel sector where Amazon DSP resides. Just over one-third (34%) of 3P brands and over a quarter (26%) of 1P brands believe Amazon DSP drives the greatest return on ad spend for their brand, yet these numbers are likely to increase as Amazon broadens its awareness-geared programmatic media offering.

Also worth noting, the DSP can contribute to the high RoAS experienced with Sponsored Products and Sponsored Brands, given its ability to generate a halo effect in which the DSP drives demand while the Sponsored ads complete the conversion.

Amazon Ad Solution That Drives Brands’ Greatest RoAS

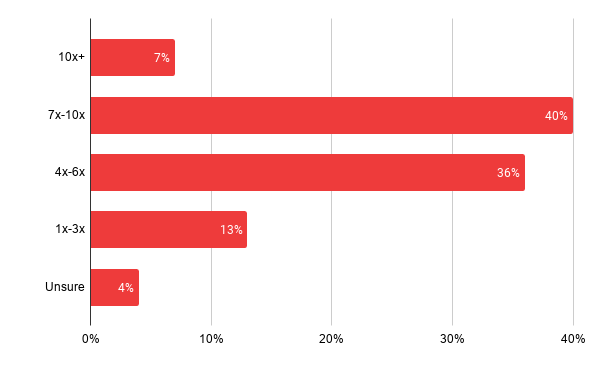

Nearly Half of Brands See at Least a 7x Return on Amazon Advertising Initiatives

Brands’ investments in Amazon Advertising are proving fruitful, with 47% of brands experiencing a whopping 7x return or more with Amazon Advertising.

A staggering 83% of brands see at least a 4x return on their Amazon Advertising efforts, a number that rises to 88% among specifically 3P brands.

Two-fifths of brands see a 7x-10x average return with Amazon Advertising, while 36% see a 4x-6x return and only 13% saw a lower return of 1x-3x. Nearly half (45%) of brands who experience a 7x-10x return on their Amazon ad campaigns identify exclusively as a 3P brand, and 41% of brands who identify as hybrid also see this same level of return.

Interestingly, exclusively 1P brands are more likely to see lower returns, with 17% reporting a 1x-3x average return on Amazon Advertising, compared to only 8% of 3P brands reporting returns in the same threshold.

Brands appreciate the clear connection to ROI with Amazon. The platform has a major advantage versus its competitors in that it is inherently a destination where consumers go to make purchases, making it easier to track the number of sales that ad spend truly converted.

Through intricate shopper data, Amazon can track the consumer’s purchase journey and steps he or she took after being served an ad — clicking on it and making the purchase, clicking on it and buying a competitor’s ASIN, not clicking on the ad at all, etc.

Average Return Brands See on Amazon Advertising

From Duopoly to Triopoly: Brands’ Ad Dollars Shifting to Amazon From Google and Facebook

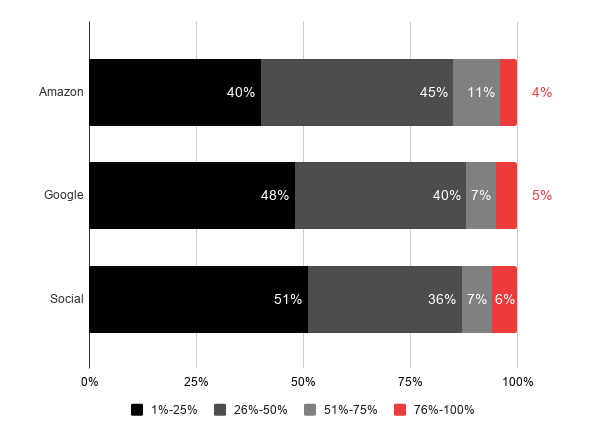

Although today only 4% of brands allocate between 76%-100% of their media spend to Amazon, brands are gradually allocating more digital media spend to the platform. Forrester anticipates a substantial shift in ad dollars to Amazon from Google and Facebook in 2020.10

Over half (56%) of brands said Amazon accounts for one quarter to three quarters of their overall media spend, while 51% said they allocate a quarter or less of their spend to social channels, like Facebook.

While brands still trust the incumbents of Google and Facebook for their ads versus Amazon, we anticipate that brands will put further investment behind Amazon as it continues to develop its full-funnel ad offering.

Allocation of Brands’ Digital Media Spend Across Channels

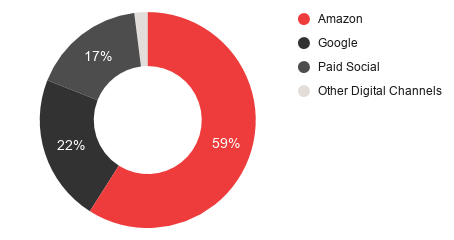

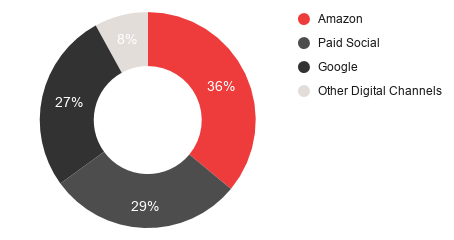

Over Half of Brands on Amazon Say the Platform Drives the Highest Return on Media Spend

A majority (59%) of brands selling on Amazon said that the platform generates their highest return on media spend, followed by Google (22%) and paid social (17%).

More than half (55%) of brands advertising on Amazon said Sponsored Products drive their greatest return on the channel. For brands not currently on Amazon, 43% say that paid social generates the highest return, followed by 33% citing Google for highest return.

This reveals that, while Google is beneficial for B2B search ads, it is not the go-to advertising choice for brands in general. For all brand respondents in the survey, 36% say Amazon generates the highest return on media spend, followed by paid social (29%) and then Google (27%).

The sentiment that Amazon is the greatest driver for RoAS amongst brands’ channel mix resonates with brands of all kinds, as 66% of hybrid brands generate their highest return on media spend on Amazon, along with 62% of 3P brands and half (50%) of 1P brands.

Of the brands that would like to join Amazon, 41% say their highest return on media spend currently comes from paid social, and nearly one-fifth (19%) say it comes from Amazon. Once they establish a presence on the platform and begin to experience its additional benefits, the returns they experience from Amazon are likely to increase.

Channels That Drive the Highest RoAS

Brands on Amazon

All Brands

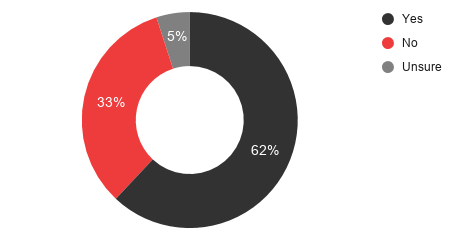

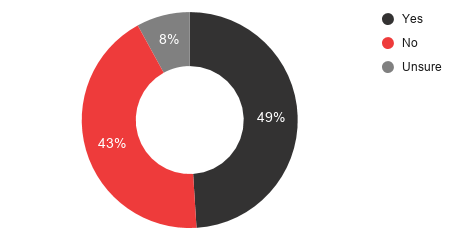

Nearly Half of Brands Run Off-Amazon Promotions to Coincide With Prime Day

Interestingly, whether or not they sell on Amazon, brands run promotions that coincide with Amazon’s annual shopping event that is exclusive to Prime members.

Nearly half (49%) of all brands surveyed run off-Amazon promotions leading up to and during Prime Day, 34% of which are brands not currently selling on Amazon. Moreover, 56% of the brands who want to begin selling on Amazon also launch promotions to capitalize on the increased shopper activity around the sales event.

More than three-fifths (62%) of brands selling on Amazon run their own off-Amazon promotions in addition to any Prime Day-specific deals or discounts they run on Amazon. Many brands are likely to leverage the Prime Day momentum and increase in sales and traffic to bring consumers back to their own channels or to ensure price parity across their various channels.

Brands Run Promotions on Their Own Channels to Compete With Amazon Prime Day

Brands on Amazon

All Brands

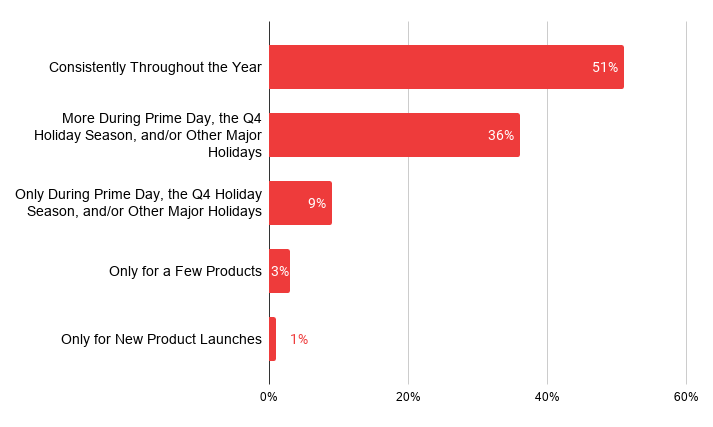

Over half (51%) of brands on Amazon advertise consistently throughout the year, aligning well with Amazon’s “always-on approach.” Amazon recommends setting no end date for campaigns, such as for Sponsored Products, so brands can drive consumer discovery at any time and generate demand and sales year round.11

Over one-third (36%) of brands on Amazon advertise more during key shopping periods such as Prime Day, the Q4 holiday season, and/or other major holidays. Conversely, just 9% of brands advertise exclusively during key shopping periods such as those aforementioned.

Frequency of Brands’ Advertising Initiatives

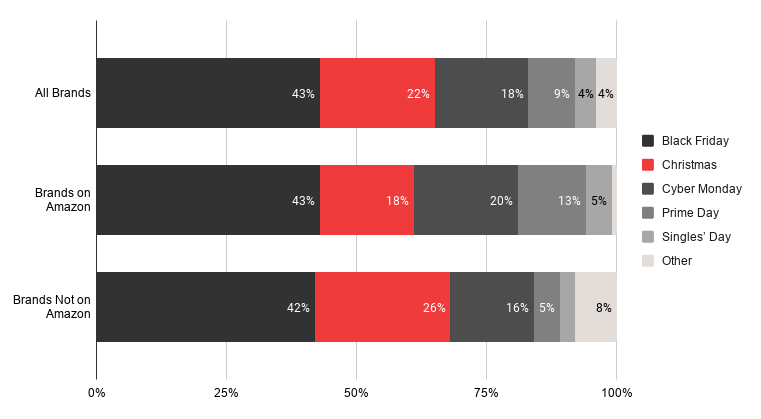

While Prime Day Is Important, Nothing Competes With the ‘Turkey 5’

For all brands — total respondents including brands on Amazon and brands not currently selling on the platform — Black Friday generates the greatest returns.

When analyzing the overall sample, brands see the largest sales increase on Black Friday (43%), followed by Christmas (22%), and Cyber Monday (18%). Interestingly, only 9% of all brands said that their largest sales jump takes place on Prime Day.

While there is no arguing that Prime members are an extremely lucrative audience for Amazon and the brands and retailers who operate on it, when it comes to isolated sales events, Black Friday, Cyber Monday, and “Christmas,” or holiday shopping, vastly outperform Prime Day.

While Prime Day has come to accelerate the kickoff of back to school shopping, year-over-year trends demonstrate that traditional holiday shopping events reign supreme.

For brands on Amazon, Black Friday once again took the lead as the greatest driver of sales (43%), while only 13% cited Prime Day. Brands that have yet to join Amazon also cited Black Friday for their biggest increase in sales (42%), this time followed by Christmas (26%) as opposed to Cyber Monday (16%). Interestingly, 67% of brands who are not on Amazon cited increased exposure and sales volume from Prime Day as factors that motivate them to sell on the platform.

Shopping Events Where Brands See the Biggest Increase in Sales

4. Expansion and Marketplaces

Channel Strategies and the Rising Role of Walmart

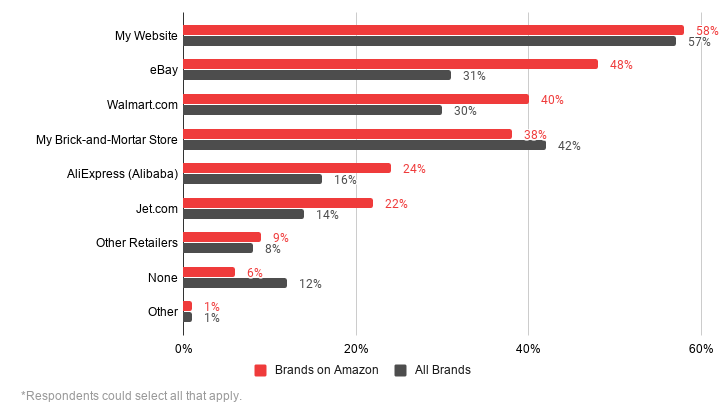

While Amazon Is the Focus, Channel Diversity Is Key for Brand Preservation

57% of brands still need and rely on their own website for sales, and 42% of survey respondents currently sell products at their own brick-and-mortar stores.

Additionally, 31% of brands also sell on eBay, 30% sell on Walmart, and 16% sell on AliExpress, a digital marketplace owned by Alibaba. For brands already selling on Amazon, 58% still leverage their own website, as well as eBay (48%) and Walmart (40%).

Not surprising, the most popular channels for brands not selling on Amazon are their own websites (54%) and brick-and-mortar store locations (47%).

When asked about channels their brand would consider selling on, 19% of survey respondents said they would consider selling on Jet.com, while 18% said Walmart.com and 17% said they would consider selling on eBay. These statistics align with Feedvisor consumer data, which indicates that Walmart and eBay are the leading alternatives to Amazon for consumers to buy on, once again revealing the uncontested dominance of marketplaces across e‑commerce.12

For brands currently selling on Amazon, only 19% would not consider selling anywhere else. Expanding their online presence represents a significant opportunity for revenue diversification, ensuring long-term, sustainable business growth and mitigating any associated risks with single-channel selling.

Alongside Amazon’s disruption of the entire retail ecosystem, marketplaces — with more emerging each day — are becoming the driving force behind e‑commerce growth, as evidenced by consumers’ preference to shop these destinations. As such, brands will want to ensure channel diversification to meet shoppers where they are.

Channels Brands Currently Sell On in Addition to Amazon

70% of Brands Are Currently Advertising on Walmart

On Jan. 3, 2020, Walmart introduced its highly anticipated in-house advertising platform and API, a direct play in its notorious competition against Amazon.

The retailer took several steps in 2019 to build out its advertising business, Walmart Media Group, including strengthening its supply-side ad stack with native ad campaigns and reports as well as enhancing its technology offering through the acquisition of advertising startup Polymorph Labs.13

With its new self-serve platform, Walmart Advertising Partners, brands and advertisers alike can directly buy on-site search and sponsored product ad placements on Walmart.com, granting them more transparency and control over ad spend as well as relevant insights from both in-store and online data.13

Of all brands surveyed, 70% currently advertise on Walmart.com and, of brands selling on Amazon, 74% are currently advertising on Walmart.com.

Interestingly, of the brands advertising on Amazon, 81% also allocate advertising spend to Walmart.com, indicating brands’ priority to have an advertising presence across key marketplaces beyond Amazon.

More than half (59%) of brands not selling on Amazon are advertising on Walmart.com. While still in its early stages, Walmart’s introduction of an ad platform marks a turning point for brands both online and in-store.

When comparing it to Amazon’s ad arm, Walmart has room for optimization — such as with regard to targeting and measurement — but we anticipate that additional features and benefits will be launched to improve the user experience and adoption will continue to rise.

Brands Advertising on Walmart.com

All Brands

Brands on Amazon

Brands Are Equally Inclined to Allocate Ad Spend to Walmart vs. Amazon

As mentioned, 70% of brands have taken their advertising efforts to Walmart.com, including 74% of brands currently selling on Amazon.

More than half (58%) of brands spend at least $40,000 per month advertising on Walmart.com. Similarly, 62% of brands on Amazon spend the same amount on Amazon Advertising.

Moreover, 31% of brands spend at least $60,000 per month advertising on Walmart — and the trend is similar for brands advertising on Amazon, with 38% allocating budgets in that same threshold to Amazon ad placements. This reveals that brands spend nearly comparable amounts advertising on Amazon and Walmart, despite the infancy of Walmart’s ad offerings. Of brands selling on Amazon, nearly a third (29%) spend between $41,000-$60,000 advertising on Walmart.

Over a quarter (26%) of brands spend between $41,000-$60,000 on Walmart advertising, followed by 23% who spend up to $20,000 and 19% who spend between $21,000-$40,000. Only 9% of brands are spending more than $100,000 on Walmart advertising.

Interestingly, nearly three-quarters (74%) of brands not selling on Amazon are spending up to $60,000 on Walmart advertising, alluding to the fact that they established a Walmart marketplace and advertising presence before joining or advertising on Amazon.

Monthly Amount Brands Spend Advertising on Walmart.com

5. Acquisition Trends

Driving Sales and Gaining New Customers

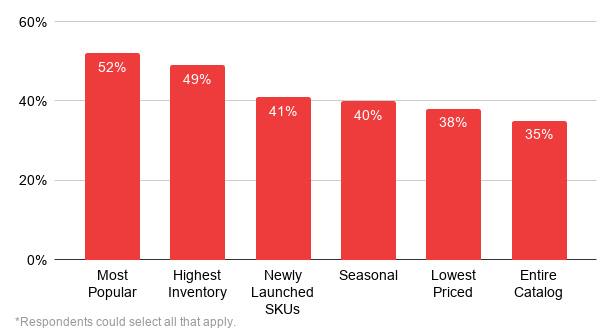

Brands Put Their Most Popular Products on Amazon

More than half (52%) of brands on Amazon put their most popular products on the platform in conjunction with their own websites or channels.

This trend was similar for products with high inventory levels (49%), newly launched SKUs (41%), and seasonal goods (40%).

Brands are strategic about their SKU selection process for Amazon and lead with their most popular products that they know will resonate with customers and already have a strong sales history, ultimately resulting in stronger returns.

These findings indicate brands’ changing perception of Amazon, from a “discount store” or place to sell unique SKUs to a destination for all types of business objectives, from new product launches to sales-driving top performers.

Products Brands Put on Amazon in Conjunction With Their Own Website and/or Channels

Brands Leverage Amazon as a Full-Funnel Purchase Channel

Similar to the way consumers use Amazon for every step of their purchase journey, brands utilize Amazon to fulfill their cross-funnel business goals.

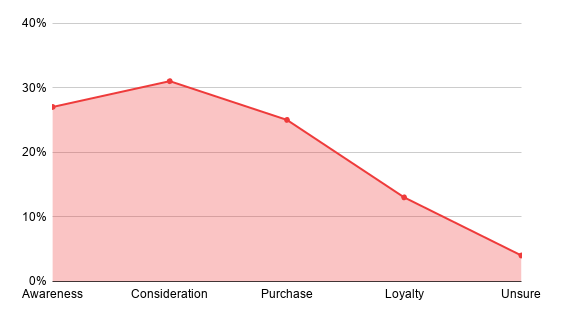

When asked at what stage brands believe Amazon most often falls into their average customer’s shopping journey, nearly one-third (31%) of brands cited the middle-of-the-funnel, consideration stage of their journey, closely followed by the awareness stage (27%) and purchase (25%).

According to proprietary Feedvisor data, consumers use Amazon through various stages of their shopping journeys, from searching to checking prices to scanning product reviews to buying. Brands, in turn, know they can find shoppers with various motivations and at different stages of their paths to purchase on Amazon and therefore use it as a means to a variety of ends.

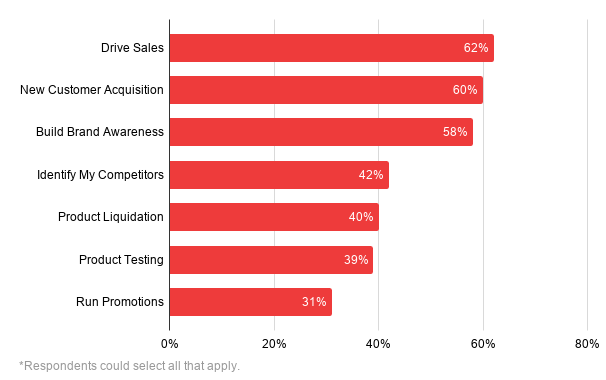

When asked about their top business strategies for Amazon, 62% said they use the channel to drive sales, 60% said they use it to acquire new customers, and 58% said they use it to build brand awareness, demonstrating that brands rely on Amazon, both the marketplace and advertising arm, as a holistic purchase channel.

Brands’ Perception of Amazon’s Most Frequent Role in Shopper Journey

Almost Half of Brands on Amazon Have an Average Customer Acquisition Cost Lower Than $100

A majority (69%) of brands selling on Amazon know their average customer acquisition cost (CAC) on Amazon. More 3P brands (69%) are likely to know their CAC, compared to 59% of 1P brands.

A company’s CAC is the total sales and marketing cost required to earn a new customer over a specific time period. Essentially, it is the cost of converting a potential lead into a customer.

The associated costs include all program and marketing spend such as any production or creative costs, employee salaries, commissions, bonuses, and overhead involved with gaining new customers.14

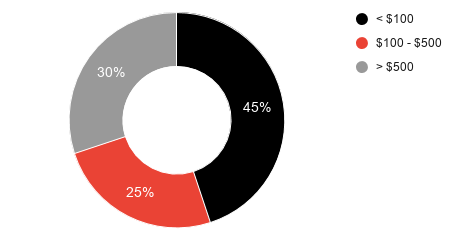

When asked about their average CAC on Amazon, nearly half (45%) of brands reported it is less than $100.

According to HubSpot, CAC varies by industry and is based on factors including but not limited to the length of the sales cycle, company maturity, customer lifespan, purchase value, and purchase frequency. Brands that said their Amazon CAC is less than $100 are on par with industry standards that report, for example, an average CAC for retail is $10, consumer goods is $22, and manufacturing is $83.

Just under one-third (30%) reported their Amazon CAC is over $500 and a quarter (25%) reported that it falls between $100-$500.

Brands’ Average Customer Acquisition Cost on Amazon

For 45% Brands on Amazon, Their Amazon CAC Is the Same or Lower Than Other Channels

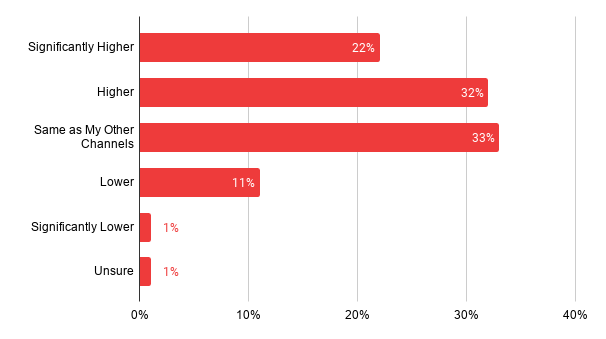

Nearly half of brands on Amazon report an Amazon CAC that is the same or lower than other channels. Specifically, 33% of brands said their Amazon CAC is the same as their CAC on other channels, while 12% of brands selling on Amazon report an Amazon CAC that is lower or significantly lower than that on other channels.

For many (54%) of the brands selling on Amazon, the Amazon customer acquisition cost is either higher or significantly higher than their CAC on other channels.

Interestingly, nearly one-third (31%) of 1P brands report their Amazon CAC to be significantly higher than their CAC on other channels, compared to only 15% of 3P brands who say the same.

Knowing your CAC for each channel in your portfolio will help you identify the areas where you can invest more marketing spend and, over time, gain new customers for a fixed budget amount.

While there are certainly more challenges upon reaching new sales thresholds, gaining a certain level of status and reputation, and navigating Amazon as an enterprise brand, you can maintain an optimal Amazon CAC by regularly improving overall user value and closely monitoring ad performance, specifically through new-to-brand metrics.

Brands’ CAC on Amazon vs. Other Channels

6. Competition and Opportunities

Brands' Sources of Tension and Growth

Brands Increasingly Use Amazon to Identify Their Competitors

Increasingly, brands are utilizing Amazon to understand their competition — the competitive landscape, if competitors sell like ASINs and are taking share of voice, how they are priced, and so on.

42% of brands say their top business strategy on Amazon is to identify their competitors.

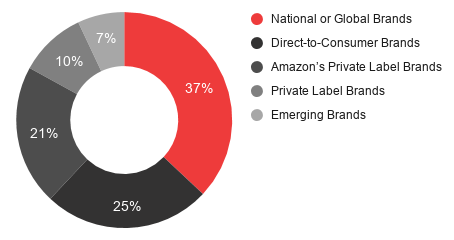

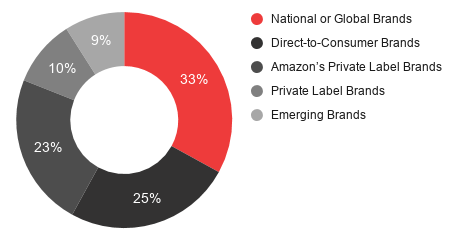

When asked about their top source of competition, 37% of brands cited national or global brands, followed by direct-to-consumer (D2C) brands (25%) and Amazon’s private label brands (21%).

Of the brands selling on Amazon, nearly one-quarter (23%) said their greatest source of competition is Amazon’s private label brands, while the same was said for 19% of the brands not selling on Amazon.

Feedvisor enables brands to understand and optimize their “digital shelf” presence on Amazon, including how they are performing against the competition at the brand level, in key areas such as content, discoverability, market share, pricing, ratings and reviews, and customer engagement. To learn more, click here.

As mentioned earlier, when asked about their top business strategies for Amazon, 62% use the channel to drive sales, 60% use it to acquire new customers, and 58% use it to build brand awareness.

Outside of those three top responses related to the sales funnel, brands use Amazon to receive insights on their current competitive arena, nix competitors that are not actually a threat, and truly understand who may be stealing demand or market share from them.

Brands’ Business Strategies on Amazon

Brands On and Off Amazon Fear Amazon’s Private Label Brands

Although brands are facing competition from national, global, and D2C brands, Amazon’s private label brands — over 146 of them — are channel specific and pervasive.15

69% of brands selling on Amazon agree that one of the worst parts about selling on the platform is the company’s exclusive or private label products.

There has certainly been a lack of clarity as to whether Amazon leverages data to inform its own private label assortment, as 68% of brands selling on Amazon cited a lack of transparency into how the company uses its data as one of the worst parts about selling on the platform.

Even further, 67% of all brands surveyed agree in some capacity that the growth of Amazon’s own private labels is negatively impacting their interest in doing business with Amazon.

Given that private labels are a long-term play for Amazon — sales in the sector are slated to hit $25 billion by 2022 — brands need to take precise measures to remain profitable and competitive alongside these products.16

Brands can perform an analysis of their KPIs down to the SKU level, including ad optimization, to make sure they are leveraging all angles to increase conversion.

They can also maintain a specialized focus on Amazon’s private label goods, tracking their own ad placements and organic rankings against Amazon’s for benchmarking purposes. Brands can differentiate their products through strong, optimized product listings, SEO-rich content and images, and an innovative value proposition.

Brands’ Biggest Source of Competition

All Brands

Brands on Amazon

Nearly Half of Brands on Amazon Participate in Amazon’s “Our Brands” Accelerator

According to Amazon, when consumers see the “Our Brands” message above certain products on the platform, the item is either part of an Amazon private label brand or comes from a curated selection of brands exclusively sold on Amazon.17

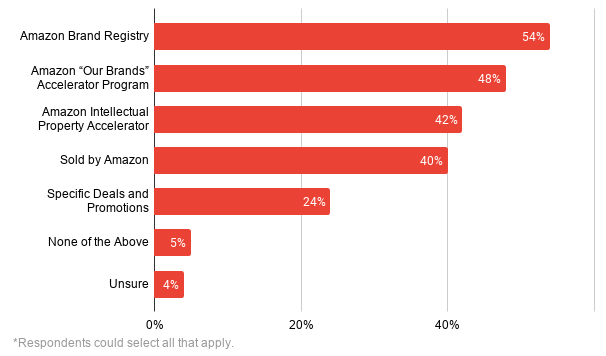

Just about half (48%) of brands belong to the “Our Brands” accelerator program, an initiative Amazon designed to bring competitively priced, high-quality products to its vast network of both consumers and commercial businesses.

The program is a win-win for both Amazon and participating brands. For Amazon, it helps maintain market share, diversify its products selection, and drive incremental growth to its retail arm. Brands receive onboarding support, a suite of marketing services from Amazon’s merchandising team, and a strategic approach to testing new products and receiving feedback to optimize from there.

Additionally, more than half (54%) of brands participate in Amazon’s Brand Registry, a service dedicated to helping brands protect their intellectual property and verify themselves as the rights owner for trademarks.

In 2020, Amazon is planning to relinquish more data on counterfeit goods over to law enforcement to further regulate counterfeit activity on its marketplace.18 Being enrolled in the Brand Registry provides brands with added layers of proactive brand protection and can help remove suspected infringing or inaccurate product content on the platform while helping brands improve their overall selling experience.

Amount of Brands Participating in Amazon Programs

Brands Seek More Support From Amazon to Join the Platform

Selling on Amazon is an immensely complex undertaking, even for enterprise brands. With performance metrics and customer satisfaction requirements to adhere to, demand forecasting and inventory management to act on, pricing and advertising to establish and optimize, and Amazon policies to familiarize themselves with, Amazon’s dynamic nature can be difficult to keep pace with.

In fact, the sentiment from many brands surveyed indicate that greater support from Amazon could encourage more brands to eventually join and begin selling.

A majority (69%) of brands cited lower selling fees and access to consumer insights as motivating factors, along with shipping and fulfillment support (68%) and greater brand control (67%).

Specifically, 68% of brands not yet on Amazon said support with shipping and fulfillment would be a motivation for them to sell on the platform, along with half (49%) of brands that want to begin selling on the platform.

Over two-thirds (67%) of brands not on Amazon and nearly half (47%) of brands that want to sell on Amazon in the future said support with product launches and ongoing optimizations would motivate them to do so. Both statistics reinforce the notion that brands need expert guidance to navigate marketplaces in general, but particularly Amazon given its highly unpredictable nature and hyper-competitive landscape.

Feedvisor leverages AI-powered technology to provide brands with the tools and expertise they need to achieve their business goals, from profit generation to brand presence optimization to new product launches.

Brands’ Top Motivations to Sell on Amazon Are…

72% to be where consumers are searching for products

72% expanded advertising capabilities

71% access to Prime member audience

69% lower selling fees

69% access to customer insights

68% support with shipping and fulfillment

67% increased exposure and sales volume

67% greater control over my brand

67% support with product launches and ongoing optimizations

*Respondents could cite “highly motivate,” “somewhat motivate,” or “would not motivate” for each option. The chart represents an aggregate of “highly motivate” and “somewhat motivate.”

Brands Seek Expertise to Help Them Face the Myriad of Challenges Amazon Marketplace Poses

Over the last two decades, Amazon has evolved with such speed and momentum that it has become difficult for brands to keep pace. While brands see significant value in Amazon’s audience and influence, new waves of challenges arise regularly for brands to respond and adapt to.

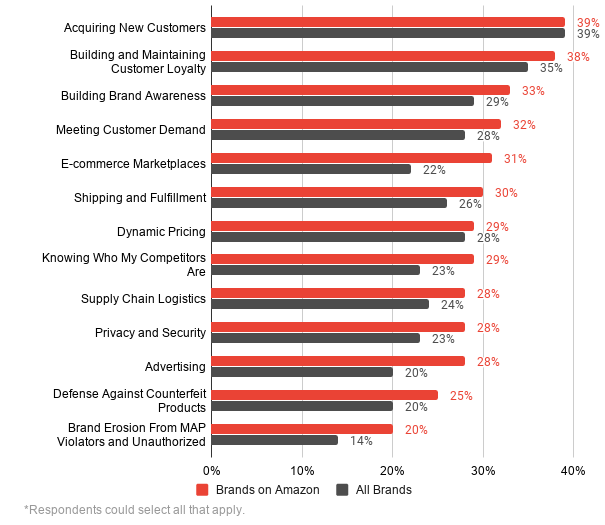

Of all brands surveyed, acquiring new customers (39%), building and maintaining customer loyalty (35%), and building brand awareness (29%) were the top three most cited challenges amongst brands. Interestingly, just 20% of brands cited defense against counterfeits as a challenge, a number that rose to 28% of brands when looking at those with an Amazon presence.

Brands on Amazon seemingly grapple with the same leading three challenges experienced among all brands. To navigate these challenges, stakeholders are open to experimenting with new avenues to acquire customers, such as remarketing with the Amazon DSP, for example, and finding new ways to generate brand exposure and transform shoppers from one-time consumers to recurring customers.

Further, 36% of the brands who want to begin selling on Amazon cited acquiring new customers as their biggest challenge.

Brands can leverage deep Amazon expertise and sophisticated technology platforms such as Feedvisor’s to help them drive sales and traffic to their product detail pages, deliver first-rate customer experiences, and leverage the ad types that generate the highest RoAS for their brand — all of which can result in new customers.

Challenges Brands Are Facing

Fear of Ceding Control Hinders Brands From Selling on Amazon

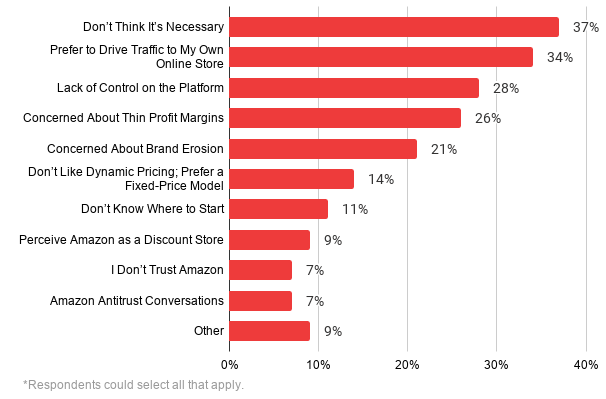

Over one-third (37%) of brands are not selling on Amazon because they do not think it is necessary. Others (34%) prefer to funnel the traffic to their own online store.

Interestingly, though, 28% of brands cited a lack of control as the reason they have not yet begun selling products on Amazon. Of the brands that would like to begin selling on Amazon in the future, 38% said they are not already doing so because of the lack of control on the platform and 30% said they are unsure where to start. Further, 67% of brands not selling on Amazon said greater brand control would motivate them to join the platform.

Lack of control can manifest in a myriad of ways for brands — over their brand voice, brand loyalty, pricing, customer relationships, customer data, and so on. With such a saturated marketplace, brands are left to understand how to maintain their brand identities on the platform to avoid price erosion, losing sales demand to a competitor, or degradation of their brand equity, for example.

Brands can leverage AI-fueled optimization software and Amazon expertise to ensure accurate representation in both the marketplace and first-party settings.

With Feedvisor’s data-backed platform and end-to-end managed services offering, brands can identify unauthorized sellers and MAP violators, increase their market share and gain stronger brand reputation control, maintain influence and protection over their intellectual property and product detail pages, and police their unique seller footprint.

Reason Brands Have Not Yet Sold Products on Amazon

Brands See Marketplaces as the Future of E‑Commerce

Marketplaces are rapidly shifting the trajectory of the e‑commerce landscape. In 2018, the world’s online marketplaces sold more merchandise than all standalone retail websites combined.19

The global emergence, expansion, and domination of marketplaces seems to just be getting started. These platforms effectively attract and maintain the attention of consumers through their vast product selections and competitive prices. As a result of marketplace ascension, brands and retailers are transitioning from what has historically been a wholesale model to selling directly to consumers via marketplaces.

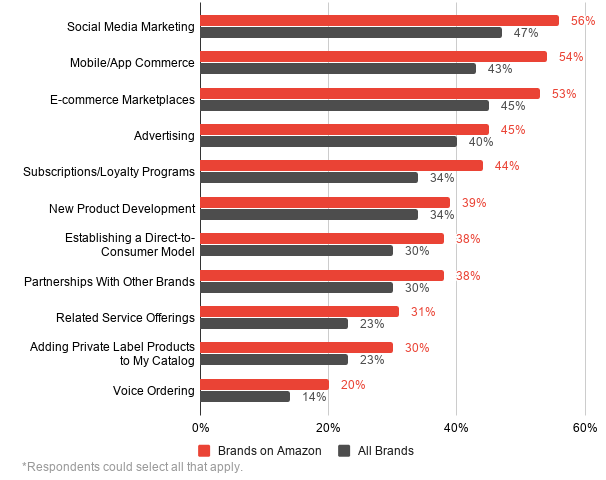

These channels signify extreme potential and opportunity for brands — more than half (54%) of brands on Amazon said e‑commerce marketplaces are their greatest source of opportunity.

The trend is similar for brands who would like to start selling on Amazon in the future, with 41% citing e‑commerce marketplaces as their greatest opportunity.

While brands on Amazon also favor social media marketing (56%) and app/mobile commerce (53%), both of these directly correlate to success on Amazon and meeting customers where they are — on mobile devices, across social media platforms, and on convenient marketplace websites.

Although brands not on Amazon favored social media marketing (37%) and mobile/app commerce (36%) as well, it speaks volumes that they recognize e‑commerce marketplaces (30%) as a source of opportunity for their brand, even though they are not currently utilizing Amazon, the marketplace leader.

Additionally, brands on Amazon value the opportunity that advertising offers their business (45%), as it can offer formative benefits such as product exposure and discovery, improved organic rankings, brand awareness, and even net new customers.

Only 20% of brands on Amazon find voice ordering to be their greatest driver of e‑commerce opportunity, indicating there is still some hesitancy from brands to experiment with the technology.

Brands’ Greatest Source of E‑Commerce Opportunity

7. Looking Ahead

The Future of Brands, Amazon, and Modern Marketplaces

With its expansive audience, relentless commitment to customer experience, and the conversion-geared composition of its platform, brands recognize the transformative impact that Amazon can have on their business.

While advertising is certainly a key focus of Amazon’s as it remains steadfast in disrupting the Facebook and Google duopoly, it is one piece of the greater, more complex Amazon puzzle. Brands need a holistic strategy, deep expertise, and real-time, data-backed technology that considers the many factors influencing success on the platform.

Brands, now more than ever, need to leverage the platform to accomplish full-funnel goals, from building brand awareness to acquiring new customers to driving sales. They need a granular understanding of which SKUs make the most sense for Amazon versus their owned channels, how they should allocate their digital media spend across their channel mix to drive the highest RoAS, and tools to quantify customer acquisition costs and ingrain shopper loyalty.

This report aims to shed light on the intricate, dynamic relationships between brands and Amazon, highlighting opportunities and challenges brands face amidst an e-commerce landscape continuously in flux and where Amazon is the driving force. The platform is not just another sales channel that brands are adding to their e-commerce mix — it is a strategic selling tool used to promote their bespoke, value-added features and benefits and connect with new, high-value audiences.

By keeping pace with the ever-evolving retail landscape, with Amazon at the center and Walmart close behind, brands can effectively differentiate themselves, solidify their brand identities, and drive long-term growth.

Key Takeaways

- 73% of brands currently advertise on Amazon, up from 57% last year.

- 83% of brands see at least a 4x return with Amazon Advertising.

- 54% of brands on Amazon said e-commerce marketplaces are their greatest source of e-commerce opportunity.

- 62% of brands selling on Amazon use it to drive sales, 60% to acquire new customers, and 58% to build brand awareness.

- 98% of brands see value in Amazon Advertising.

- 59% of brands selling on Amazon say that Amazon generates the highest return on media spend, over Google and paid social.

- 74% of brands selling on Amazon are currently advertising on Walmart.

- 52% of brands put their most popular products on Amazon in conjunction with their own website or channels.

- 45% of brands reported an Amazon CAC of less than $100.

- 55% of brands currently sell on Amazon.

- 55% of brands believe Sponsored Products drive the highest RoAS on Amazon.

Get Full Access to the Report

Get access to the 100+ findings in this report. Please note that the form will not appear if you are using ad blockers.