The Amazon Profitability Playbook

How to Track Finances and Calculate Profit on Amazon

Do you know how to determine your true profits on Amazon? In this playbook, the Amazon experts at Feedvisor and Payability break down the numerous variables that impact your profitability on the marketplace, as well as strategies for keeping track of your Amazon finances, generating more cash flow to fund your business’s growth, and ways to accurately calculate and maximize your profits.

Co-authored by

![]()

1. Introduction

Do You Know Your True Profitability on Amazon?

It is a challenge most — if not all — Amazon merchants face. Whether you are a new seller just beginning to navigate the marketplace or an enterprise consumer brand with an established e-commerce strategy, determining your true profitability on Amazon or other marketplaces can be an intricate and complicated undertaking. Yet, it is one that is crucial to the health and sustainability of your business.

The Amazon marketplace has 1.1 million active sellers, with 250,000 new sellers joining the platform in 2019. However, growth of the marketplace is slow in terms of active sellers, at just 5.1%, as many of the new sellers replace old sellers when they stop selling, and some new sellers stop without ever making a sale.1

Indeed, surviving on Amazon’s marketplace is no easy feat, and some experts suggest the inability to accurately calculate and manage profitability is a major reason why many merchants stop selling on the platform.

Yet, from 2018 to 2019, nearly three-quarters (70%) of sellers grew their revenue on Amazon and over half (56%) experienced profit growth.2

In order to achieve success and maximize the growth opportunities for your Amazon business, you must have a clear understanding of each variable that impacts your profitability, from fulfillment fees to the cost of goods. Doing so will help you optimize appropriately by either proactively finding ways to increase revenue or reduce your costs.

Once you are acutely aware of the impacts that specific costs and fees can have across every facet of your Amazon operation, you can then start to understand how much more overall profit you can capture on the marketplace — and scale accordingly.

2. Tracking Amazon Finances

How to Track Your Finances on Amazon

58% of Amazon sellers agree that they need help managing their Amazon operation.2

Running your Amazon business is hard enough. Not knowing how to track your income, expenses, cash flow, inventory management, and other key performance indicators (KPIs) can make it impossible. While you do not have to be a certified public accountant or financial analyst to track your finances on Amazon, there are items and concepts that all sellers — whether you make $100,000 or $100 million in revenue — should know.

While there are various technologies and resources that exist, from tracking software to analytical software to accounting software, the following information will pertain to the areas of your Amazon business that you should be closely monitoring, rather than leveraging software to manage the information. We break down these areas into three main concepts: business operations; income; and expenses, including hidden fees.

Business Operations

When examining the business operations of your Amazon business, you should focus on all the variables that will impact your profitability. These variables — excluding income and expenses — include:

Inventory Purchases: The amount of inventory being purchased, both monetarily and quantifiably.

Damaged Goods: The amount of goods purchased that are not in a condition to be sold; often more of a problem for resellers on Amazon.

Orders Placed: The total amount of customers’ purchases, both monetarily and quantifiably.

Units Sold: The total amount of the aforementioned orders placed that result in a depletion of inventory from the completion of the sale.

Promotions Run: The number of promotional deals that customers claimed.

Inventory Levels: The amount of inventory on hand to satisfy demand, tracked by the quantity of available inventory levels and days of inventory on stock, which is tracked by available inventory compared to daily sales velocity.

Stockout Occurrences: The number of times you have stocked out over a 90-, 180-, or 365-day period.

SKU Diversity: The quantity of different SKUs available, as to avoid a heavy concentration of a particular SKU.

Advertising Cost of Sale (ACoS): Your total ad spend divided by total sales, providing visibility into the performance of your Sponsored Product campaigns.

Lead Time: The amount of time it takes from placing an order with your supplier to having the product available for sales, whether self-fulfilled or ready for sale at a Fulfillment by Amazon (FBA) fulfillment center.

Income

One you understand the costs associated with purchasing inventory and making sales, it is important to look at your income from those sales. To do so, you should track the variables outlined below:

Sales: The money received from selling goods on Amazon.

Refunds: The offset of sales due to items that are returned for any number of reasons that, in effect, make the original sale invalid.

Reimbursement: A credit to your account when a customer is refunded, but the item is not returned within the specified time, forcing Amazon to charge the customer for the replacement value of the item.

Merchant Fulfilled Network (MNF) Shipping Credit: Shipping credits for sellers, credited to your account based on what the buyer was charged. This will be offset in expense by the shipping chargeback.

Shipping Credit Refunds: Amount credited back to you for the order-related fees that were originally charged for the item you refunded, minus the refund administration fee, which is an expense. This will be offset in expense by the shipping chargeback refund.

Gift Wrap Credits: Reimbursement from Amazon for the customer choosing gift wrapping that will be offset in expense by the gift-wrap chargeback.

Gift Wrap Credit Refunds: The accounting reversal for returned and refunded items that had gift wrapping.

Promotional Rebates: The rebates received for items that qualified for free shipping. This is offset in expense by the shipping charge.

Promotional Rebate Refunds: The offset for the aforementioned promotional rebate in the event that a customer returns the purchased item.

Restocking Fee: The amount credited for returned items that were self-fulfilled and returned as “No Longer Needed.” Fees generally can go as high as 20%. Be aware that customers are allowed to leave you negative feedback, so weigh your options if the restocking fee is worth the negative feedback.

Amazon Miscellaneous Adjustment: The fees assessed by Amazon for various reasons including: subscriptions; other fees related to service; and credits or charges that Amazon initiated.

Commission Correction: An offset of an erroneously charged commission to your account.

Total: The total income less any income offsets.

Expenses

To truly understand profitability, you must look at the expenses that are relevant to the income that you made. The following expenses should be carefully tracked:

Cost of Goods Sold (COGS): The cost of procuring the product and getting the product to market. Within COGS, you should be tracking: production costs; procurement costs; taxes and duties; listing fees; and inventory storage fees and costs. When fully accounting for COGS, you should be adding those costs to the balance of the inventory asset, in accrual accounting, and reducing the inventory asset as you expense the COGS over time.

Amazon Referral Fee: Fees paid to Amazon for selling a product on Amazon, typically seen as a percentage of the sold price, and, depending on the product category, are usually 15% or less.

Closing Fees: Also known as the Variable Closing Fee, it is assessed for products sold under Amazon’s Media categories. It is generally a flat fee of $1.80, which is added to the Referral Fees for items in a Media category, including books.

FBA Fulfillment Fees: Fees paid to Amazon for utilizing its FBA fulfillment program, including picking, packing, and shipping.

Gift Wrap Chargeback: The offset of the aforementioned gift wrap credit you receive from Amazon.

Gift Wrap Chargeback Refunds: The accounting offset for the aforementioned gift wrap credit refund, which falls under income.

Shipping Chargeback Refunds: The offset for the aforementioned shipping credit refund, which is income.

30-Day Storage Fees: Fees incurred when your inventory remains in an Amazon FBA fulfillment center for longer than 30 days. Avoiding this fee requires diligent inventory management and the avoidance of keeping more than two months of stock within the Amazon FBA center at any one time.

Removal Order Fees: Fees incurred to return items to the location of your choice.

Disposal Order Fees: Fees incurred in the event you do not want items returned, but you want them disposed of.

Inbound Shipping Fees: Fees incurred for shipping items to Amazon FBA fulfillment center.

Long-Term Storage Fees (LTSF): Fees incurred for items stored in Amazon’s warehouses beyond 12 months. These fees will be $3.45 per cubic foot and, after 12 months, rise to $6.90 per cubic foot, or $0.15 per unit, whichever is greater.

FBA Customer Return Per-Unit Fee: Fees incurred for customer-returned products sold on Amazon in categories for which Amazon offers free return shipping, including: Luggage; Jewelry; Shoes; Handbags; Sunglasses; Apparel; and Watches. The fee is equal to the Total Fulfillment Fee for any given product.

Refund Administration Fee: The aforementioned offset to Shipping Credit Refunds, which are income.

MNF Shipping Label Cost: Shipping label costs you incur when you are self-fulfilling.

Selling Fee Refunds: The offset you are issued when you issue a full refund to the customer for a non-BMVD (books, music, video, or DVD) product. Amazon retains 20% of the original order-related fees, up to a maximum of $5 for each line item in the refund, which is retained as a Refund Administration Fee.

Sales Tax Service Fee: Fees Amazon incurs on your behalf for sales tax collection and remittance.

Individual Seller Fees: Fees incurred if you are not a professional seller — generally a $1 flat fee on all Amazon FBA products sold.

Amazon Professional Subscription: Fees incurred if you are a professional seller — generally $39.99 per month.

Coupon Redemption Fee: The fee associated with offering a discount for your product. This fee is in addition to the discount given.

Early Reviewer Program Fee: The fee required to participate in the Early Reviewer Program if your product has less than five reviews and costs at least $15. Generally, the fee is $60.

Inventory Placement Service Fees: The fee incurred per item for Inventory Placement Services, a service to spread your items across different fulfillment centers, chosen by Amazon.

Warehouse Prep Fees: Fees incurred for having Amazon prep your inventory for fulfillment, usually including proper packaging.

Manual Processing Fee: The fees incurred per unit for shipments received at the fulfillment centers without box content information.

Total: This is the summation of the total expenses, less any expense offsets.

Net Profit: The actual profit after expenses are considered.

While there are countless other KPIs and financial metrics that companies monitor, specific to their business model, the information above serves as a solid foundation for you to reference as you track the finances of your Amazon business.

;

3. Determining Net Profit

How to Calculate Amazon Pure Profit Margin

Pure profit margin (PPM), or net profit margin, represents how much net income or profit is generated as a percentage of revenue.3 Relative to your Amazon business, it is the ratio of net profits to revenue, or the percentage of profit generated from revenue after you have accounted for all of your expenses, costs, and open cash flow items. The formula for calculating net profit margin is as follows:

Total Revenue – COGS ÷ Total Revenue = Pure Profit Margin

PPM is used to calculate how much of each dollar of your revenue trickles down to actual profit. It can also be used to assess whether you are gaining enough profit from sales and if operating costs and overhead costs are being maintained.

PPM is especially important to your Amazon business because it helps you quantify your operation’s overall financial health. In order to maintain a sound PPM, you must effectively track your business’s overall profit and losses, as well as monitor all of your costs on an ongoing basis. To keep your costs low and your PPM high, consider the following tips:

1. Factor Amazon selling fees into your recurring budget.

The numerous hidden costs and fees associated with operating a business on Amazon — as outlined earlier in this playbook — must all be considered and carefully monitored in order to maintain an accurate pulse on your finances and profitability.

2. Find the best sourcing method for your unique business needs.

While using a manufacturer to fill a product need might require higher costs upfront, this strategy can benefit your PPM if you sell through your inventory, as you can leverage a low cost per unit.

3. Establish a thorough inventory management strategy.

This will help you mitigate any leaks in your supply chain and prevent stockouts that lead consumers elsewhere. In addition, having surplus inventory will tie up your capital and prevent you from turning a profit.

4. Know your catalog.

Which items are your best sellers? These products can drive profitability, as they fuel healthy relationships with your vendors. Be sure to always keep these SKUs in stock. If you cannot replenish them, adjust your pricing strategy to increase prices wherever possible, which will help bolster your margins. Assess these items regularly for any fluctuations in velocity and Buy Box share.

5. Streamline your returns management process.

E-commerce’s “silent killer,” returns can compromise your profit margins if not streamlined appropriately. The key is to be proactive rather than reactive in your approach toward returns. By keeping the line of communication open with customers and constantly acting on feedback and reviews, you can improve your products and consumer experience on an ongoing basis, instead of dealing with returns in a case-by-case manner as they happen.

;

4. Amazon Payouts

How Amazon Pays Sellers

Generally, Amazon pays its sellers every 14 days or longer, such as in the case of an unavailable balance, which is outlined in the next section. However, it is not always that simple.

Below we share insight into the payment process and the payment options Amazon offers its sellers based on our experience and observations at Payability. Having an understanding of how and when Amazon actually pays you will allow you to make more informed decisions about each and every aspect of your business.

What Are Amazon’s Payment Terms?

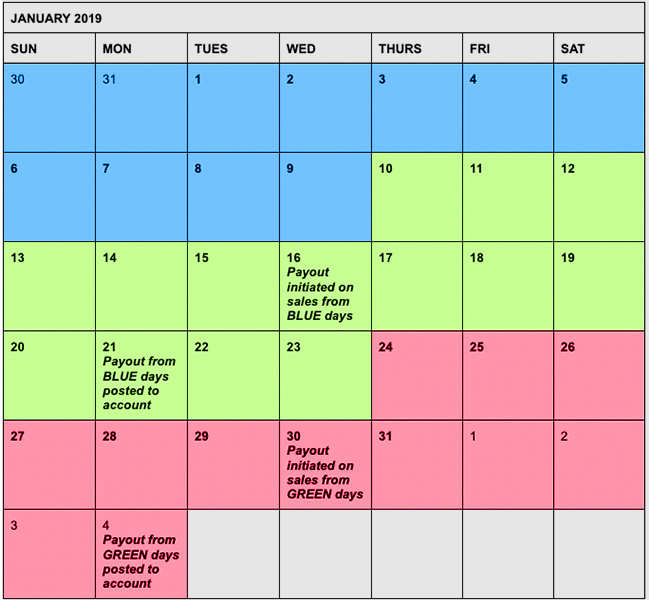

In most situations, Amazon pays Professional Sellers every two weeks, with each payment including 14 days of orders — less Amazon’s fees — that were delivered at least seven days prior. The actual dates of each payout typically depend on when the seller began selling on the platform. In other words, Amazon does not necessarily initiate payments on the first and 15th of each month, like some marketplaces do.

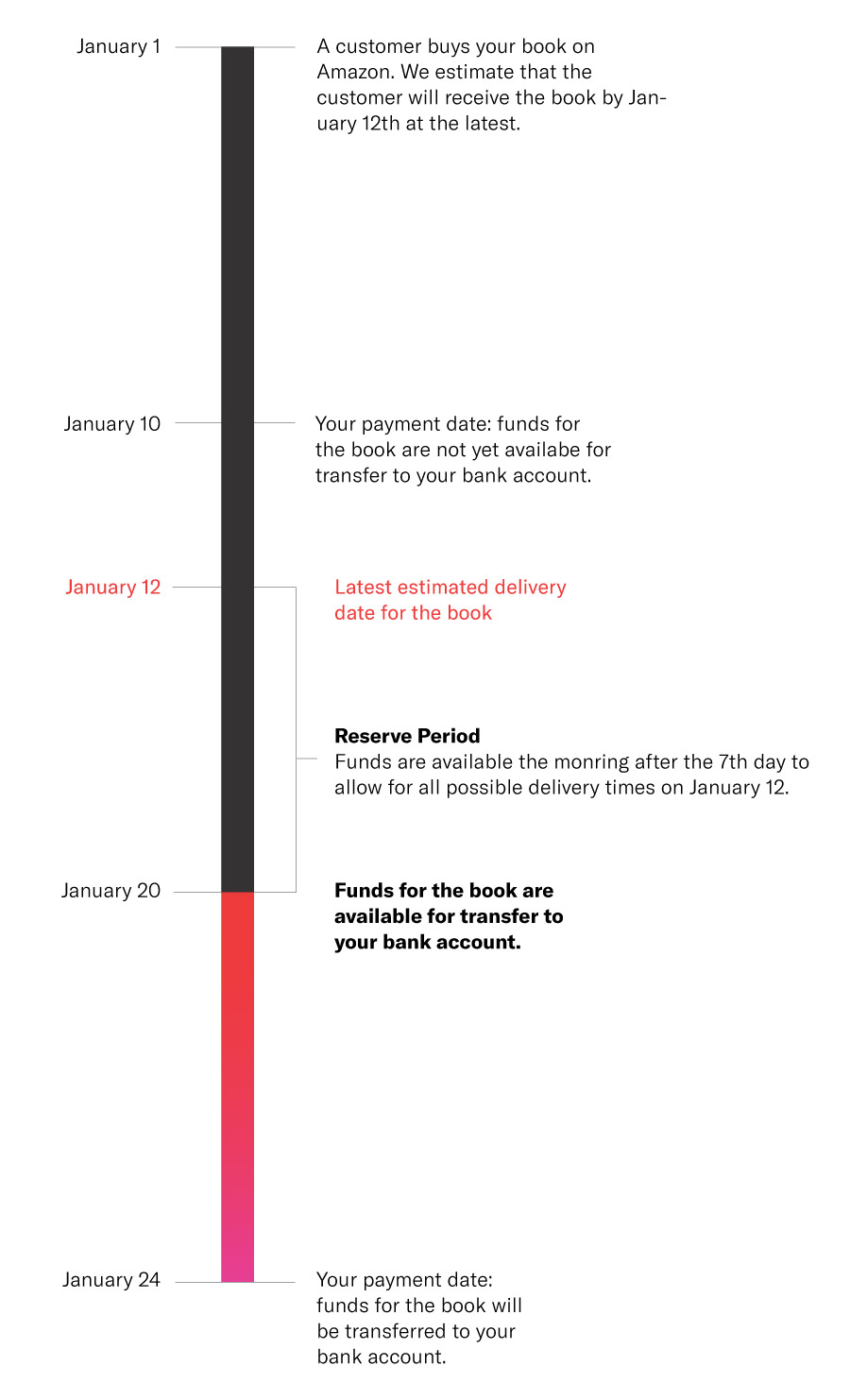

When all is said and done, proceeds are paid out seven days after the latest estimated delivery date — Amazon values customer satisfaction and holding your payout for seven days allows the buyer to assess the order and confirm that it arrived in the expected condition.

If a customer is dissatisfied and wants to make a return within that seven-day window, it will be processed from the funds that Amazon has on hold. Below is a sample timeline from Amazon about the payout schedule:

In many cases, some sellers have to wait more than 14 days for payment. Here are a few reasons why a further delay may occur:

- If orders are delivered within seven days of your payout date, the balance will roll over into the next payment period.

- Actual transfers can take three to five business days to post to your account.

- Amazon might hold back all or part of your payment for more than 14 days as an “unavailable balance.”

How Do Amazon Payment Transfers Work?

It is possible that you may not receive your payouts for 17-19 business days after making a sale. This is not because Amazon has not released the payout, but rather it often takes a few days for the money to actually hit your bank account.

Amazon uses only one method of payment: automated clearing house (ACH) transfers to your bank account. Because these are not Same-Day ACH transfers, you can expect to see your funds in your bank account within five business days. Whether your funds arrive the next day or by the fifth day really depends on the bank you use and the type of account you have.

These three to five business days are in addition to the 14-day payout cycle, hence why you could end up waiting nearly 20 days for payment. Regardless of how long payment takes to post, you will see a deposit labeled in one of two ways (or you might see two individual deposits):

1. “Amazon Payments Inc.” covers transactions where buyers agree to pay on or before the shipment of goods.

2. “Amazon Services LLC” includes transactions where buyers agree to pay after shipment.

Below is an illustration of how all of this works. In the example, the seller’s payout dates are the 16th and 30th of each month.

The Truth About the ‘Request Transfer’ Button

Some sellers have a “Request Transfer” button in their accounts — if you have access to this feature, you will see the button in your Amazon dashboard. Not all accounts have this feature, so do not be alarmed if you do not see it.

Request Transfer is designed to initiate a payment transfer before your regularly scheduled payout date. However, it is important to understand this does not necessarily mean you are getting paid early. Rather, you are initiating a transfer of the current available payout (i.e. of orders delivered seven to 10 days ago that are available on the day you hit the button). The whole amount you see in your account essentially shows you what you will have available. In other words, it includes the funds for all orders, not just those marked “delivered.”

Once you initiate a Request Transfer, the normal payment period closes and a new two-week cycle begins — so you are effectively pushing out the date of full payment to get a portion of it early.

Here is an example:

- You have a pending balance of $5,000, which is scheduled to be transferred on the 30th.

- It is the 20th and you need a boost in cash flow, so you hit “Request Transfer.”

- On the 20th, $1,000 of the balance that has been marked delivered for seven-plus days is available for transfer.

- This transfer of $1,000 is expected to show in your bank account in three to five business days.

- The remaining $4,000 will be deposited 14 days from the 20th — not on the 30th, as originally scheduled.

Here are a few other key considerations about the Request Transfer button:

- You can choose to “Request Transfer” every 24 hours. Each new request will initiate a transfer of the remaining balance that is available that day (again, not the full balance).

- Some fees, like shipping, might be deducted from the amount of your requested transfer.

- Similar to a regular Amazon ACH transfer, a requested transfer may not hit your account for an additional three to five business days. Always keep in mind that every time you hit the “Request Transfer” button, it resets your payment date for another 14 days.

- Some sellers use Request Transfer to increase their payment frequency — to get daily payouts or weekly payouts, for instance. While you may initiate Amazon payments each day that you click the button, it does not necessarily mean that you will receive daily payouts — or any payout, for that matter. This is because Amazon might choose to not release funds on the day of your request or to only release a portion of your funds.

The Difference Between Daily Payouts vs. Next-Day Payouts

Some sellers have daily or even next-day Amazon payouts. However, this could mean a variety of different things. Such payouts could occur in many different ways — and there are important considerations for each.

Daily Payouts can be made possible if you hit the “Request Transfer” button every day. However, while money is hitting your bank account every day, that does not mean you are getting paid the next day or in real time for your sales. There is still at least a 14-day delay from the date your sales closed and inventory was scanned, shipped, and delivered. So, if you have a big sales day, you will still need to wait at least 14 days to access those funds.

Next-Day Payouts on Amazon can only happen in one of the following two ways:

1. Grandfathered Accounts:

If you have been selling on Amazon for 10 years or longer, you may get paid for your sales the next day or shortly thereafter. Amazon previously offered this to all sellers, but as the platform grew, issues with fraudulent products also increased. In an effort to cut back on fraud, Amazon moved to longer payment terms for most sellers. If you were grandfathered in, consider yourself lucky. If not, it is still possible to receive payment the next day, everyday with the help of third-party services.

2. Instant Access From Payability:

The other way to get daily real-time payouts is with Payability’s Instant Access, which pays sellers one business day after shipping a sale. Instant Access is designed to level the playing field for sellers that need faster access to their sales in order to keep up with demand. For instance, if you have $1,000 in your account on Monday, you will receive $800 of it on Tuesday. The remaining $200 is kept on hold to cover any necessary returns or chargebacks and is then paid out according to your regular payout schedule.

Amazon payouts are not as cut and dry as the typical 14-day delay might appear to be. However, you can simplify your business by understanding the process and your payment options.

;

5. Amazon Unavailable Balances

What Are Amazon Unavailable Balances and What Are Your Options?

It is not uncommon for businesses selling on Amazon to see an unavailable balance on their Payments report — but what exactly is it? Why does it occur?

If you have an unavailable balance, it means Amazon is keeping a certain amount of your earnings on hold for longer than your usual 14-day payment cycle — so it is essentially the balance of payment that is not yet available for transfer to your bank account. Unfortunately, the amount and length of the hold are not always predictable. In some cases, the balance will rollover into your next pay period, while in others it will be held for longer. Not only that, you might have more than one unavailable balance at the same time.

With an unavailable balance, you have to wait twice as long — or more. The payout of an unavailable balance could roll over into your next payout or it could continue to be held for several payouts.

How to Know You Have an Unavailable Balance

To see if you have an unavailable balance, look in the Closing Balance section of the Statement View on your Payments report. In addition to the delay post-delivery, there could be a variety of reasons for your unavailable balance. You can go to your Account Health page in Seller Central to learn more about your specific reason. Typically, it will fall into one of these categories — or it could be a combination of reasons:

Order Delivery Issue or Delay:

If Amazon is awaiting order delivery confirmation, it will post an unavailable balance to your account in case the buyer in question makes a return or files a claim or chargeback. Amazon does this to ensure there are funds available to process such claims.

A-to-Z Guarantee Claim or Chargeback:

If a buyer files an A-to-Z Guarantee claim, or if you have any chargebacks from transactions in the last 30 days, you might see an unavailable balance. For A-to-Z claims, the reserve will be released as soon as there is a resolution. However, it could take up to 14 days or longer. For chargebacks, the funds will be released after they are processed.

Seller Performance:

If your performance metrics fall below Amazon’s benchmarks, you should expect an unavailable balance. After all, a drop in metrics is typically accompanied by an increase in claims, chargebacks, and returns.

Account Review:

If there is a sudden change in your sales or account activity, or if you are new to selling and have an estimated delivery time that is longer than your settlement period, Amazon will launch an account review and will post an unavailable balance.

Tips to Avoid an Unavailable Balance

There is no sure way to prevent an unavailable balance. Even if your account is in perfect health and you have done everything right, you can still end up with one. To avoid an unavailable balance or decrease your chances of getting one, run an audit of your account, including your overall seller performance, customer feedback, fulfillment updates, and so on.

If any areas are concerning you, try to determine the root of the problem so you can fix it before Amazon holds your payments for even longer. If you sell in verticals such as shoes or clothing — where returns and exchanges are more frequent due to sizing issues — unavailable balances can be difficult to avoid, even if your other metrics are excellent.

What to Do If You Have an Unavailable Balance

An unavailable balance can be a huge setback for businesses looking to grow on Amazon. For one thing, you are not getting paid at the time you expected. Not to mention, you likely will lack a sense of how long it will take Amazon to resolve your unavailable balance issue and disperse your funds. If you were depending on that payment to pay your credit card bill or order your next round of inventory, an unavailable balance can be detrimental to your growth.

Marketplace sellers that receive a significant portion of their revenue from Amazon sales may need that unavailable balance to order inventory, make payroll, pay credit cards, or invest in marketing. This sounds overwhelming, but you do have options. Here are six ways to overcome an unavailable balance, as well as the pros and cons of each:

1. Ask for an increased credit card limit.

Pros: This is a fast way to get increased access to cash and spending power, and you may need a larger limit in the future, anyway.

Cons: If you use your credit card irresponsibly, you might find yourself unable to pay down your balance. You could end up relying on that unavailable balance to pay off your credit card bill and it might not be released by your payment due date — or it could not be enough to cover your full credit card balance.

2. Get a bank term loan.

Pros: These typically have low interest rates and long, favorable payment terms.

Cons: Small businesses may not qualify. In fact, approval rates for small businesses — especially online businesses — are very low. The application process is long and tedious, often taking longer than you have to wait for funds.

3. Get an online business loan.

Pros: The application process is generally quick and easy, and approval rates are higher for small and online businesses.

Cons: These often come with high interest rates and short payment terms.

4. Tap into your savings.

Pros: You gain immediate access to cash, without the need for an application or interest payments.

Cons: Your savings may not be enough or you may not have any to begin with. Savings can take years to accrue and tapping into the funds should be your absolute last resort.

5. Ask suppliers for longer payment terms.

Pros: You could purchase the inventory you need right away.

Cons: This is not a long-term solution and could end up being more expensive. You still might not have your payout when payment is due to your supplier or your supplier might not even agree to longer payment terms.

6. Sign up for Payability’s Instant Access.

Pros: This is a fast, easy, and long-term solution to seller cash flow issues.

Cons: Additional fees apply to rollover balances.

An unavailable balance can be a huge and unexpected roadblock to your business growth. However, it is a reality of selling on Amazon and, while it may be frustrating, it is not the end of the world. For many sellers, the hardest part about an unavailable balance is not knowing when the payment will actually be released. If you are faced with one, do not panic. Simply evaluate your options and hope to see your balance in full soon. Chances are you have more options than you think.

;

6. Cash Flow on Amazon

How to Generate Cash Flow for Your Amazon Business

Indeed, cash flow is perhaps the most important financial variable to consider and carefully monitor for your business. Without it, you run the risk of vulnerability to unexpected occurrences, like inventory policy changes, poor pricing deals with suppliers and vendors, and a lack of resources to properly invest in your growth.

Cash flow is defined as the net amount of cash and cash equivalents going into and out of your business, and it is typically measured by bank account balances.4

Cash coming in is most likely your bi-weekly sales payout from Amazon after customers purchase your products, while cash going out can include sourcing and inventory management costs, taxes, Amazon seller fees, and employee salaries. Furthermore, cash flow is broken into two types:

1. Negative Cash Flow: when more cash is going out of the business than coming into the business

2. Positive Cash Flow: when more cash is coming into the business than going out

The success of your business on Amazon requires consistent positive cash flow. However, even enterprise businesses at times will face negative cash flow from a number of triggers, such as payment terms.

As discussed in the previous chapter, the time from when you purchase inventory to when you receive payment from Amazon can take weeks. When funds are tied up, you will not have enough cash flow to purchase new inventory, which, in turn, can decrease your sales velocity and snowball into bigger complications, such as stockouts, loss of organic search rank, and late payment fees.

How to Resolve and Prevent Cash Flow Challenges

To maintain a strong financial position for your Amazon operation, consider the following tips to navigate and prevent cash flow challenges:

1. Create a monthly budget for expenses and operations.

Having a comprehensive budget strategy will help you keep a close eye on the funds moving in and out of your Amazon operation, allowing you to allocate money for inventory and other business-related expenses. Be sure to allocate funds to cover the duration in which your payment from Amazon is pending and, in your balance sheet, always include every expense — big or small — from advertising costs to office supplies.

2. Negotiate with your suppliers.

Terms of Trade or long-standing relationships with suppliers can be leveraged for better pricing deals and payment terms, such as inventory discounts or free shipping. Periodic, effective, and structured negotiations with your suppliers are important to ensure ongoing profitability, healthy performance metrics, and a strong sourcing model and supply channel.

3. Use FBA to your advantage.

Amazon’s FBA program touts countless benefits, like Prime eligibility, which, in turn, can help you increase sales and lead to positive cash flow. Plus, product storage, order fulfillment, and customer service are left in Amazon’s hands, freeing up your time and resources to focus instead on scaling your business and optimizing your cash flow processes.

4. Consider external financing.

If a lack of inbound capital is causing negative cash flow, consider external financing options. From savings and credit, bank loans, Amazon lending, or third-party finance companies that are designed specifically for enterprise Amazon sellers, you must keep constant tabs of your payables and receivables to ensure effective financial management.

;

7. Conclusion

Financial Health Is Key to the Sustainability of Your Amazon Business

With a comprehensive understanding of the numerous financial variables outlined in this playbook, and a strategy to thoroughly calculate and track key metrics to monitor your business’s financial health, you will be equipped to adjust facets of your Amazon operation to avoid financial gaps and maximize your profitability.

By controlling your business’s costs, preparing for potential delays in payment from Amazon, and selling your products in volumes and prices that outweigh your costs and expenses, you can attain a high profit margin on Amazon and continuously scale your business. With a financial management strategy in place, you can keep operation costs low and pinpoint areas that require adjustments in order to not only reach but maintain profitability.

;

Get Access

Get full access to all chapters of the playbook. Please note that the form will not appear if you are using ad blockers.