The Amazon vs. Walmart Playbook

Whether you are considering expanding your marketplace presence this year or are already selling on both Amazon and Walmart, it is essential to know how the two companies — specifically their e-commerce arms — compare.

From launching new products and monitoring performance to loyalty programs and their geographical footprints, Amazon and Walmart are drastically different.

Leverage this playbook to uncover how the two retail forces stack up across fulfillment, advertising, grocery, and much more, and in turn use those insights to inform your selling strategy in 2020 and beyond.

1. Introduction

How Do Amazon and Walmart Compare?

The storied competition between Amazon and Walmart — and the question of which entity reigns supreme as the leader of retail — comes down to several variables: how long the companies have existed; their sizes and financials; their unique relationships with e-commerce; and their continuously evolving offerings.

While the hunt for market share and new customers between the two companies is ongoing and transcends both physical and online formats, the global retailers each maintain their own unique competitive differentiators and value propositions.

In this playbook, discover how Amazon and Walmart compare when it comes to their marketplaces, advertising offerings, product selections, delivery capabilities, physical footprints, and target audiences, amongst other factors. In addition to noteworthy highlights that played a formative role in the companies’ long-term successes, you will uncover actionable takeaways to inform your marketplace selling strategy.

Whether you are a brand or retailer already selling on both platforms or you are considering expanding your online footprint to include one or both, this in-depth playbook sheds light on similarities, differences, and defining characteristics of the companies, particularly their online marketplaces, and how you can leverage them to propel your business’s growth.

2. Amazon’s History

Key Moments in Amazon’s History

-

1994

Jeff Bezos and his wife Mackenzie launch an online bookstore in Seattle.

-

1997

Amazon becomes a publicly traded company. Later that year, Amazon opens its second distribution center in New Castle, Del., to serve East Coast customers.

-

1999

Amazon patents its “1-Click” technology, which enables the ability to purchase a product online with one mouse click.

Also that year, Amazon launches its now globally recognized third-party (3P) marketplace.

-

2005

Amazon launches its Prime membership program, a service with an annual membership fee that includes free two-day shipping on any order.

-

2006

Amazon publicly launches Amazon Web Services (AWS) to sell IT infrastructure services to businesses via cloud computing.

That same year, the company launches Fulfillment by Amazon (FBA), which allows 3P sellers to use Amazon’s own order fulfillment and customer service infrastructure for their orders.

-

2007

Amazon reveals its electronic reading device, the Kindle, to the market. Shortly after, in early 2008, it acquires audiobooks company Audible for $300 million.

-

2012

Amazon acquires robotics company Kiva Systems to optimize its fulfillment and delivery logistics.

-

2014

Amazon revealed its first smart speaker, the Echo, to select customers and launched it more broadly during the 2015 holiday season.

-

2015

Amazon opens its first physical bookstore in Seattle.

Also that year, Amazon hosted its first global shopping event, Prime Day, to celebrate Prime members on the company’s 20th anniversary.

-

2017

Amazon acquires Whole Foods Market — including its more than 460 stores in the U.S., Canada, and the U.K. — for over $13 billion.

-

2018

Amazon becomes the second company to ever reach a $1 trillion valuation, preceded only by Apple.

-

2019

Amazon walks back its decision to make New York home to its HQ2 headquarters. The plans for Arlington, Va., still remain.

Amazon launches same-day and one-day Prime delivery.

Amazon acquires Sizmek Ad Server and Sizmek Dynamic Creative Optimization (DCO) to improve its advertising offering.

Amazon celebrates its 25th anniversary as a company.

Amazon has its most successful Prime Day yet, running for 48 hours and driving record sales and Prime membership enrollment.

Amazon hosts its first AdCon event to help businesses effectively use Amazon Advertising.

Amazon Prime membership reaches 100 million in the U.S. alone.1

Source: CNN

3. Walmart’s History

Key Moments in Walmart’s History

-

1962

Sam Walton opens the first Walmart store in Rogers, Ark.

-

1970

Walmart becomes a publicly traded company.

-

1971

Walmart opens its first distribution center in Bentonville, Ark.

-

1980

Walmart hits $1 billion in annual sales.

-

1983

Walmart opens its first Sam’s Club location in Oklahoma, named after founder Sam Walton.

-

1988

Walmart opens its first Walmart Supercenter, a concept that combines a complete supermarket with general merchandise.

-

1990

Walmart earns the title of America’s No.1 retailer, generating over $26 billion in product sales.

-

1991

Walmart expands globally by opening a Sam’s Club in Mexico City.

-

2000

Walmart.com is founded, enabling U.S. customers to buy Walmart products online.

-

2009

Walmart launched its third-party e-commerce marketplace to expand its online product selection.

-

2011

Walmart introduces same-day pickup in stores.

-

2016

Walmart opens its Culinary & Innovation Center in Bentonville, Ark., as an incubator for new products. It also acquires e-commerce startup Jet.com for approximately $3 billion.

Also that year, Walmart and Chinese e-commerce platform JD.com form a partnership to better serve consumers in China via both online and offline retail.

-

2017

Walmart launches free two-day shipping on more than 2 million products, with no membership free required.

That same year, it acquires a portfolio of brands and retailers including Moosejaw, ModCloth, and Bonobos as well as same-day and last-mile delivery company Parcel.

-

2018

Walmart changes its legal name from Wal-Mart Stores, Inc. to Walmart Inc.

Also that year, Walmart invested $16 billion in Indian e-commerce company Flipkart to grow its presence in the Indian market.

-

2019

Walmart acquires Polymorph Labs to optimize and grow its in-house advertising technology.

That same year, Walmart launches free NextDay Delivery without a membership fee to complement its same-day Grocery Delivery and remain competitive with Amazon.

-

2020

Walmart Media Group expands its search advertising offering through the launch of its Walmart Advertising Partners program.

Source: Walmart

4. Marketplace Differences

What Brands and Retailers Need to Know About Marketplaces

While 89% of consumers agree they are more likely to buy products from Amazon than other e-commerce sites, Walmart is the leading platform on which consumers shop in addition to Amazon.2

Despite Amazon surpassing Walmart as the world’s largest retailer and outpacing Walmart in online sales, Walmart demonstrated a 41% year-over-year e-commerce growth rate in the third quarter of 2019, making its marketplace increasingly sought after by consumers and sellers alike.3,4 Walmart’s growth in the e-commerce space is heavily fueled by its online grocery business and expanded delivery options, both of which will be discussed in detail later in the playbook.

Although more than 35% of Amazon sellers already operate on Walmart’s marketplace, establishing a marketplace strategy inclusive of both platforms is becoming more of a necessity than a “nice-to-have.”5 Below are some key ways in which the two marketplaces stack up:

1. There is a lower barrier to entry on Amazon.

While selling on Amazon’s marketplace is open to anyone, Walmart’s marketplace is more exclusive and only approves select sellers. If you are brand new to selling online, your application to sell on Walmart may not get approved, the platform requires sellers to have a pre-existing product catalog and proven demonstration of historical sales on your own website as well as on Amazon and/or eBay.

On Walmart, you need to complete a comprehensive marketplace application in which you provide contact information as well as details regarding your business, annual revenue, product assortment, operations, and e-commerce and marketplace experience. Once you submit the application, it typically takes about two to three weeks to find out if you are approved. At that point, you will receive an email to set up your seller account.

With Amazon, you just need to create an Amazon account and register as an “Individual” or “Professional” seller. Then, make sure you have a product to sell and inventory on hand, have IDs for your products such as a UPC code, have a plan in place for order fulfillment, and be ready for approvals if you want to sell in the product categories that require them.6

2. It is free to sell on Walmart, but there is a cost to selling on Amazon.

If you plan on selling more than 40 products a month on Amazon, you need to register as a “Professional” seller, which comes with a monthly fee of $39.99.6 These sellers must abide by product and category-specific restrictions. Walmart has only one kind of seller account and does not require any monthly fees or category restrictions.

Like on Amazon, though, you will be charged a referral fee on Walmart, which ranges from 6% to 20% of your product’s selling price, depending on the category. However, Walmart does not tack on additional selling fees, whereas Amazon will charge you a variable closing fee if you sell media products as well as a $0.99 per-item fee if you sell as an “Individual.”6 Both platforms have lists of completely prohibited products and brands to avoid when deciding on the SKUs you want to sell on each marketplace.

3. While both marketplaces have performance standards you must adhere to, they are not identical.

In order to maintain customer satisfaction and remain in good standings, you must maintain strong performance on both Amazon and Walmart, especially in key areas such as order defect rate, on-time shipment rate, and valid tracking rate. It is important to note that the compliance thresholds and definitions of each metric differ by marketplace.

On Amazon, you will utilize a portal known as Seller Central to manage your catalog, inventory, orders, performance analysis and reporting, buyer messages, customer feedback, news from Amazon, and more. On Walmart, this portal is known as Seller Center and is used to update inventory and prices, manage orders, and receive insights and analytics. This is where you will be able to check in on your Seller Scorecard, which houses your performance standards as well as your ratings and reviews.7

4. The process for uploading and managing items is marketplace specific.

On both the Walmart and Amazon marketplaces, you can sell products that are already listed for sale as well as create unique listings for products that do not yet exist on each platform. You can leverage third-party software to easily upload bulk product feeds, manage inventory, and/or adjust pricing for select product listings.

On Amazon, most “Professional” sellers leverage inventory file templates, the option that is ideal for adding multiple listings at once and those listing more than 100 products. The tab-delimited text files include the necessary information to list your products and can be easily edited in Excel. If you cannot find matches to Amazon’s existing catalog using a product identifier such as a UPC or EAN, you will get to create a new product listing.

On Walmart, you can choose from several integration methods to get your products online: an API integration method; a bulk upload method similar to that of Amazon’s; a single-item method; or through a solution provider. Once you have identified the right category and subcategory for your products, have your image URLs or files ready and prepare your item set-up feed with all of the product details. Then, you will upload the files in Seller Center and preview them on Walmart.com to see if any changes are needed.

Like on Amazon, a similar item matching process takes place on Walmart to see if your products match against existing items on the Walmart marketplace. Conversely, you should use Walmart’s full item spec option if you want to set up an item using your own content or if no match was found using the previous listing set up option. To meet Walmart’s catalog go-live criteria, you must upload 10% or 1,000 of the products in your catalog in sellable condition, including inventory and a price. Additionally, at least 95% of your products must be classified correctly.7

5. Amazon offers fulfillment, Walmart does not — yet.

Currently, Walmart does not fulfill orders on behalf of its Marketplace sellers. However, it does partner with solutions provider Deliverr, which offers fulfillment services on its behalf or sellers can choose to fulfill orders on their own.

On the other hand, Amazon offers sellers three options for fulfillment — Fulfillment by Amazon (FBA), Fulfillment by Merchant (FBM), and Seller Fulfilled Prime (SFP). FBA is highly sought after by retailers and brands on the marketplace, given that Amazon takes care of housing inventory, fulfilling orders, and managing customer service and returns.

However, the proper fulfillment method for your Amazon business requires a detailed review of your business’s size, forecasted growth potential, and your product categories. You may decide to move forward with one or multiple fulfillment methods depending on the results of that analysis, a practice that should be revisited quarterly to uncover any additional product exposure or sales opportunities.

On both platforms, you need to maintain specific performance metrics to offer free two-day shipping. Doing so will grant you access to searches from customers who filter specifically for fast shipping options (such as solely Prime-eligible products on Amazon) and maintain engagement with customers who have grown accustomed to receiving their products within two days.

Walmart did announce in September 2019 its plans to test a fulfillment center program for vendors, similar to Amazons’ in function and name – “Fulfilled by Walmart.” Seeking to entice more merchants to its platform, Walmart is exploring the storage and shipment of products on behalf of its third-party merchants.8

6. Amazon has a Brand Registry, Walmart does not.

Walmart partners with select sellers for sales of specific brands and all other offers for these branded products will be unpublished by the company. Amazon does the same, as evidenced by its “Our Brands” accelerator that targets brands that it believes will be fit to become an Amazon private label brand or exclusive-to-Amazon brand.9

Like Amazon, Walmart operates on a first-come, first-serve basis for listing content, so the first merchant to list a product usually has the most influence or control over the content and provides it for all attributes.

Amazon’s Brand Registry and Transparency services both serve to help you protect your brand on Amazon. The Brand Registry provides you greater control over your product listings on Amazon and proactively removes suspected infringing or inaccurate content. Transparency, Amazon’s product serialization service, enables you to proactively prevent counterfeit products from reaching customers.10

While Walmart does not currently have an official registry, it has processes in place to mitigate the risk of intellectual property infringement including trademark, patent, and counterfeit claims.

7. Pricing is your responsibility on both marketplaces.

On Walmart, you set and maintain the prices for the products in your catalog. However, if you do not maintain price parity, you will be penalized. Essentially, this means that if a shopper would drastically save money by purchasing the item on a competing website, Walmart will automatically unpublish your product from its marketplace. The pricing also includes shipping costs. Once your pricing is updated to once again be competitive with market conditions, Walmart will reinstate your listing within 48 hours.7

Similarly on Amazon, you can list products at “any price you feel is fair, regardless of the Amazon price or list price, within the limits set by Amazon, and so long as your price adheres to the parity requirements of your selling agreement and the policy on reference prices.”11 Amazon used to have a price parity requirement like Walmart’s, but it quietly removed it in March 2019. However, many sellers still abide by the rule in fear that their account will be negatively impacted as a result.12

Sellers on both marketplaces can leverage third-party pricing software, such as Feedvisor’s price optimization and intelligence platform, to automate pricing changes according to demand and market dynamics. You will want to ensure that your pricing solution aims to predict how the hyper-competitive arena will evolve in the future and make more informed business decisions based on these predictions.

5. Advertising Offering

Google, Facebook, Amazon — and Now Walmart Advertising

Amazon generated nearly $10 billion in U.S. ad revenues in 2019, which represents almost 8% of the digital ad market.13

To compete with Amazon in the advertising space, Walmart on Jan. 3, 2020, launched its in-house advertising platform and API. During 2019, Walmart took steps toward building out its advertising business, Walmart Media Group, including strengthening its supply-side ad stack with native ad campaigns and reports as well as enhancing its technology offering through the acquisition of advertising startup Polymorph labs.

Now, with its self-serve platform, Walmart Advertising Partners, brands and advertisers can directly buy on-site search and sponsored product ads on Walmart.com, giving them more transparency and control over ad spend as well as valuable insights from both in-store and online data.14

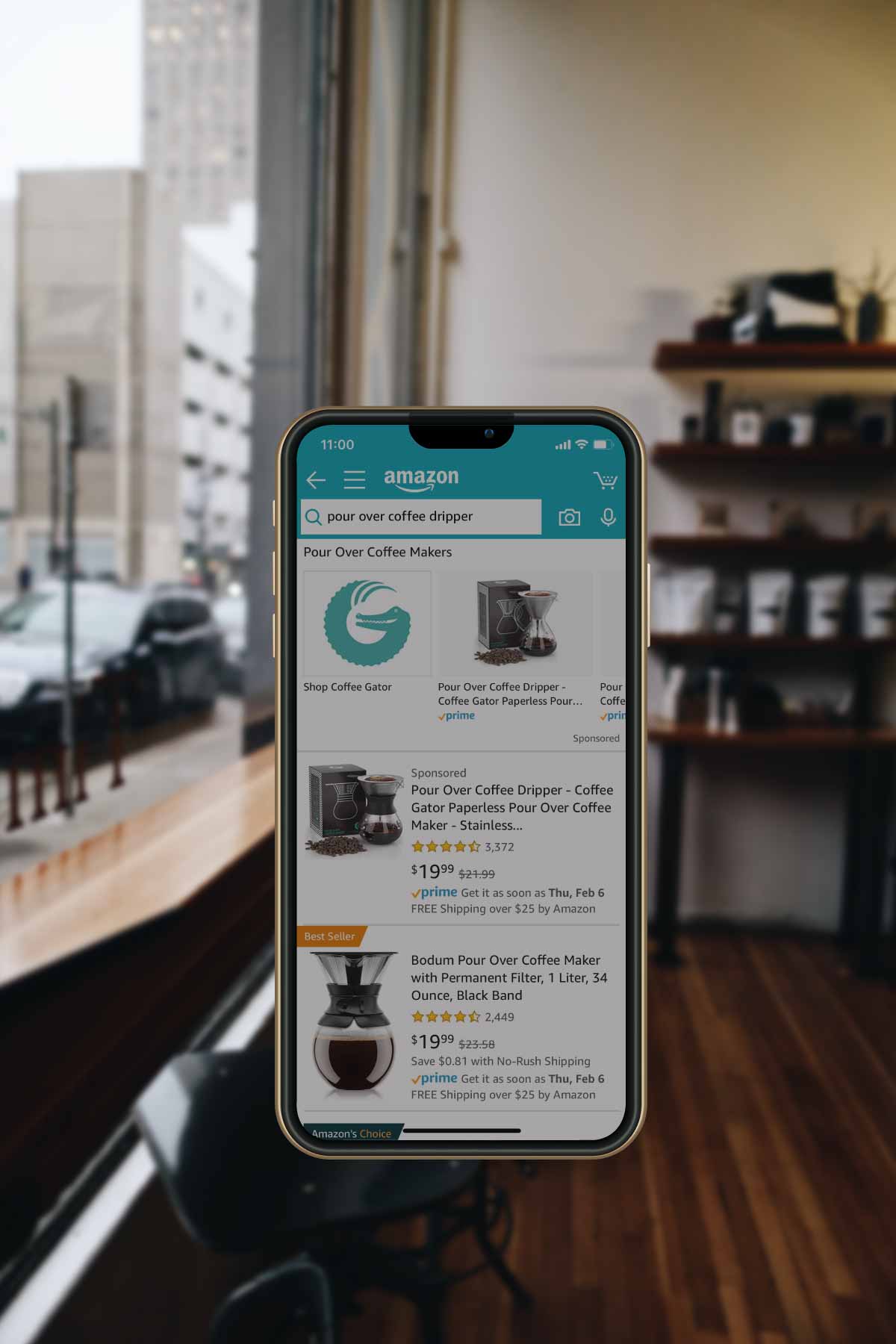

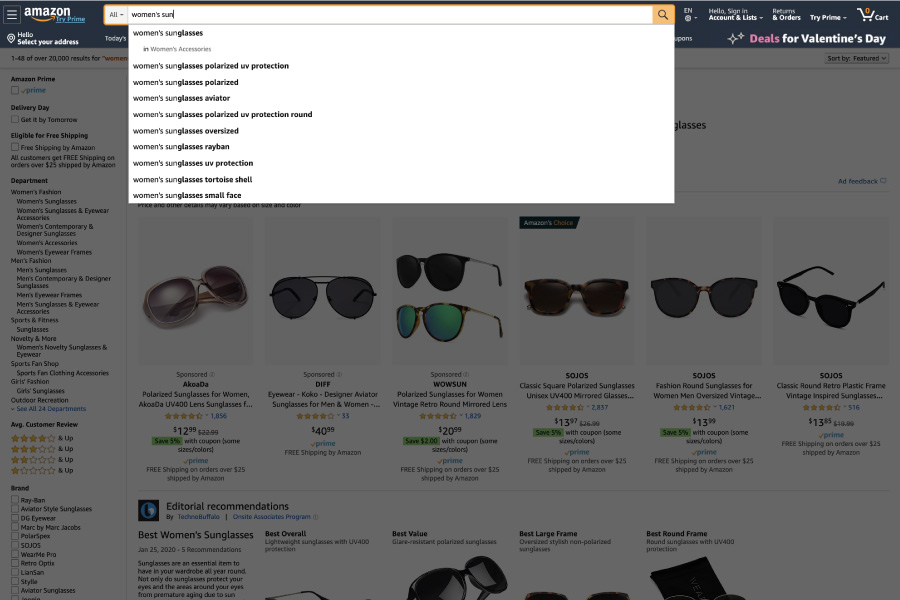

Previously, advertisers were required to use Walmart’s managed services to launch campaigns, whereas Walmart Advertising Partners gives them complete control over their campaigns. Like on Amazon, the platform offers keyword-targeted sponsored product ads, which are known as Walmart Performance ads. The ads appear individually within a search engine results page (SERP) as well as in carousels and banner ads on product detail pages.

Products must rank organically within the top three pages of search results and must also be winning the Walmart buy box in order to be eligible for sponsored product ads. The company allows for two sponsored products per SERP and has a $1,000-minimum lifetime campaign spend and a $100-minimum daily spend.15

While there is no minimum daily budget for Amazon Sponsored Products, Amazon recommends setting one that is high enough so your campaigns will not stop showing in the middle of the day. It is averaged over the course of a calendar month, so at month’s end you will not have spent more than the daily budget you set, multiplied by the number of days that month.16

Additionally, like Amazon, Walmart is offering an API that enables users to examine their campaign performance, set up automated actions like scheduling, and identify stock outs. However, most notably, Walmart’s API reportedly houses data from both Amazon and Walmart under the same tool, allowing users to leverage data from multiple retailers simultaneously to inform their strategies.

Be sure to follow both platforms’ unique SEO and content listing optimization best practices to help improve your organic rankings and drive engagement. Focus on strong item descriptions and keywords to help prospective customers find your products when they enter a related keyword or phrase into a search. The stronger your organic listings are, the more easily you will be able to tap into profitable keywords and integrate them into your ad campaigns.

Key Differences Between Walmart’s and Amazon’s Ad Platforms

Generally speaking, Walmart’s ad platform operates similarly to that of Amazon’s in its early stages. Marketers can certainly expect Walmart to optimize and implement new features over time, but at its current stage, there are several distinctions between Walmart’s and Amazon’s ad platforms to keep in mind:

Walmart’s targeting capability is limited.

It does not provide its unique audience or retail sales data to platforms to use for ad targeting, but rather offers keyword targeting only. On the other hand, Amazon also offers product attribute targeting (PAT) and automatic targeting based on keywords and products.

Brands could pay a lot more bidding on Walmart.

While Amazon has a second-price bid auction, Walmart has a first-price bid auction, which means you pay the exact price of what you bid. For example, if you bid $10 on “hand towels” and another marketer bids $5, you would pay $10 on Walmart whereas on Amazon, you would only pay 1 cent above the second-highest bid in the auction or, in this case, $5.01. With this in mind, brands that utilize a high-bid strategy should be cautious of applying it to Walmart.15

Walmart’s ads directly impact organic search results.

Although Amazon implies that organic search results are impacted by ads, Walmart explicitly states that sponsored products ads will improve your product’s organic ranking. On both platforms, the seller has to be winning the Buy Box for the sponsored ad to show up.

Walmart’s reporting is limited.

Currently, Walmart provides advertisers with minimal information in terms of reporting, like visibility into performance by device and insights into the frequency of searches. However, given that the majority of Walmart’s sales still occur in-store, the company does provide some data to map site search to in-store sales. As Walmart further develops its ad offerings, there is a significant opportunity for advertisers to link online behavior with in-store shopping.

Walmart’s offering is particularly attractive to brands with a physical presence.

Although nascent, Walmart’s new ad platform marks a defining moment for marketers both online and in-store. The retailer’s physical footprint — alongside its in-store shopper data — makes for an appealing advertising channel for brands, especially CPGs, that lack physical shelf inventory, providing them with digital shelf space to reach their target audience.

6. Grocery Wars

The Ever-Changing Landscape of Online Grocery Shopping

The grocery wars between Amazon and Walmart are intensifying regularly. Despite Amazon currently holding the largest share of online grocery — its U.S. food and beverage sales represented nearly 24% of total U.S. food and beverage e-commerce sales in 2019 — Walmart is capitalizing on quarterly growth momentum to remain close behind.17

Below is a roundup of how Walmart is optimizing its grocery delivery business:

It is leveraging its existing brick-and-mortar footprint.

With grocery sales accounting for 56% of Walmart’s total U.S. revenue, Walmart is the country’s largest grocer. In the U.S., 3,100 Walmart stores allow customers to order their groceries online and pick them up in-store.18 As more locations become available for in-store pickup, online grocery sales will continue to grow.

It is testing robotics to expedite its grocery pickup service.

Through its partnership with autonomous vehicle company Nuro, Walmart is testing how it can use the self-driving technology to optimize grocery delivery.19

It expanded its grocery delivery subscription service, Delivery Unlimited, to more than 1,600 stores across 200 markets.

The program gives customers the option to pay an annual $98 fee or a monthly $12.95 fee to receive unlimited grocery delivery orders. Customers can also pay a per-delivery fee, without a membership. In select markets, customers can also test “InHome Delivery” to get their groceries delivered when they are not home.20

It established unique partnerships to help improve its technology capabilities.

By partnering with BuzzFeed’s Tasty app, customers can add recipe ingredients directly to their online grocery carts for pickup or delivery. The company also partnered with Apple to establish a Siri Shortcut for grocery delivery, adding products to their cart via voice order.21

Amazon, on the other hand, has taken the following steps to maintain its leadership position in online grocery:

It has enabled Prime members to get two-hour grocery delivery for free through its AmazonFresh grocery delivery business.

Eligible in 2,000 select regions, the program allows customers to pick from thousands of products from Amazon Fresh and the Whole Foods chain.22 This option is in addition to the free delivery Amazon offers to Prime members who shop at most Whole Foods Market stores.

It continues to preserve Prime membership through programs like Prime Now and Prime Pantry.

The former enables one- or two-hour delivery on select grocery products in over 50 cities, while the latter allows customers to buy items that are normally cost prohibitive to ship individually, such as a single box of cereal.23,24

It announced plans to open a grocery store chain separate from the Whole Foods brand.

The company confirmed Woodland Hills, Calif., as “Amazon’s first grocery store,” alluding that it will have the Amazon brand name.25 It is expected that the chain will expand to multiple locations, solidifying Amazon’s move into mainstream grocery.

It allowed U.S. vendors to advertise on its AmazonFresh platform.

In March 2019, Amazon released Sponsored Products on its AmazonFresh platform. The capability is category specific and only available to vendors in the U.S. If you are a vendor in this space, you can now add your ASINs with AmazonFresh offers to new or existing Sponsored Products campaigns.26

7. Membership and Delivery Capabilities

Delivery Wars and the Role of Amazon Prime

As the go-to destination for consumers when they want to start their search for new products or when they are ready to buy a specific product, it is no surprise that Amazon.com maintains more monthly visitors than Walmart.com — 2.1 billion monthly visits versus 300 million, respectively.2,27

When it comes to loyalty programs, Amazon boasts 112 Prime members in the U.S. alone, while Walmart does not charge a membership fee for any online purchases.28 For either $12.99 per month or an annual fee of $119, Prime members get their products delivered in either one or two days, or even the same day if the products are eligible and shoppers hit a $35 minimum.

Other benefits of the program include free two-hour grocery delivery in select areas, the ability to choose delivery on the day they choose with Amazon Day, Key by Amazon in-home or in-garage delivery, unlimited reading and music streaming, access to Prime Video, the ability to shop on Amazon Prime Day, and unique deals and discounts at Whole Foods Market, among other benefits.29

Conversely, Walmart offers free next-day or two-day delivery on orders that hit a $35 minimum order requirement. At the time of writing this playbook, next-day delivery is only available in specific zip codes and on eligible items. For products that do not qualify for free two-day delivery, the company offers free three- to five-day shipping for orders of $35 or more.30

8. Physical Locations

How Amazon’s and Walmart’s Brick-and-Mortar Footprints Differ

A key differentiator between the two companies is the nature and composition of their stores. While Walmart started out as a chain of physical stores and added an online store nearly a decade after Amazon launched its marketplace, Amazon began as an e-commerce platform and has branched out to include a limited subset of physical locations.

Here is a breakdown of how Amazon’s and Walmart’s physical footprints compare:

Number of physical stores.

In the U.S. alone, Walmart has more than 5,000 stores and clubs, including Supercenters, discount stores, and Sam’s Club locations.31 According to the company, 90% of Americans live within 10 miles of a Walmart store.32 Amazon, on the other hand, has a growing number of bespoke physical outlets.

Amazon has led the foray into cashierless stores.

At the time of writing this playbook, Amazon has 26 Amazon Go stores that are open, coming soon, or under renovation. The cashierless locations utilize AI-powered “Just Walk Out” technology to monitor items as if they were sitting in a virtual cart.33 While Amazon led this charge, Walmart opened a Sam’s Club “Now” store as a testing ground for cashierless shopping in 2018 and opened a cashierless Neighborhood Market in 2020.34

While Walmart leads the competition as the larger physical grocer — with its Supercenters, Neighborhood Markets, and Sam’s Club stores, for example — Amazon is flexing its muscles in the grocery space. In addition to its growing collection of Go stores, the company is creating new Whole Foods Market locations, as well as a separate grocery store chain that is set to launch in 2020.

Both companies have small format stores, but Amazon is more experiential.

Amazon currently has 22 Amazon Books stores, 18 Amazon 4-Star locations, 26 Amazon Go stores, and six Amazon Pop Up stores.35 Amazon Books stores sell an extensive book collection, Amazon devices, and merchandise, while Amazon 4-Star stores focus on top-selling products from Amazon.com, all with four stars and above. Amazon’s newest concept, Pop Up stores, feature themes and brands that are updated regularly in an “immersive, try-before-you-buy experience.” Walmart has small format stores such as Walmart on Campus locations, convenience stores, and Amigo Supermarkets in Puerto Rico.31

Both companies have expansive, technology-backed fulfillment and distribution networks.

Amazon has more than 175 fulfillment centers used for picking, packing, and shipping Amazon.com orders, while Walmart has over 150 distribution centers to service store and club locations as well as direct delivery to customers. Both companies leverage robotics and AI-powered technology to help streamline their end-to-end fulfillment models. For example, Amazon leverages robots to operate product pods in its warehouses, while Walmart uses them to clean stores and perform tasks such as check product availability, location, and pricing.

9. Product Selection

Becoming the 'Everything Store'

It is clear that both online marketplaces, Amazon and Walmart, strive to provide similar tenets to their customers — price value, convenience, and a vast product selection.

With regard to product selection, Walmart’s marketplace consists of nearly 52 million products, 3.9 million of which are sold directly by Walmart, revealing that the marketplace contributes to more than 90% of Walmart’s online assortment.36 Amazon, on the other hand, sells more than 353 million products, including marketplace SKUs.37 It makes sense that Amazon’s online catalog is drastically larger, given that its marketplace was established nearly a decade before Walmart’s.

Specifically looking at one-day delivery, Amazon has more than 10 million products available for the service, while Walmart is still building out its offering and has 220,000 SKUs available for the fast shipping option.38,39 Both marketplaces sell products across a vast array of product categories — from electronics to apparel to grocery products — with Walmart citing 24 categories and Amazon citing more than 20. We anticipate that both marketplaces will continue to strengthen their product assortments to continue to function as one-stop shopping destinations for their target audiences.

As of November 2019, Walmart’s marketplace includes more than 32,000 sellers, 10,000 of which were added in 2019.36 Also in 2019, Walmart’s catalog increased from 41 million products for sale to nearly 52 million, revealing the positive impact that an influx of marketplace sellers and brands is having on the catalog’s overall diversity. In the U.S., the Amazon marketplace is home to 1.1 million active sellers, a significantly higher number than Walmart, which also makes sense given the marketplace’s older age and continuous e-commerce focus.40

10. Conclusion

Looking Ahead as the Storied Competition Persists

When you stop and think about it, Amazon and Walmart have essentially taken a page out of each other’s playbooks, particularly as the retail landscape continues to evolve. Amazon, which started out as a strictly e-commerce platform, has opened physical stores that all fulfill a specific objective. Walmart, on the other hand, has leveraged its massive brick-and-mortar footprint and physical retail prowess to feed its growing e-commerce success.

Whether their genesis was digital or physical, both companies — specifically their online marketplaces — seek to provide consumers value, convenience, and the power of choice amidst seemingly endless product selections. Both companies’ commitment to e-commerce demonstrates that they will continue to encourage development and healthy competition with one another.

Undoubtedly, Amazon and Walmart will continue to viciously compete in across key areas such as fulfillment and delivery, grocery, technological innovation, and — as Walmart continues to beef up its solution — digital advertising. Through strategic partnerships and bespoke initiatives, the companies are prioritizing their unique marketplaces, as these destinations are becoming regularly sought after for shoppers’ end-to-end purchase journeys.

As Walmart continues to invert its traditional retail model to pursue e-commerce growth and meet its customers where they are and Amazon explores more ad-hoc, experiential physical outposts, key stakeholders — specifically brands and retailers — will want a stake in the race to increasingly bolster exposure to their target customer profiles.

Whether you are optimizing your presence on Amazon and/or Walmart or are researching the tools to help you join the marketplaces in as frictionless of a manner as possible, this playbook will shed light on the tangible value each marketplace, and their greater footprint, can provide to your business.

Get Access

Get full access to all chapters of the playbook. Please note that the form will not appear if you are using ad blockers.