Resources - Blog

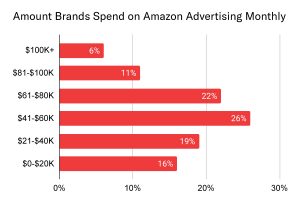

Brands Are Increasing Their Spend on Amazon Advertising

Stay on top of the latest e-commerce and marketplace trends.

Amazon is emerging as a full-funnel advertising player and marketers’ strategies are evolving, as a result. Over the last few years, Amazon has expanded and optimized its slate of advertising options, encouraging brands’ increased investment and adoption.

More than three-fifths of brands selling on Amazon are spending over $40,000 per month on Amazon Advertising, a 33% increase from last year.

In addition, more than one-third (38%) of brands are spending over $60,000 monthly on Amazon Advertising, according to our most recent report, “Brands and Amazon in the Age of E-Commerce.”

From New-to-Brand metrics to Sponsored Brand improvements, like negative keyword targeting, to enhanced targeting options for Sponsored Products, and more, marketers have a variety of ways to leverage Amazon Advertising for their full-funnel marketing needs — including new product launches, profit generation, brand awareness, and so on.

In fact, 45% of brands cite acquiring new customers as their top goal for advertising on Amazon, followed by driving brand awareness (65%), generating sales (65%), and gaining market share over their competitors (54%).

Maintaining Visibility on a Saturated Marketplace

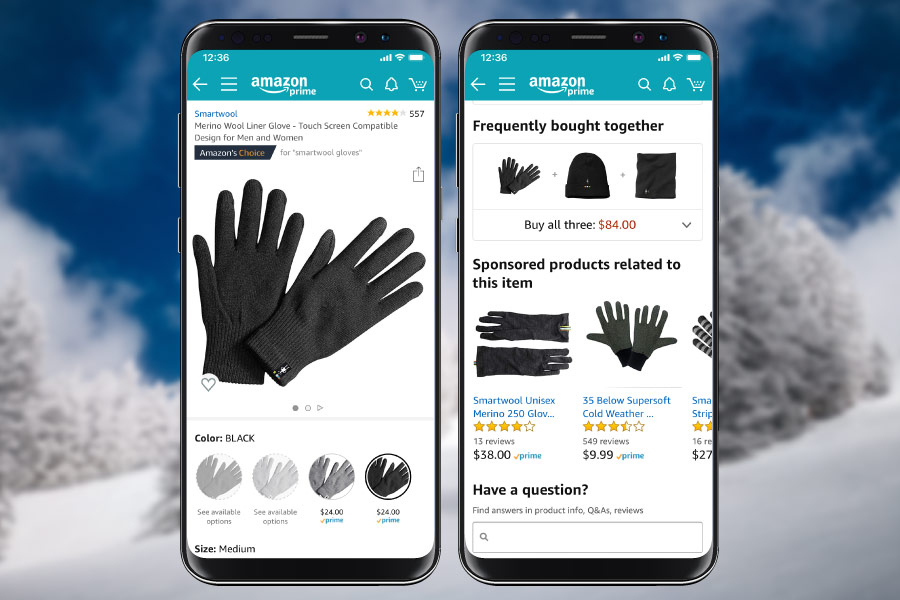

Indeed, advertising is becoming more of an imperative for brands and retailers to maintain visibility on Amazon’s saturated marketplace. According to Marketplace Pulse, recommendations in product pages on the platform are increasingly being replaced with sponsored ads.

As such, organic visibility is becoming harder to achieve, and brands are upping their ad spend and leveraging new tactics to place their items where customers previously sought out product suggestions.

Over the past year, according to Marketplace Pulse, Sponsored Products started to surface more frequently in product detail pages, as ad spending on Amazon in the U.S. increased by 33% to reach $10 billion in 2019.

However, as spending on Amazon Advertising continues to rise, so too does the price of Sponsored Products ads. According to a recent report by eMarketer, prices on Amazon’s Sponsored Product ads were up 13% in Q3 2019. Conversely, prices on Sponsored Brand ads have been falling, as Amazon has been adding more inventory for the ad format in placements that are less likely to result in conversions.

Despite this, over half (59%) of brands selling on Amazon say the platform generates their highest return on media spend, according to Feedvisor data, ahead of Google and paid social channels such as Facebook. Furthermore, 47% of brands see at least a 7x return on their Amazon Advertising efforts.

Final Thoughts

Amazon has a unique advantage over advertising rivals like Google and Facebook in that it is already a shopping destination — and a starting point for the majority of consumers’ purchase journeys. As Amazon continues to enhance its advertising offerings, and expand ad placement to new locations on the platform, brands will have to rethink their marketing strategies and adjust their ad spend allocation accordingly.

For more insights on more than 1,000 U.S. brands and their relationships with Amazon, including over 100 additional statistics, download a free copy of our 2020 report, “Brands and Amazon in the Age of E-Commerce,” at the link provided here.

Learn what Feedvisor can do for your business.

When you partner with Feedvisor, you automatically receive access to our true, AI-driven technology and hands-on team of e-commerce experts. Contact one of our team members today to learn more about our end-to-end solution for brands and large sellers on Amazon, Walmart, and e-marketplaces.