Resources - Blog

The Digital Evolution of Retail Is Now a Revolution

Industry transformation is typically an evolutionary process. That is not the case for the U.S. retail industry in 2020.

The COVID-19 pandemic transformed U.S. retail practically overnight, as non-essential businesses were forced to shutter their doors and consumers flocked to online shopping channels at unprecedented rates. Online growth that was predicted to take years occurred in just a matter of weeks, with Amazon and Walmart being among the biggest beneficiaries.

According to Feedvisor customer data, predominantly across the U.S. Amazon and Walmart marketplaces, sales of essential and nonessential product categories combined were up 30% in March compared to February*, and have shown a sustained increase of 9% through May. Even with panic-buying now subsided, e-commerce continues to grow, as consumer shopping behavior adjusts to new, digital-first habits.

How did such unprecedented change happen — virtually in real time? With physical store shelves low on stock, and consumers avoiding in-person interactions, COVID-19 expedited consumers’ adoption of and comfortability with online shopping, particularly on e-marketplaces like Amazon and Walmart, where consumers flocked for essential items including hand sanitizer, food, and electronics in preparation of social distancing and working from home.

While unprecedented demand during the early days of the COVID-19 crisis put considerable strain on e-commerce supply chains, it also opened the door for many consumers to a new, convenient and personalized way of shopping. As a result, U.S. e-commerce sales may grow as high as $6.5 trillion by 2023, according to eMarketer.

This rare and unpredictable “black swan” event has now put into motion a disruptive series of events that no one saw coming, and no one can stop. Consumers quickly adapted to a low-touch, digital-first economy, and now there is no looking back. The pandemic will clearly disrupt retail and e-commerce for years to come. However, it is what happens in the next six to 12 months that will set the stage for what will become our “new normal.”

This rare “black swan” event has now put into motion a disruptive series of events that no one saw coming, and no one can stop.

New Foundational Realities

We have been thrown headfirst into the next evolutionary stage of retail — but are consumers, brands, and retailers ready? Will consumer behavior continue its rapid shift to online? Are brands and retailers prepared to react and adapt? Many questions remain to be answered, but several foundational realities have come into focus:

- E-commerce will move to center stage for many more products and categories

- Brick-and-mortar retail will undergo a painful reinvention

- The biggest beneficiaries will be the leading e-marketplaces, Amazon and Walmart, which will become even more dominant than they already are today

- One key result will be a new online growth curve by category — a new waterline — far higher than pre-pandemic levels, that will reset expectations and forecasts for what can be achieved online

These realities have become the bedrock of the new normal in U.S. retail for 2020 and beyond. They were once forecasted to occur over years, but are now realities to be dealt with in the present.

This is the new normal, where shoppers have a newfound appreciation and reliance on e-commerce — and not just for essential products but across many categories.

Are You Ready for the ‘New Normal’?

To explain the “new normal,” a perhaps unexpected but telling example is the meteoric rise of online food retail.

Before the pandemic, the grocery category was one of the slowest-moving categories to shift online, with e-commerce sales accounting for just 2% of the overall category. After years of innovation and attempts to appeal to consumer behavior, online grocery was showing growth, though on a very small base, and was basically running in place.

That is no longer the case.

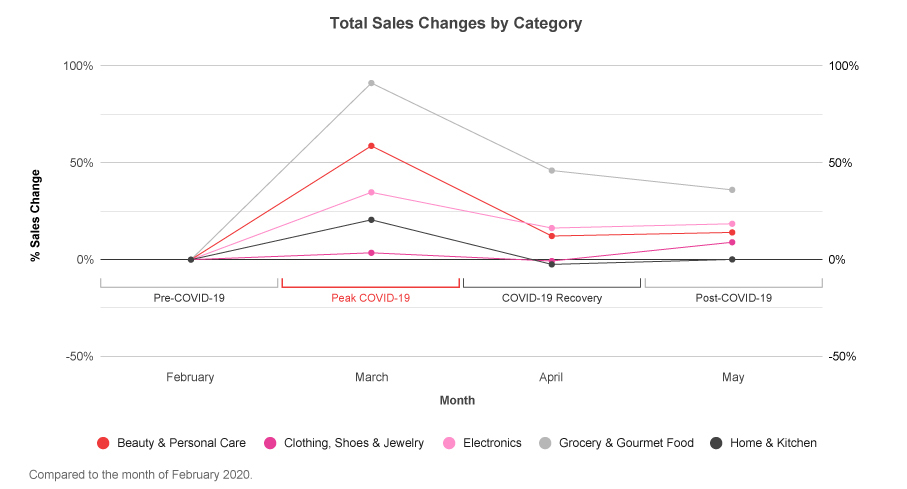

Post-COVID-19, sales of essential categories Grocery and Gourmet and Beauty and Personal Care — the latter of which includes health and wellness— were up 91% and 59%, respectively, over the month of March compared to February. Despite panic-buying subsiding, sales of these categories continue to grow, up 36% and 14% in Grocery and Gourmet and Beauty and Personal Care, respectively, in May compared with February — indicating an extended effect on consumer shopping behavior.

This is the new normal, where shoppers have a newfound appreciation and reliance on e-commerce — and not just for essential products but across many categories, from groceries to home goods to electronics and office supplies.

This new normal is built on the presumption that consumers will continue to expand their usage of e-commerce while approaching in-store shopping with skepticism and caution. Recent studies back this up. An analysis by Morning Consult found that nearly a quarter (24%) of consumers said they would not feel comfortable shopping in a mall for more than six months and, according to Technomic, 52% of consumers are avoiding crowds, while 32% are leaving their house less often because of COVID-19. This trend may or may not continue in perpetuity, but the increased reliance on online channels is here to stay.

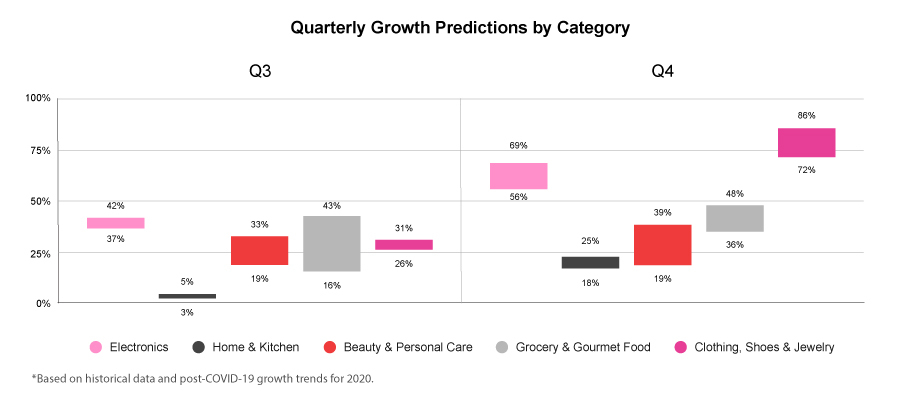

We anticipate overall growth of e-marketplace sales in 2020 to increase about 15% in Q3 and between 32%–35% in Q4.

Establishing the New Waterline for Online Retail

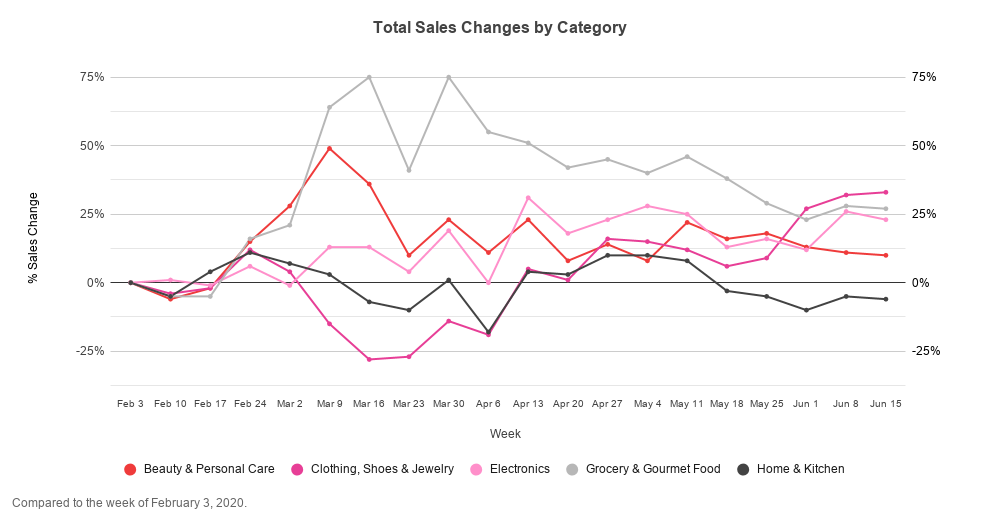

They say, “a rising tide lifts all boats,” and the tide is clearly rising for U.S. e-commerce, as consumers continue to flock online post-pandemic. When we look at recent Feedvisor customer data, we see that total sales across e-marketplaces were up 9% when comparing post-pandemic (May) to pre-pandemic behavior (February). When we look more closely by category, we see how, for example, Clothing, Shoes, and Jewelry sales rebounded, after an initial downward shock, to be up 9% in May versus February. Similarly, sales of Electronics were up 19% over the same period after seeing 0% growth in early April, the last weeks of Amazon’s FBA inventory restriction on nonessential products.

Sales growth in these categories were driven by multiple simultaneous events: easing pressure on the overburdened supply chain; a shift in the consumer mindset, as panic-buying and hoarding abated; unemployment benefits and stimulus checks being distributed; and shoppers pivoting toward nonessential items, like clothing and entertainment.

This 16-week period may not represent a clear trend just yet, but we believe it is setting up a new baseline for what can be achieved online in various, high-demand categories.

If we project the above curves forward for full-year 2020, we predict what is likely to occur, as new baselines are established by category on e-marketplaces. Specifically, we anticipate overall growth of e-marketplace sales in 2020 to increase about 15% in Q3 and between 32%–35% in Q4 compared to the same period in 2019.

- Without COVID-19, 2020 year-over-year e-marketplace growth was projected to be 17%, based on our historical data and 2020 January and February sales trends — the original waterline

- With COVID-19, we project year-over-year growth will be between 21%–29%, based on the lasting growth trends we are seeing as a result of the pandemic

In other words, all boats are rising with the tide, some just much more than others. Where these figures will ultimately settle is something we will learn over time, but the new normal in consumer behavior has certainly raised the waterline across all categories in online retail.

The Dominant Become Even More Dominant

According to eMarketer, the COVID-19 crisis has further solidified Amazon’s No. 1 position, as it increases its e-commerce market share to 38%, from 37%, with Walmart also seeing strong growth. In fact, with an anticipated post-pandemic growth rate of over 44%, Walmart will surpass eBay as the No. 2 e-commerce leader with 5.8% market share, up from 4.7% the previous year.

Prior to the pandemic, Feedvisor data revealed that two-thirds of consumers already began their search for new products on Amazon. Now, with social distancing and restrictions on in-person shopping a new reality, Amazon and Walmart have become even more powerful and core channels across the consumer journey, from awareness to purchase.

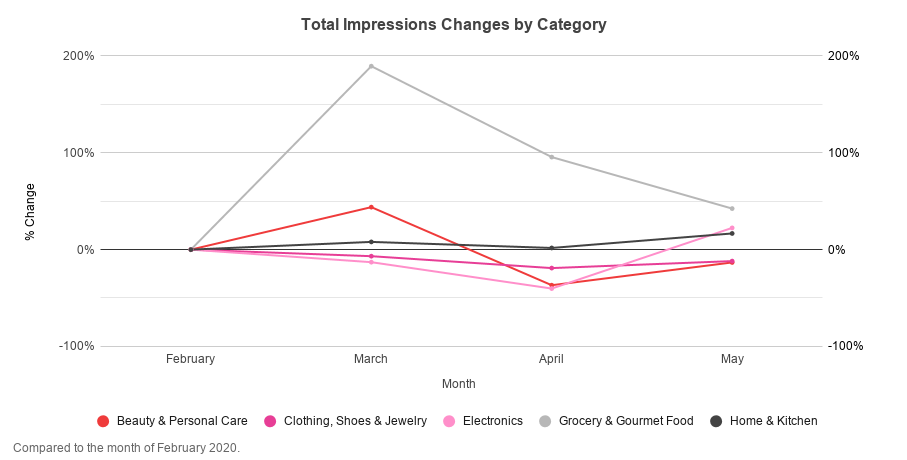

Indeed, e-marketplaces during the pandemic saw drastic increases in impressions, as consumers flooded Amazon and Walmart in search of essential items. According to Feedvisor data, Grocery and Gourmet saw impressions grow 190% in March compared to February, while Beauty and Personal Care impressions grew 44% over the same period.

There was a 237% increase in ad spend in Grocery and Gourmet during March 2020.

The Advertising Impact (and Opportunity)

With more consumers shopping on e-marketplaces, brands and sellers will need to rethink and reprioritize their advertising strategies and budgets to drive discoverability, engagement, and conversions. We can expect to see increased impression counts on keywords across categories, as shoppers move online, and, in turn, we expect to see media budgets shift increasingly to e-marketplaces to keep up with demand.

In effect, we now have more consumers searching and, in response, more advertising dollars being allocated to reach them. For example, brands and sellers within the grocery and CPG category adjusted their advertising strategies to maintain visibility in what became a highly competitive market. In March, for instance, ad spend in Grocery and Gourmet and Beauty and Personal Care was up 237% and 36%, respectively, compared to the month of February.

Conversely, advertisers in nonessential categories that experienced sales declines and fewer impressions were found to have cut back on ad spend as a means to conserve resources and adjust to the shift in consumer search behavior. The same was seen across the advertising duopoly Google and Facebook, which recently reported that their digital ad revenue plunged as the economy began shutting down in March.

Ad spend in the Clothing, Shoes, and Jewelry category was down 8% during March compared to February. This can be attributed to the supply chain issues and delivery delays for nonessential products during the height of the COVID-19 crisis — as orders in these categories could not be received — as well as consumers’ shift of purchase priority to essential items.

Yet, even post-pandemic, ad spend in the Clothing, Shoes, and Jewelry category continues to trend downward, down 16% in May compared to February — indicating the lingering effects of the COVID-19 crisis — while essential categories continue to trend upward. Ad spend in Grocery and Gourmet, albeit lower than peak-pandemic, was up 106% in May versus February. Similarly, ad spend in essential category Beauty and Personal Care was up 26% over the same period.

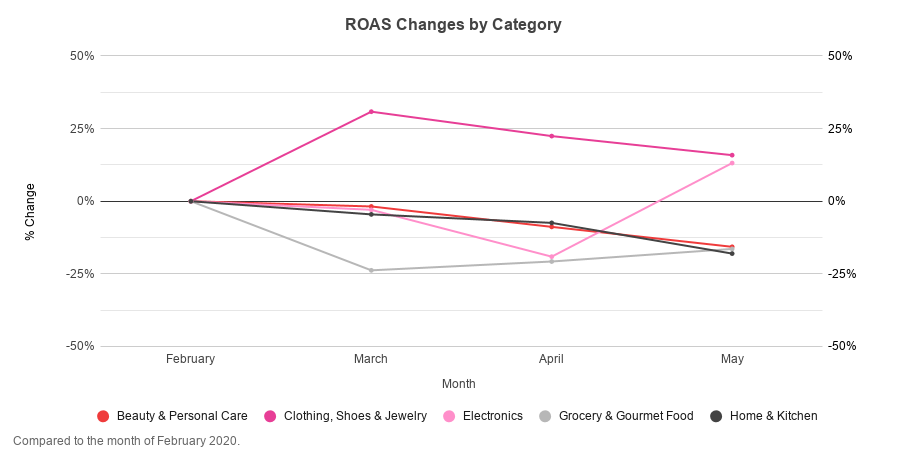

These fluctuations have led to shifts in brands’ and retailers’ return on ad spend (RoAS), which declined for high-demand, high-sales categories like Grocery and Gourmet during the height of the pandemic — and height of competition within the market. Despite these high-demand categories seeing increases in impressions, clicks, and sales, their RoAS declined due to their higher costs, as bid prices became more competitive and ad budgets increased to keep up.

On the other hand, hard-hit, nonessential categories with lower sales, such as apparel, saw RoAS increase during the COVID-19 crisis. While these categories cut their ad spend to account for the stark reduction in sales volume, their costs per click and conversion rates were resultantly lower due to less competition on bids and reduced budgets.

Over the month of March, RoAS for Beauty and Personal Care and Grocery and Gourmet was down 2% and 24%, respectively, compared to the month of February, while Clothing, Shoes, and Jewelry saw RoAS increase 31% over the same period.

With the effects of the pandemic ensuing across e-marketplace sales and ad spend, RoAS continues to fluctuate. During May, RoAS for Grocery and Gourmet was down 16% in May compared to February, while RoAS for the Electronics category increased 13% over the same period. Clothing, Shoes, and Jewelry, on the other hand, is rebounding, with RoAS up 16% in May versus February.

With browsing traffic high, there is great opportunity to invest in awareness-building campaigns to reach new audiences and leverage that data to retarget consumers for purchases in the future. For brands and sellers that can maintain their ad spend while their competitors cut back, now is the time to focus on improving conversion rates, generating clicks, and investing in upper-funnel strategies, as traffic and page views are high.

Stay on top of the latest e-commerce and marketplace trends.

How Brands and Sellers Respond Is Critical

If the last few months have proven anything, it is that consumers are now more inclined than ever to shop online, especially via e-marketplaces, where they can browse and engage with countless brands and storefronts, purchase items from a range of product categories, and rely on convenient, fast shipping — all without the risks and concerns stemming from COVID-19.

Yet, the anticipated growth of e-commerce also depends on the actions of brands and retailers, and of the e-marketplaces themselves, to turn new online shoppers into loyal customers. To mitigate backlash and avoid customer churn, they must:

- Focus on enhancing the experience and assortment to reinforce consumers’ new online behaviors and habits

- Continue to expand their offerings to allow brands the ability to convey their catalogue’s key benefits and points of differentiation

- Look to create more personalized offers, pricing, and promotional capabilities that speak to individual users’ needs and interests

- Optimize and expand their warehousing and fulfillment capabilities to ensure order processing and shipping times continually meet consumer expectations, even during unexpected surges in demand

- Keep prices at competitive levels and protect against price gouging

- Explore ways to limit — and eliminate — the risk of online fakes and counterfeits

- Innovate ways to fill the missing “personal touch gap” for a channel that not long ago was commonly considered adverse and impersonal

In the short run, given stress on supply chains –– and also reduced consumer spending, with today’s economic downturn –– we predict that brands will become more selective with the products they choose to sell online moving forward. Already, over half of brands put their most popular products on Amazon. In the future, it will be critical that brands and retailers analyze their catalogues and apply a portfolio strategy to e-marketplaces, ensuring that the right products are merchandised in the best ways to meet and capture consumer demand.

There is no longer a debate over whether or not a brand or retailer should sell online.

Welcome to the New Normal: Final Thoughts

There is no longer a debate over whether or not a brand or retailer should sell online. There is no longer a debate over whether or not a brand or retailer should sell via the major e-marketplaces. Rather, the debate lies on which specific strategies and tactics to deploy, how much budget to allocate, which products to offer, how to price competitively, and how to operationalize for success.

Welcome to the new normal: a world where shoppers have a newfound appreciation and reliance on e-commerce; a world where consumer behavior is rapidly adjusting to new, digital-first habits; a world where a new waterline is being established for each category on what can and will be achievable online.

The challenge for brands and retailers will be to adapt quickly — and intelligently — to the new normal, to new consumer habits and preferences. Only then will they be positioned to earn their fair share of online growth in a post-Covid world.

Feedvisor can help you maximize the opportunity. Are you ready?

*For the purposes of this data, Feedvisor uses February as a pre-Covid benchmark before the effects of the pandemic began to take shape on the industry.

Learn what Feedvisor can do for your business.

When you partner with Feedvisor, you automatically receive access to our true, AI-driven technology and hands-on team of e-commerce experts. Contact one of our team members today to learn more about our end-to-end solution for brands and large sellers on Amazon, Walmart, and e-marketplaces.