Resources - Blog

The COVID-19 Impact on Amazon and Walmart Sales

Stay on top of the latest e-commerce and marketplace trends.

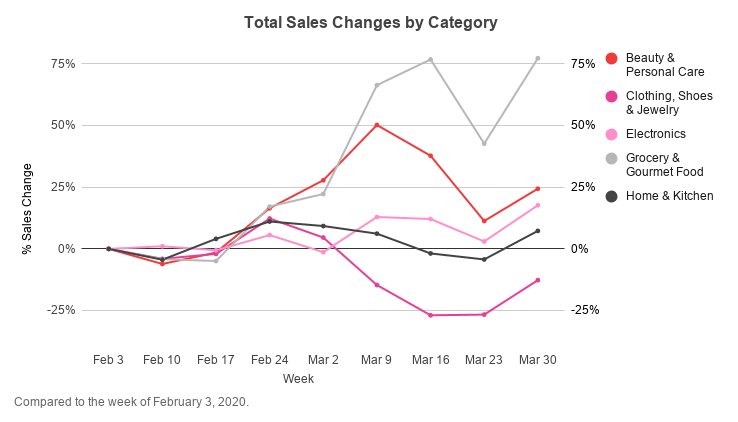

Marketplace sales in Grocery and Gourmet were up 77% over the week of March 30 to April 5.

In a matter of weeks, COVID‑19 has dramatically disrupted the U.S. retail industry, as states issued shelter-in-place orders and non-essential businesses were forced to shutter their doors.

In an analysis of Feedvisor customer sales data, predominantly across Amazon’s and Walmart’s U.S. marketplaces, the COVID‑19 impact on e‑commerce is undeniable. Grocery and Gourmet, for instance, which has historically been slow to penetrate e‑commerce, is up 37% since Feb. 3, 2020.

Beauty and Personal Care and Electronics have also seen sales increases of 17% and 3%, respectively, since Feb. 3, while Clothing, Shoes and Jewelry is down 11% and Home and Kitchen is flat at 0%.

With physical store shelves low on stock, and consumers avoiding in‑person interactions, COVID‑19 has expedited consumers’ adoption of online shopping, and will likely leave a long‑lasting effect on the e‑commerce industry moving forward.

According to Goldman Sachs data, nearly 500,000 brick‑and‑mortar retail locations have temporarily closed due to COVID‑19 and, in a survey of 1,500 small businesses, 50% said they will not be able to continue operating for more than three months in the current climate.

Unsurprisingly, e‑commerce — Amazon and Walmart, in particular — is more critical than ever before. Not only are consumers, across all demographics, making more purchases online, but their shopping behaviors have also shifted since the start of the COVID-19 pandemic. The effect on sellers and brands operating on marketplaces may vary based on several factors, but largely depends on the category in which these businesses operate.

Below, we break down the top category trends we have seen from our customers operating on Amazon and Walmart over the course of the pandemic and the key dates during the outbreak that have made an impact on the industry.

Marketplace sales in Clothing, Shoes, and Jewelry were down 31% over the week of March 30 to April 5.

Key Dates and Their Impact on Marketplace Sales

While ripple effects of the COVID‑19 crisis began trickling into online U.S. marketplaces in early February — as China’s manufacturing industry came to a halt, causing significant supply chain challenges — category sales on the marketplace remained generally stable until mid-March.

On March 11, the World Health Organization (WHO) declared COVID-19 a global pandemic, triggering a drastic shift in consumer purchase behavior. For the week ending March 15, sales for Beauty and Personal Care, Electronics, and Grocery and Gourmet were up 50%, 13%, and 66%, respectively, compared to the week ending Feb. 9.

Indeed, the WHO’s announcement initiated a spike in online shopping, and consumers flocked to online marketplaces to stock up on needed items including hand sanitizer, food, and electronics to prepare for sheltering in place and working from home.

In response to the substantial spike in orders related to COVID‑19 demand, Amazon on March 17 suspended shipments of nonessential products to its FBA fulfillment centers for its U.S. and EU markets. For the week ending March 22, marketplace sales of essential categories Beauty and Personal Care and Grocery and Gourmet were up 38% and 77%, respectively, compared to sales over the week ending Feb. 3, while nonessential categories took a hit. Clothing, Shoes, and Jewelry, for instance, saw sales decline 27% over the same period.

On March 27, Amazon broadened the list of products deemed as essential, enabling sales growth in categories that had largely been left at a standstill. Over the week ending April 5, marketplace sales of Electronics were up 18% compared to the week ending Feb. 9, while Grocery and Gourmet and Beauty and Personal Care were up 77% and 24%, respectively, over the same period.

Interestingly, sales of Clothing, Shoes, and Jewelry continued to decline, down 13% the week ending April 5 versus Feb. 9. This indicates that, despite the broadening of inventory restrictions, consumers were still prioritizing purchases of items that are needed at home.

Amazon on April 13 lifted all shipping restrictions on nonessential inventory to allow third‑party sellers resume sending inventory to its FBA warehouses — a welcomed relief to sellers and brands in these categories. However, with overwhelming demand for Grocery and Gourmet, Amazon is putting new grocery‑delivery customers on a waiting list, which could result in further fluctuations in the category’s sales.

Walmart’s grocery delivery also continues to see a surge in demand — downloads of the company’s app, Walmart Grocery, have reached an all-time high, securing its No. 1 position across all shopping apps in the U.S., surpassing Amazon by 20%, according to a recent analysis. As of April 5, 2020, the Walmart Grocery app saw a 460% growth in average daily downloads, in comparison with its January 2020 performance.

Final Thoughts

The role of e‑commerce — and marketplaces such as Amazon and Walmart, specifically — has never been more critical, and we expect the accelerated adoption of online shopping to have a positive impact on marketplaces in the long term. As supply chains and e-commerce fulfillment operations slowly improve, we can expect to see sales trends continue to positively shift across key Amazon categories.

For more information on the coronavirus crisis and its impact on e‑commerce marketplaces, visit our COVID‑19 resource center.

Learn what Feedvisor can do for your business.

When you partner with Feedvisor, you automatically receive access to our true, AI-driven technology and hands-on team of e-commerce experts. Contact one of our team members today to learn more about our end-to-end solution for brands and large sellers on Amazon, Walmart, and e-marketplaces.