Resources - Blog

Infographic: What Statistics Say About Consumer-Brand Relationships on Amazon in 2019

Stay on top of the latest e-commerce and marketplace trends.

Amazon’s Rise to Dominance

More than 100 million U.S. Prime members and even more globally.

An annual global shopping event that sold more than 175 million items in 2019.

Over 175 fulfillment centers worldwide used to rapidly deliver products.

An air cargo fleet of 20 airplanes, slated to be 70 by 2021.

180+ countries with loyal Amazon consumers.

30+ highly diverse product categories.

14 marketplaces.

Amazon’s indispensable role in e-commerce has never been more clear. The Amazon Effect, which is the ongoing evolution and disruption of the online retail market, nods to the e-commerce leader’s continued domination of each stage of the consumer purchase journey and innate ability to deliver on consumer expectations with convenience, agility, speed, and personalization.

From transformative acquisitions in a variety of industries to more specific technological innovations that are ongoing, Amazon’s accelerated growth is difficult to confine to any one source. One notable trend is the gradual but evident increase in brands and private labels migrating to the marketplace and establishing an Amazon presence.

Whether to defend their brand from unauthorized resellers, combat existing private labels, test the performance of a select subset of SKUs, offload discounted product, quickly liquidate end-of-life inventory, acquire new customers, or promote brand awareness, an ever-increasing number of brands and private labels are moving to or joining the platform.

Although many are still mapping their approach and exploring ways in which the marketplace most closely aligns with their greater e-commerce strategies and business goals for the year, opportunities exist on Amazon for these stakeholders to accelerate growth, maintain relevance with target audiences, or diversify channels and inbound revenue streams for incremental discovery and exposure.

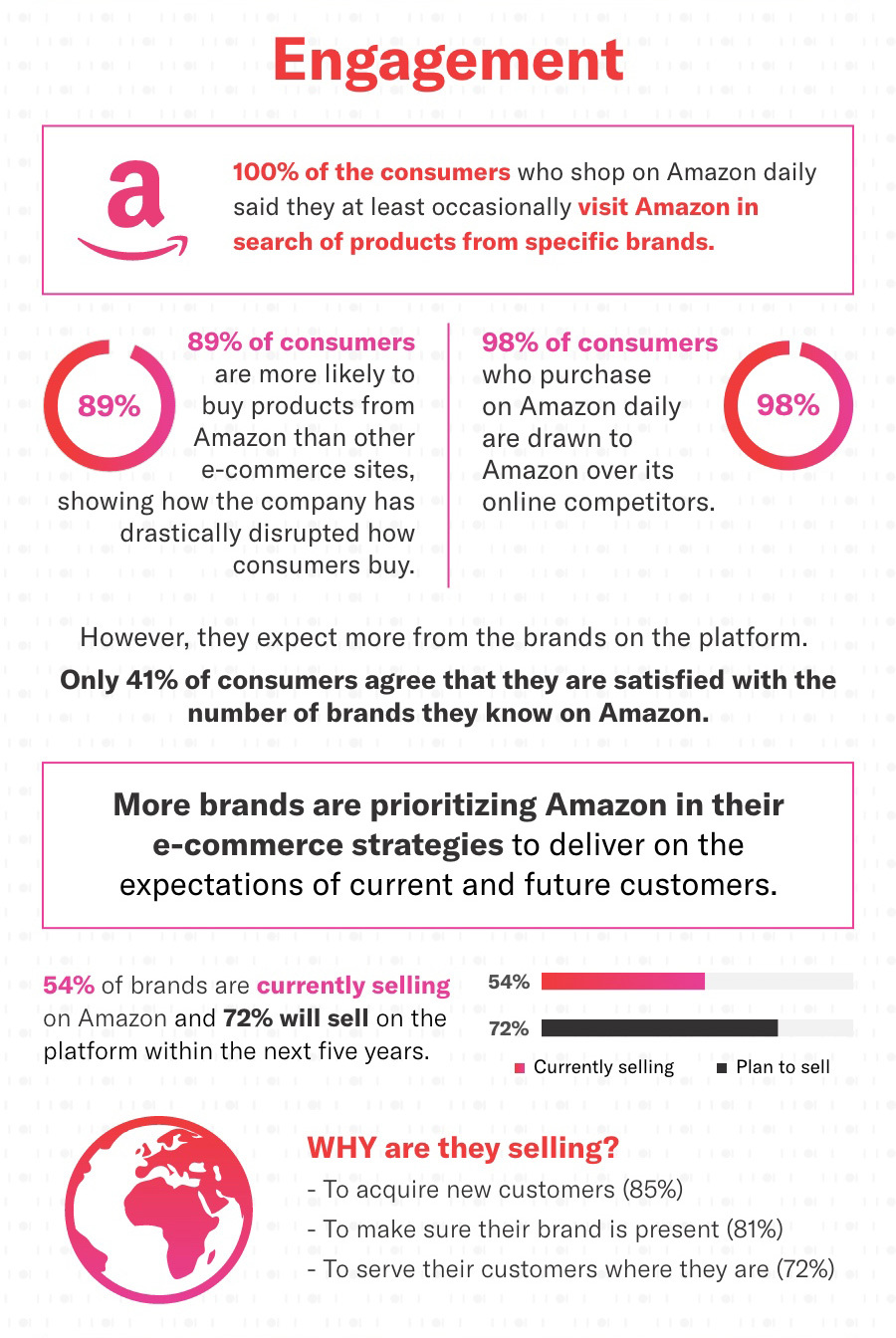

Consumers — two-thirds of which typically start their search for new products on Amazon — have made their loyalty to Amazon apparent. Nearly half of U.S. consumers visit Amazon at least a few times a week and a significant majority (89%) visit the platform at least once a month. With a continual rise in consumer expectations, it is critical for sellers and brands to know how to be nimble amidst today’s omnichannel retail landscape in order to remain competitive, increase revenue and profits, and gain and retain customers on Amazon.

In this infographic, we have compiled several compelling, data-driven statistics across two of our cornerstone reports on consumer behavior and brands on Amazon. We polled 2,000+ U.S. consumers and 500+ U.S. brands to uncover the evolving relationships with both target groups and Amazon, as well as with each other. Across pricing, advertising, and engagement, we explore how brands and consumers leverage one another for successful transactions, as well as uncover areas for improvement.

Over the last year or so, Amazon has continued to build out and refine its offering for brands, making it a channel that is difficult for brands to ignore. With offerings such as new-to-brand metrics, the Brand Dashboard, Sponsored Brands, Amazon Stores, the Amazon Brand Registry, Enhanced Brand Content, and more, Amazon is increasingly helping brands understand and improve their overall brand health, protect their brand identities, and engage with customers on a deeper level.

Moreover, brands and private labels now have a solution that allows them to dynamically price their inventory and win against the competition. Feedvisor’s ProductSphere™ pricing technology, which is the first of its kind, is an answer to the industry’s lack of a solution for pricing branded, private label, and single-seller ASINs, leaving these segments unsure how to competitively price these items.

ProductSphere™ pricing allows brands and private label sellers to set the pricing strategy by SKU according to their business objectives, such as revenue optimization, profit, or liquidation, and machine-learning algorithms continuously search for the optimal price point and make real-time adjustments, driving their business goals to achievement.

Final Thoughts

Part of Amazon’s mission when it launched in 1995 included the notion of offering customers “the lowest possible prices.” As evident in the creative above, the importance of affordable pricing still rings true today — 82% of consumers cite price as a very important factor when selecting a product.

Brands need to know how to price competitively to drive sales, and then go a step further and leverage advertising in conjunction with a robust pricing strategy to increase awareness, engagement, and conversion. In the retail culture of today, brands need to prioritize Amazon as an integral asset in their overall e-commerce strategies, which, in turn, can provide a deep understanding of how to continuously adapt and deliver on consumers’ expectations.

Learn what Feedvisor can do for your business.

When you partner with Feedvisor, you automatically receive access to our true, AI-driven technology and hands-on team of e-commerce experts. Contact one of our team members today to learn more about our end-to-end solution for brands and large sellers on Amazon, Walmart, and e-marketplaces.