Resources - Blog

Inside Amazon’s Big Style Sale 2020

Stay on top of the latest e-commerce and marketplace trends.

The COVID-19 crisis caused considerable strain on e-commerce operations and supply chains, but the pandemic’s true impact on individual sellers and brands largely depended on the product category in which they operate.

Indeed, apparel was among the hardest-hit categories during the COVID-19 crisis, seeing sales decline week over week in March, the peak period of panic-buying and nonessential inventory restrictions, dropping as much as 28% the week ending March 22 compared to the pre-pandemic weekly period ending Feb. 9, according to Feedvisor data.

Following the initial postponement of its annual Prime Day event — which is now expected to begin on Oct. 5 — Amazon announced a fashion-focused summer promotion in an effort to boost sales and aid the Clothing, Shoes, and Jewelry category’s recovery from the COVID-19 slump.

However, the Big Style Sale, which took place June 22–28, lacked the promotion and build-up that is typically seen during other Amazon events such as Prime Day, and ultimately had little impact on the recovery trajectory of the apparel category.

What Was the Summer Sale’s Impact?

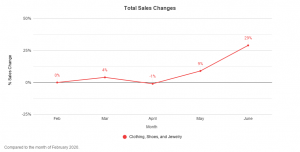

Month over month, Clothing, Shoes, and Jewelry sales were already rebounding from COVID-19, as states began reopening nonessential businesses and consumers loosened up on social distancing efforts with the start of summer. Across e-marketplaces, namely Amazon and Walmart, Clothing, Shoes, and Jewelry sales were up 9% in May compared with February, and increased 29% from May to June.

Certainly, the Big Style Sale can be attributed to some of this growth, given that Clothing, Shoes, and Jewelry sales during the week of the event, ending June 28, increased 31% compared with the week ending Feb. 9.

However, when examining week-over-week data, it becomes clearer that sales in the category had already been consistently improving, and the Big Style Sale did not generate as much of a sales boost as anticipated. Over the weeks ending June 14 and June 21, Clothing, Shoes, and Jewelry sales were up 32% week over week, revealing a 1% decrease during the week of the Big Style Sale.

This trend can likely be attributed to several factors, particularly consumer behavior. As economies reopened and the weather grew warmer, consumers may have prioritized apparel purchases during the weeks leading up to the Fourth of July holiday weekend, in anticipation of social gatherings and outings, after prioritizing essential items and reducing spending during the months of quarantine.

Was the Big Style Sale Worth It?

The Big Style Sale, albeit low-impact, offered apparel brands and sellers an opportunity to unload excess inventory accumulated during the peak months of the COVID-19 crisis and FBA nonessential inventory suspension. While merchants in other categories such as Electronics experience massive sales growth during key online shopping events, including Prime Day and Cyber Monday, apparel sales trends are typically more seasonal and do not benefit as greatly from the same sales lift during Prime Day and other holiday shopping events.

In fact, Clothing, Shoes, and Jewelry sales during the week of the Big Style Sale were 31% higher compared to the same week in 2019, and 7% higher compared to Prime Day 2019. Furthermore, sales growth is now decelerating after the Big Style Sale, up just 16% over the period ending July 5.

Ultimately, apparel brands and sellers continue to see volatility in their growth trajectory, and seasonal promotions, discounts, and brand awareness will be key to driving sales and maintaining the momentum of consumers’ online shopping behavior.

As the e-commerce industry prepares for high-demand periods of Prime Day 2020 and other holiday shopping events of Q4, apparel merchants should focus on diversifying their fulfillment capabilities and optimizing their brand experience to attract new customers and avoid a potential repeat of fulfillment setbacks that hindered growth during the onset of the COVID-19 crisis.

Learn what Feedvisor can do for your business.

When you partner with Feedvisor, you automatically receive access to our true, AI-driven technology and hands-on team of e-commerce experts. Contact one of our team members today to learn more about our end-to-end solution for brands and large sellers on Amazon, Walmart, and e-marketplaces.